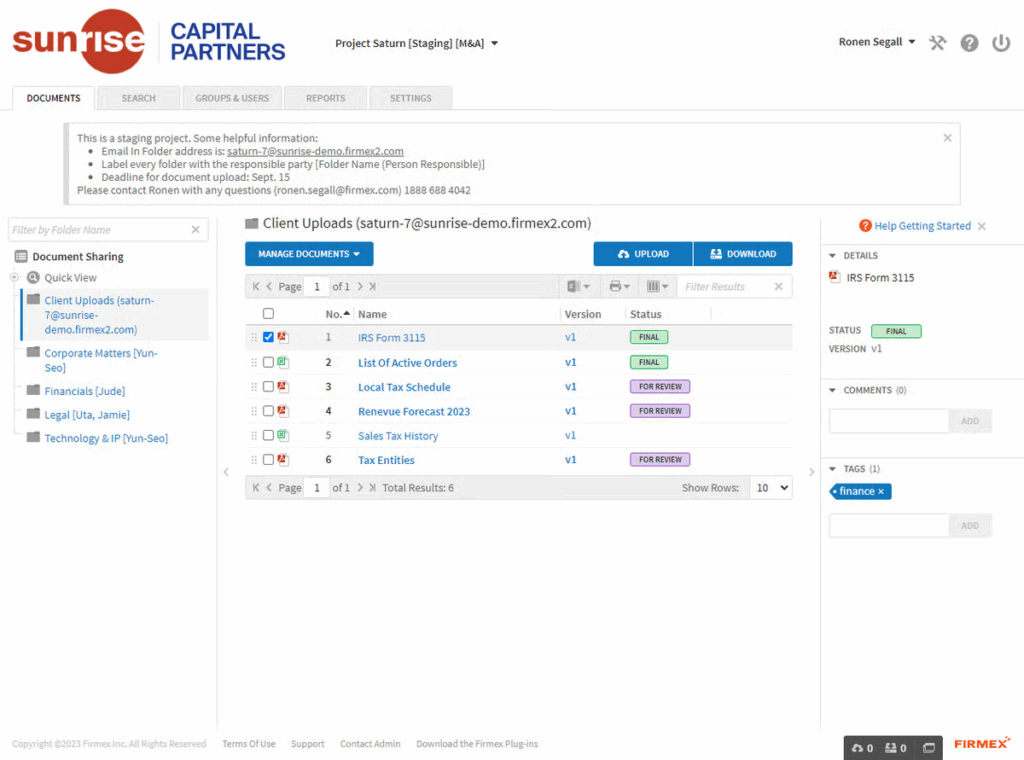

Firmex is a long-standing Canada-based virtual data room provider. Since 2006, it has served 223,000 clients from 180+ countries. It helps deal professionals, legal teams, investment banking groups, and law firms manage sensitive documents during due diligence, compliance reviews, complex transactions, and M&A projects.

The most common Firmex use cases include:

- Sell- and buy-side M&A

- Investor reporting

- Financing

- Restructuring

- Licensing and joint ventures

- Private equity fundraising

- Procurement and bid management

- Audits

- Client extranets

- Board portal

Firmex is known for its intuitive interface, helpful and reliable customer support, solid security, and effortless document management, which users often highlight on review sites like G2 and Capterra.

Even so, some users might want to look for alternatives to Firmex.

Common reasons that are mentioned as drawbacks in negative reviews on G2 include poor UI, learning difficulty, file management issues, steep pricing, complicated setup of access controls, and cases where certain advanced features feel less modern compared with newer tools.

Source: G2

This article suggests five alternatives to Firmex and explains how to evaluate them to choose the VDR that best fits your project’s specific needs.

Why Consider Alternatives to Firmex?

According to real client reviews on G2 and Capterra, users might most often consider alternatives to Firmex due to the following reasons:

- Complicated user access management. Some users admit that it’s not 100% clear how to change user access rights if something changes in the deal room. Also, they say they would enjoy the ability to see, for a specific document, which access was granted to which group and by whom.

- Poor UI. While many users consider Firmex a user-friendly platform, some still indicate that the interface could use some improvement, especially when it comes to folder organization or access settings management.

