While mergers and acquisitions can lead to significant growth, they can also bring new challenges.

In fact, the percentage of failed mergers is difficult to determine and ranges from 70% to 90%. Regardless of the exact number, such success rate is not optimal for most M&A participants.

In the article below, we’ll explore the nine most common reasons why most mergers and acquisitions fail and provide four effective solutions to avoid common pitfalls.

What is a merger and acquisition (M&A)?

Merger and acquisition (M&A) is a process of consolidation between businesses or their assets through different financial transaction types, including acquisitions, mergers, purchase of assets, acquisitions of management, tender offers, and many more.

While the terms mergers and acquisitions are often used interchangeably, they have some differences:

- An acquisition occurs when one organization takes over another and becomes its new owner. While friendly takeovers are quite common, there are also unwelcome deals, where the target company does not want to be acquired. Such hostile takeovers are always considered acquisitions.

- A merger occurs when two roughly equal-sized companies merge to form a single entity instead of operating as separate businesses. This type of merger is also known as a “merger of equals.”

Takeaway: The distinction between a merger and an acquisition lies in the nature of the deal and how it is communicated to the target company’s stakeholders, including the board of directors, employees, and shareholders.

Why do mergers and acquisitions fail?

1. Insufficient due diligence

Due diligence is a complex step in M&As with numerous variables to consider. One issue that often arises is the target company failing to prepare the complete and relevant information, structure it properly, and securely share it with the acquirer.

Virtual data rooms (VDRs) play a vital role in solving these issues:

- According to a report by Mergermarket, using a VDR can reduce legal costs in the due diligence process by up to 50%, resulting in a faster and smoother transaction.

- Another survey by IBM found that more than one in three executives experienced some sort of a data breach as part of their M&A integration. This makes VDRs an essential tool to mitigate the risk of sharing data or facing data leak or breach.

VDRs also provide a centralized and organized platform for storing due diligence documents, allowing for easier access and review. In particular, they can help to:

- Aid in the preparation of documents with due diligence checklists

- Simplify the organization with auto-indexing and restructuring

- Offer complete audit trails and logs for better due diligence insights

- Offer better cost-efficiency in comparison with physical data rooms

- Provide easy, yet secure access to documents from anywhere and at any time

- Guarantee industry-leading support available on a 24/7/365 basis

| Solution. The use of virtual data rooms is essential in due diligence. VDRs provide a secure and efficient platform for sharing and storing information, reducing the risk of data breaches, and improving the chances of a successful transaction. |

Popular data rooms for M&A

Overall rating:

4.9/5

Excellent

Overall rating:

4.8/5

Excellent

Overall rating:

4.7/5

Excellent

2. Lack of strategic planning

Strategic planning plays a crucial role in mergers and acquisitions as it sets the foundation for the positive deal outcome. Here’s how strategic planning can increase the chances of deal success:

- A study by McKinsey & Company found that companies’ ability to successfully plan and execute M&A deals is key for resisting economic shock.

- Another study by PwC revealed that companies with a clear M&A plan are more likely to realize the intended benefits of the transaction, such as improved market share, increased stock price, and higher profitability.

That said, proper strategic planning helps companies engaging in M&A avoid common risks, such as failing to integrate the operations of the newly acquired company, not realizing expected cost savings, losing key employees, and more.

| Solution. Invest in comprehensive planning and execution to see the intended benefits and achieve long-term success. Proper planning will lay the groundwork for a successful transaction, help achieve the desired financial targets, and avoid common pitfalls of losing personnel or failing to integrate operations. |

3. Limited management involvement

Hiring M&A advisors with a high fee for various services is often seen as a necessity for mid to large-sized deals. According to a survey by McKinsey & Company, 70% of M&A deals fail to deliver expected results, and one of the reasons is a lack of active engagement from the acquiring company.

While working with advisors can boost the chances for smooth deal execution, advisors typically have a limited role, and once the deal is completed, the responsibility of the new entity falls on the owner.

For this reason, it is essential for owners to take an active role from the beginning and drive the deal forward from day one,, with investment bankers serving as support but not as key decision makers.

| Solution. While hiring M&A advisors is necessary, it is essential for owners to take an active role and drive the deal forward. This not only leads to a higher success rate, but also provides the owner with valuable knowledge and experience that will be a lifelong benefit. |

4. Overpaying

A study by McKinsey showed that larger transactions and those that include both cash and stock are more likely to fail. Among 450 deals announced each year, approximately 10% get canceled.

