Global geopolitical tensions, armed conflicts, and tariff-related political decisions shape the market for mergers and acquisitions (M&A) in 2025.

However, despite all the challenges, businesses look for new approaches to dealmaking, with 85% of them prioritizing cross-border M&A in 2025.

As Anu Aiyengar, Global Head of Advisory and M&A, puts it: “M&A and capital markets have been remarkably resilient in the face of significant macroeconomic, geopolitical, and policy volatility. Consistent, profitable growth at scale has been rewarded with premium valuations, driving companies to continue to pursue M&A. In this market, you need nuanced dealmaking with creativity, courage, and conviction.”

But with such an interest in expanding globally, businesses also need to ensure consistency and reliability in data privacy approaches to withstand cybersecurity risks. This is something virtual data rooms (VDRs) always deliver.

This article dwells on the importance of virtual data room solutions for cross-border deals and explains how VDRs ensure data privacy during the entire deal process for such transactions.

Cross-border data privacy challenges

Generally, when companies engage in cross-border transactions, protecting sensitive data is the biggest challenge.

The due diligence process requires sharing lots of sensitive and confidential data across multiple jurisdictions, such as financial records, intellectual property, employee information, and even customer data. Each jurisdiction, however, brings its own rules, and failing to comply with them can negatively impact deal outcomes.

Here are the main challenges companies face:

- Overlapping regulatory frameworks. Cross-border acquisitions often involve parties subject to different privacy laws, such as the EU’s General Data Protection Regulation (GDPR), California’s Consumer Privacy Act (CCPA), or China’s Personal Information Protection Law (PIPL). These frameworks have different scopes and requirements, and navigating them simultaneously is complex. What is allowed in one country may violate rules in another.

- Severe consequences of non-compliance. The risks of mishandling personal or corporate data can be much more serious than simply fines (though huge). Regulators can impose penalties of up to 4% of global revenue under GDPR, while non-compliance can also damage trust and reduce deal value. A well-known example is Verizon’s $350 million reduction in its purchase price of Yahoo after data breaches surfaced during the acquisition.

- Data transfer restrictions. Many jurisdictions restrict how personal data can be moved to other countries. To transfer legally, companies may need to use mechanisms such as Standard Contractual Clauses (SCCs) or Binding Corporate Rules (BCRs). Ensuring these frameworks are in place requires close coordination between legal counsel, compliance teams, and IT security professionals.

- Broader legal and reputational risks. Not only are fines a possible unwanted consequence. Non-compliance can trigger lawsuits, shareholder actions, or regulatory reviews in highly-regulated industries, such as finance. For target companies, poor data governance can undermine negotiations, raise questions about integration challenges, and slow down the overall transaction timeline.

Virtual data rooms as a solution for cross-border M&A

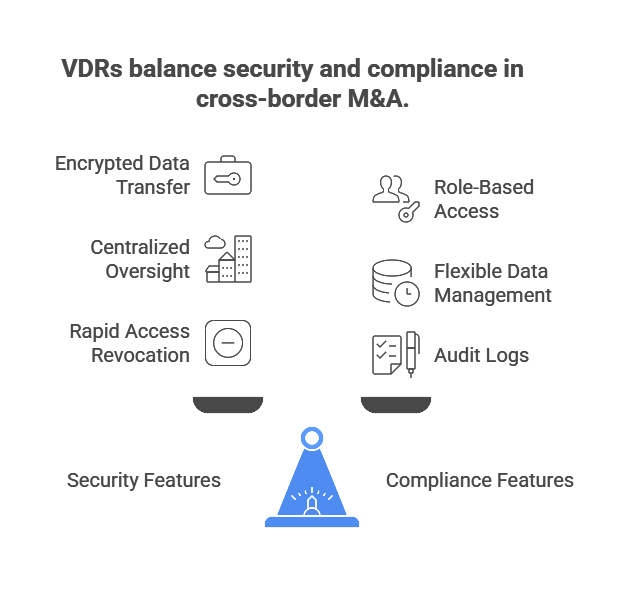

Virtual data rooms are designed to eliminate the risks associated with cross-border M&A by providing a secure and compliant environment for due diligence. They address the privacy and regulatory challenges outlined above by offering dedicated features tailored for sensitive, multi-jurisdictional transactions.

Here’s how VDRs make cross-border mergers and acquisitions secure and compliant:

- Encrypted document storage and transfer. All files uploaded into a VDR are encrypted both in transit and at rest, ensuring confidential information cannot be intercepted during cross-border transactions.