- Learning difficulty. Some users admit there’s a learning curve for first-time users, making it difficult to understand how to navigate the platform.

- Expensive pricing. While Firmex is not explicit with the actual cost of their service, users say it’s on the expensive side, especially when it comes to uploading large files.

- Feature limitations. Users highlight that some functionalities resemble those of a basic VDR, compared to more modern vendors that offer advanced features.

Popular data rooms for M&A

Overall rating:

4.9/5

Excellent

Overall rating:

4.8/5

Excellent

Overall rating:

4.7/5

Excellent

Criteria for Evaluating Firmex Alternatives

Let’s say you have already determined to research the market for a reliable Firmex alternative. What do you pay attention to when evaluating top competitors?

Here are the main things to consider:

- Security and compliance. Ensure that a competitor offers advanced security features that protect sensitive information at every stage of a deal. Look for strong data encryption, multi-factor authentication, granular access controls, and clearly stated compliance certifications on the provider’s official website. A good alternative should give legal firms and other organizations full control over who can view, edit, or download files in a secure place.

- Usability and UX. A clean interface and strong user friendliness matter, especially when external parties join the deal room. Pay attention to how easy onboarding is, whether navigation feels intuitive, and if the software supports mobile access for working on the go. It should also be easy to handle different file types, including large documents or audio files.

- Workflow and analytics. Beyond basic file sharing, evaluate tools that support real deal management. Features such as activity tracking, Q&A workflows, and advanced analytics dashboards help teams understand user behavior and spot risks early. Some platforms also offer detailed reporting and actionable insights that go beyond what a basic VDR provides.

- Pricing flexibility. Pricing structure plays a big role in long-term cost predictability. Some providers offer transparent pricing with a flat rate, while others scale costs based on storage, users, or projects. If you manage multiple deals, options like unlimited users or unlimited projects are good to have for predictable budgeting.

- Integrations and support. Strong document sharing becomes even more effective when the VDR connects with tools teams already use. Check for integrations with Google Workspace, Google Drive, or project management systems that support daily workflows. Also, a vendor should have reliable customer support, including dedicated account managers, which is especially helpful for companies running time-sensitive transactions.

Top 5 Firmex alternatives

Now, let’s explore the top Firmex alternatives users most commonly consider and compare their offerings.

Note: “What users like and dislike” lists are based on real user reviews from G2 and Capterra.