One well-known example is the America Online and Time Warner deal in 2001, where the rush to enter the new media industry led to overpayment and the biggest annual net loss ever reported.

Brokers often push to close deals quickly, even if it doesn’t make sense for the organization, which leads to excessive spending without delivering expected benefits.

To avoid overpaying for a business, it’s important to consider help from independent third-party experts. This not only provides assurance but also grants access to industry insights and financial comparisons.

| Solution. It is crucial to take the time to fully understand the shareholder value of a business before making a decision to purchase. Consider consulting a third-party expert to avoid overspending and potential failure. |

5. Financial instability and hidden debt

Target companies often have a variety of reasons for selling their business, including financial difficulties or even debt. However, it’s important for buyers to be aware of these potential issues and not be caught off guard during the due diligence process.

Being transparent with M&A advisors can greatly benefit both the seller and the buyer. By presenting a complete and honest picture of the business, including its successes and struggles, the advisor can offer immediate suggestions to stabilize the situation or fast-track the process to maximize value.

In fact, studies have shown that involving an M&A advisor early in the process can increase the likelihood of a successful sale by 25%.

| Solution. Honesty and transparency with M&A advisors can help avoid potential pitfalls in the sale process and increase the chances of a successful outcome. |

6. Overestimating synergies

A study of 22,000 M&A transactions found that 70% of companies overestimated the synergies they expected to achieve through a merger or acquisition. This often leads to overpaying in the deal, therefore resulting in a lower ROI.

Overly optimistic projections can result in significant financial losses. For instance, McKinsey found out that the average gap between expected and achieved synergies is around 20%, and it can take between three to five years to capture this gap.

| Solution. It is essential for practitioners of M&A to approach potential synergies with a highly conservative lens. Conduct thorough due diligence to accurately estimate the potential benefits and costs of a transaction. |

7. Communication barriers

Unsurprisingly, 86% executives consider poor communication to be the main driver for workplace failure.

Effective communication is key to the success in an M&A process. Usually, it begins with a well-presented company profile during introductions, continues through negotiations of an LOI, and extends to the closing stage.

Having a knowledgeable M&A advisor can help ensure smooth communication and avoid discomfort between the buyer and seller. The advisor can act as a liaison to communicate the important details, from the strengths and weaknesses of the company to expectations for the future, while aligning expectations for smoother post merger integration and closure.

| Solution. Ensuring clear and consistent communication throughout the M&A process is crucial for the success of the deal. It helps build trust, align expectations, and ensure a smoother integration process for the future. |

8. Cultural integration issues

Studies have shown that cultural and integration issues have contributed to the failure of many M&A deals, leading to billions of dollars in losses. The Daimler Chrysler case serves as an example of the difficulties that can arise from cultural differences in M&A deals, especially on a global scale.

It was a failed merger between German automaker Daimler-Benz and American automaker Chrysler in 1998. The two companies faced significant cultural differences and integration issues, which led to billions of dollars in losses and the eventual separation of the two companies in 2007.

To avoid cultural integration difficulties, it is recommended to appoint a change manager to oversee the integration process. They will draw a well-thought-out strategy that can also help find a cultural fit.

| Solution. Cultural differences can play a vital role in the success or failure of an M&A transaction. Hiring a change manager is recommended to oversee the cultural integration success. |

9. Poor integration planning

To avoid poor execution issues, it is important to have a designated point person responsible for overseeing all aspects of integration, including the crucial areas of people, culture, and communication. This person should be involved in the integration planning process from the due diligence phase to ensure that everything runs smoothly from day one.

| Solution. Having a comprehensive integration plan with a designated lead can increase the likelihood of a successful M&A transaction. |

How to prevent failures in M&A?