- Role-based access controls. Administrators can define permissions at a granular level, allowing users to view, download, or edit only what is relevant to them. This is particularly important when two companies from different jurisdictions need controlled access to sensitive records.

- Centralized oversight with audit logs. Every action inside a VDR, from viewing a file to downloading or sharing, is tracked and recorded. These audit trails provide regulators and deal parties with clear evidence of compliance across different jurisdictions.

- Flexible data management across time zones. VDRs offer a single, always-accessible repository that helps overcome language barriers, cultural differences, and time zone gaps by ensuring all parties can access the same version of documents.

- Rapid access revocation. If a potential buyer, consultant, or third-party advisor should no longer have access, VDR administrators can revoke permissions instantly. This prevents data leakage and ensures compliance with legal requirements.

Privacy and compliance capabilities of VDRs

Now, let’s take a look at how exactly virtual data rooms help businesses stay compliant with regulations during cross-border deal-making:

- Compliance-ready infrastructure. Leading VDR providers build their platforms on certified architectures that support global standards such as ISO 27001, SOC 2 Type II, and GDPR-aligned data processing frameworks. If you see that a selected VDR provider offers these certifications, you can be sure that the environment meets strict international security and privacy requirements.

- Data residency and localization options. Some transactions require data to remain within a specific jurisdiction due to local laws. Many VDR providers allow businesses to select storage locations that align with home country requirements, reducing risks tied to cross-border data transfers.

- Advanced redaction tools. During due diligence, sensitive personally identifiable information (PII) often needs to be shared but carefully controlled. Many VDRs enable selective in-built redaction of names, addresses, or financial details, ensuring authorized users can see it (or no one).

- Secure authentication and access restrictions. Features like multi-factor authentication, single sign-on (SSO), and IP-based restrictions protect access to sensitive deal information, preventing unauthorized logins and supporting strong compliance postures.

- Consent management and legal documentation. VDRs help you keep track of who sees what information. This is important for following privacy rules like GDPR. If regulators ever check, you’ll have proof that you handled data correctly.

Cybersecurity due diligence: A rising imperative

During cross-border M&A transactions, cybersecurity due diligence gains special attention. Here’s why:

- Hidden breach risk and inherited vulnerabilities. Companies that are bought often have old systems, hidden tech, or past problems that haven’t been fully revealed or fixed. These issues can cause big problems for the buyer after the purchase, creating ongoing risks once everything is combined.

- Deal valuation erosion. When buyers discover cyber incidents or weak security postures in the target’s operation, they often insist on price reductions, indemnifications, or deal adjustments. So, unresolved vulnerabilities can directly diminish the deal value, which is a great disadvantage for the target company.

- Failure or renegotiation of deals. Some due diligence discoveries are so substantial that deals are renegotiated or even abandoned. This makes cybersecurity assessments a non-negotiable part of modern dealmaking.

- Regulatory and legal exposure. With data privacy laws tightening, failing to assess potential targets’ compliance before acquisition exposes the acquiring company to regulatory fines, lawsuits, and reputational damage. In cross-border deals, misalignment between jurisdictions increases that exposure.

- Climbing cost of breaches. The financial burden of a data breach is steadily rising. In 2025, the global average cost reached $4.4 million, making cybersecurity failures not only reputational but also a heavy financial risk.

- Third-party and vendor risk. Cross-border M&A often involves extensive reliance on vendors, supply chain partners, or outsourced service providers located in other countries. Weak controls on third parties can introduce risk chains that are difficult to trace but highly damaging.

- Integration and post-deal risk. Merging two businesses with different security policies, technology stacks, and levels of maturity can expose the combined business to attacks, data leakage, and compliance failures if not addressed early.

Popular data rooms

Overall rating:

4.9/5

Excellent

Overall rating:

4.8/5

Excellent

Overall rating:

4.7/5

Excellent

VDR best practices for cross-border M&A

Here’s what you can do with the help of a virtual data room to manage the complex regulatory implications of cross-border acquisitions while ensuring secure and efficient post-merger integration:

- Redact sensitive data before launch. Remove unnecessary personally identifiable information and apply redaction where required. This is especially important in highly regulated sectors like life sciences, where labor laws and patient data protections may apply across multiple jurisdictions.

- Define access by deal structures. Assign access levels that reflect the specifics of your transaction, whether it involves joint ventures, private equity funds, or foreign investment. Use granular roles so that each party only reviews what is relevant to them.