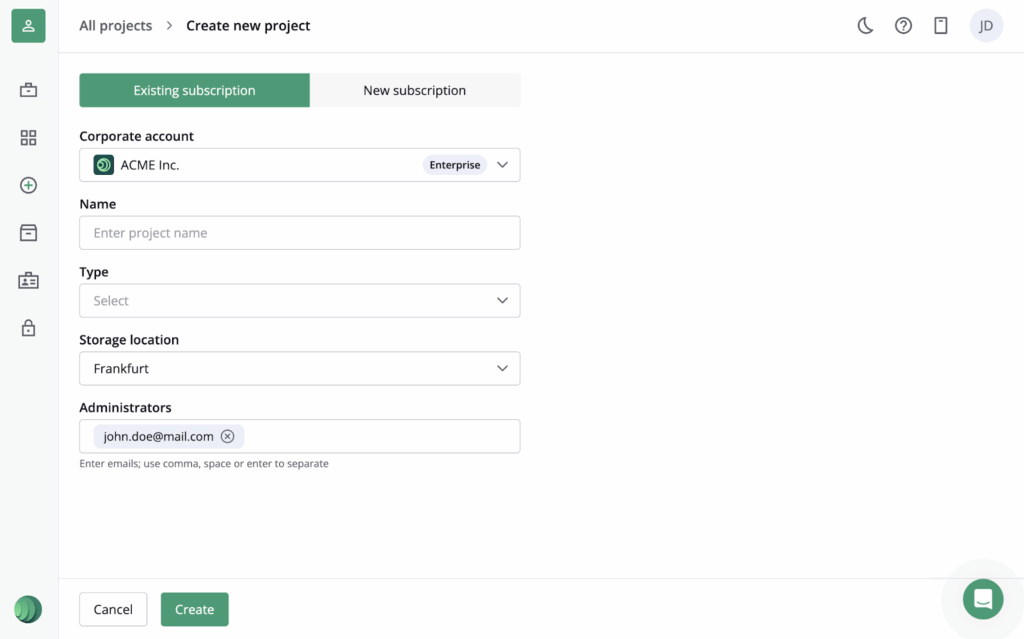

Ideals

Ideals is a virtual data room provider focused on M&A, fundraising, and other high-stakes transactions. On its official website, Ideals is a clear winner for complex deals that require strong security, clear structure, and smooth teamwork across multiple parties. It is widely used by investment banks, legal advisors, and venture capital teams that need reliable solutions for confidential projects.

Compared to what Firmex offers, Ideals is often positioned as a more flexible option for large, fast-moving transactions.

Source: Ideals Help Center

What users like

- Easy navigation and clear structure for data management

- Reliable performance during large transactions

- Strong secure collaboration between internal and external teams

- Responsive customer support

What users dislike

- Pricing may feel high for smaller deals

- Initial setup can take time for complex projects

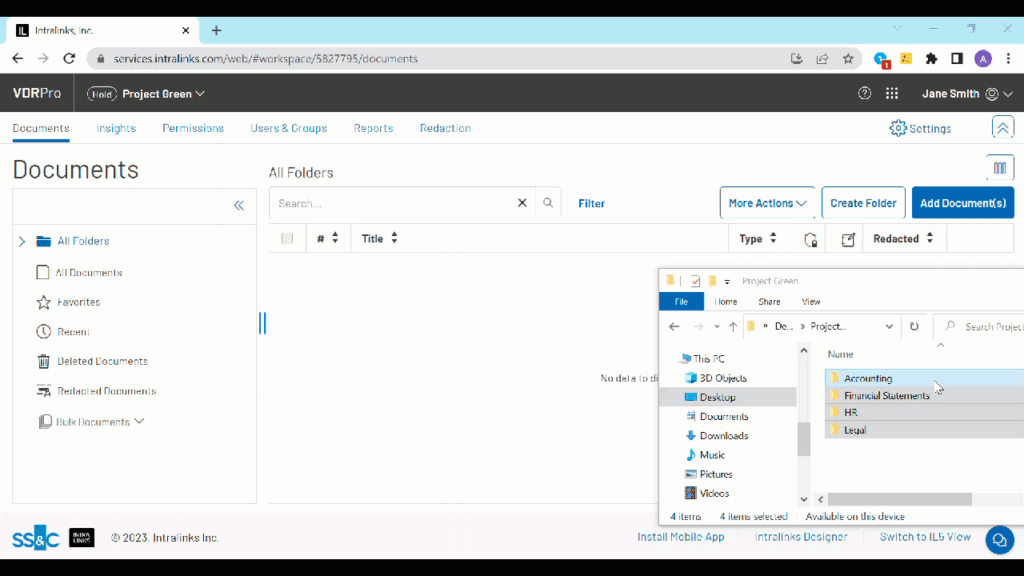

Intralinks

Intralinks is a long-established provider focused on deal execution and capital markets transactions. The platform supports mergers, acquisitions, and capital raising with structured workflows and purpose-built collaboration tools.

Intralinks is often chosen by global financial institutions and advisory firms that need a deal room like Firmex, but designed for enterprise-scale operations.