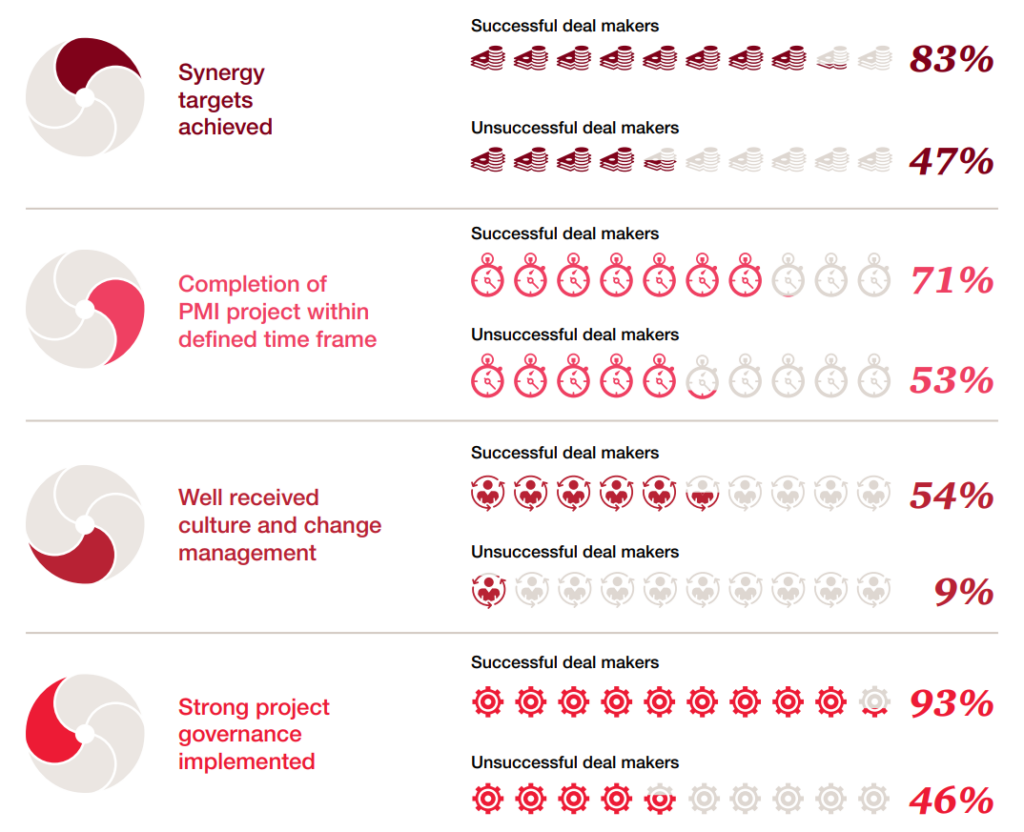

PwC’s 2017 M&A Integration report suggests four key recommendations to prevent M&A failures:

Source: PwC’s 2017 M&A Integration report

- Keep the focus on synergies. In any M&A, the primary acquisition objectives boil down to creating synergies between the two companies. Synergies can be achieved through cost savings, increased efficiency, and enhanced revenue. That said, it is critical to have a clear understanding of the estimated synergies, while prioritizing their achievement during the integration.

- Set reasonable timing for the deal. A hurried integration process can result in poor planning, inadequate due diligence, and ultimately, a failed deal. It is better to take the time to thoroughly plan and execute the integration process to increase the chances of success.

- Take cultural integration seriously. It is essential to understand the cultural differences between the two companies and to develop a plan to address these differences. A change manager should be enlisted to oversee the cultural integration process, ensuring that all stakeholders understand the changes and are able to adapt effectively.

- Maintain strong project governance. The integration process should be managed by a dedicated project team, with clear roles and responsibilities. This team should report to a steering committee, which should be made up of senior representatives from both companies. Strong project governance will help ensure that the integration process is properly planned, executed, and monitored, reducing the risk of failure.

Key takeaways

- M&A is a process of consolidation between businesses or their assets through different financial transactions including acquisitions, mergers, tender offers, and more.

- An acquisition occurs when one organization takes over another, while a merger occurs when two equal-sized businesses form a single entity.

- Reasons for M&A failure include insufficient due diligence, lack of strategic planning, limited management involvement, overpaying, financial instability and hidden debt, overestimated synergies, communication barriers, cultural integration issues, and poor integration planning.

- To improve the chances of a successful transaction, companies should use virtual data rooms, keep focus on synergies, set reasonable deal timelines, build a cultural integration plan, and keep strong project governance.

While virtual data rooms serve as a decent M&A deal facilitator boosting the chances of success, the choice of a proper solution can turn out to be daunting. Explore our main page for objective virtual data room reviews and comparisons and simplify your data room selection.