- Store data in compliant locations. Choose VDRs that let you store information in approved jurisdictions, minimizing tax issues or double taxation concerns tied to local rules. This also helps address political instability in certain regions by keeping sensitive files in trusted environments.

- Maintain one version of the truth for all parties. Centralize documents to give all stakeholders the ability to gain access to the same, updated files. This avoids confusion and helps both sides build a detailed understanding of potential targets, even when operating in new markets.

- Track activity to manage regulatory implications. Configure the platform to capture detailed records of user activity. This transparency helps satisfy regulators in cross-border acquisitions where supply chain disruptions or other country-specific risks raise scrutiny.

- Integrate VDR workflows into post-deal planning. Connect the data room with compliance, finance, and integration tools. This ensures smoother post-merger steps, supports efficient integration of two businesses, and prepares teams to adapt to future deal activity with less disruption.

VDR features for mitigating privacy risks

Now, let’s explore the concrete VDR features that help mitigate the most common privacy risks of a cross-border transaction.

| Privacy risk | VDR feature mitigation |

| Unlawful cross-border data transfer | Geofenced hosting in approved jurisdictionsData residency controlsSupport for Standard Contractual Clauses (SCCs)Binding Corporate Rules (BCRs) workflows |

| Exposure of personally identifiable information | AI-powered document redactionRole-based access permissionsDynamic watermarking with user IDsFence view to block copying/printing |

| Data breach during due diligence | AES-256 encryption at restTLS 1.2+ encryption in transitMulti-factor authenticationSingle sign-on integrationAutomatic session timeouts |

| Lack of transparency or auditability across jurisdictions | Granular activity logsReal-time monitoring dashboardsIP/time-based access trackingInstant access revocationExportable compliance reports |

| Unauthorized document distribution | Secure document viewerDownload/print restrictionsWatermarking by user/sessionExpiring document linksClipboard protection |

| Cybersecurity weaknesses identified post-acquisition | Repository for target company security certifications (ISO, SOC)Upload and share incident response plansVendor risk questionnairesSecurity Q&A modules inside the VDR |

| Insider threats from advisors, consultants, or third parties | Granular role assignment by group or projectTemporary guest accounts with expiry datesDevice/IP whitelistingAlert notifications on unusual activity |

| Loss of control over critical legal documents | Version control with check-in/check-outAutomated document expiry settingsPermission-based editingArchive and retention policies aligned with legal requirements |

| Misalignment with compliance frameworks in key jurisdictions | GDPR- and CCPA-aligned architecturesSupport for HIPAA and PIPL complianceSOC 2 Type II and ISO 27001 certified infrastructureConfigurable data retention policies |

Legal safeguards complementing VDRs

Even with a secure VDR in place, businesses need extra legal safeguards to protect themselves in cross-border M&A.

Here’s what you can do:

- Use representations and warranties. Make the seller promise (in a legally documented way) that all shared data is accurate and that there are no hidden privacy or compliance issues. This gives the buyer legal protection if problems are discovered later.

- Add indemnities for breaches. Define clear responsibilities in case of data breaches, non-compliance with laws, or hidden risks. Indemnities make sure the seller covers the cost of issues that existed before closing.

- Set survival periods and limits. Decide how long the seller stays responsible for privacy or security promises after the deal closes. Also agree on caps, or maximum amounts, they may need to pay if something goes wrong.

- Plan for dispute resolution. Agree in advance on how conflicts will be handled: whether through arbitration, mediation, or local courts. This avoids long and costly fights across different legal systems.

- Cover cross-border risks. Certain transactions may involve stricter privacy laws, labor laws, or tax issues. Legal teams should include these key considerations in contracts so both sides know who bears the risk.

Key takeaways

- Cross-border M&A raises numerous privacy concerns due to the varying regulations and severe penalties across different countries.

- Virtual data rooms help with these risks by offering dedicated features, like encrypting information, hiding sensitive parts, and controlling who sees what.

- In cross-border M&A, it’s crucial to thoroughly assess cybersecurity, as hidden vulnerabilities or weak security can significantly reduce deal value or even halt the transaction.

- Using VDRs well, by giving access based on roles, hiding personal information, and storing data where it follows the rules, ensures everything goes smoothly and securely during a cross-border deal.

- However, businesses need to take extra legal protections to add extra safety in some deals, such as guarantees and clear ways to solve problems.