Source: Intralinks Help Center

What users like

- Strong reputation in large, multi-party transactions

- Stable performance in long deal cycles

- Clear audit trails and version control

What users dislike

- Interface feels outdated to some users

- Learning curve for first-time users

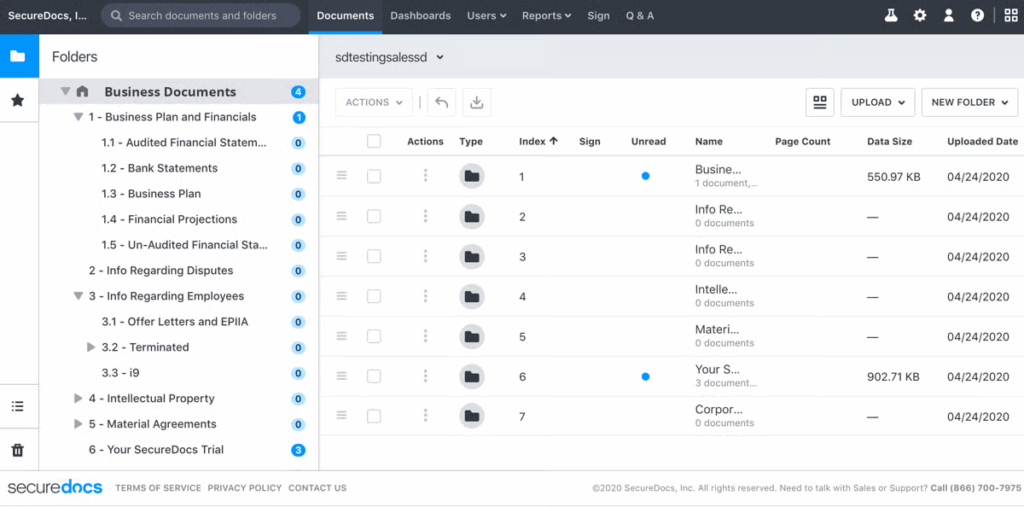

SecureDocs

SecureDocs positions itself as a simple and fast virtual data room for sharing confidential documents. The focus is on ease of setup, clear permissions, and efficient data management without unnecessary complexity. It is commonly used for audits, fundraising, and internal reviews.

Source: G2

What users like

- Quick setup and straightforward workflows

- Clean structure with auto-indexing

- Easy document uploads and access control

What users dislike

- Limited customization options

- Fewer advanced features for large deals

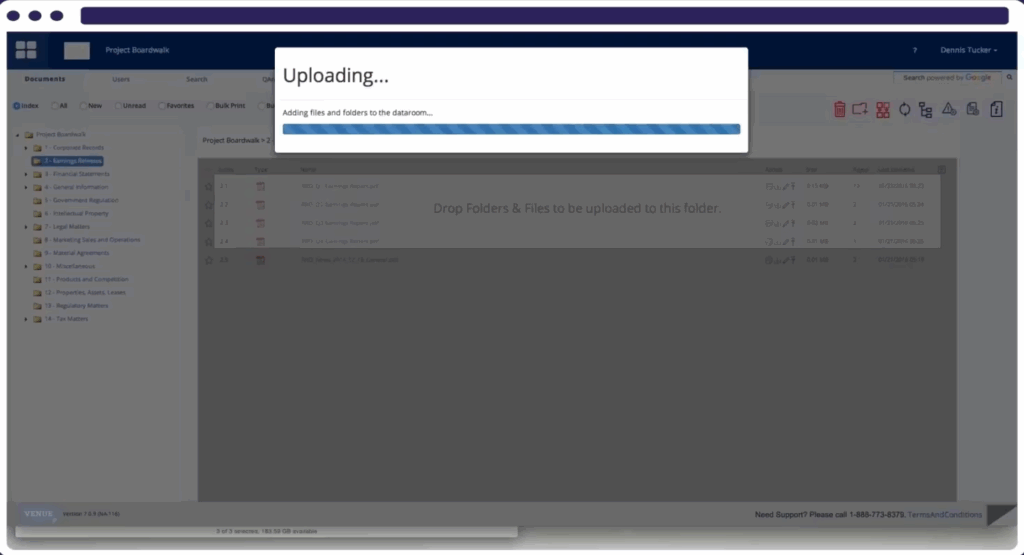

Venue by DFIN

Venue is a virtual data room developed by DFIN and designed for capital markets, IPOs, and M&A. The platform is positioned as a transaction-focused environment that supports structured deal execution and regulated workflows. It is often used by public companies and advisory firms that manage formal disclosure processes.

Source: GetApp

What users like

- Strong alignment with capital markets transactions

- Clear structure for regulated deal processes

- Reliable tools for controlled information sharing

What users dislike

- Interface may feel complex for smaller teams

- Less intuitive for users outside finance roles

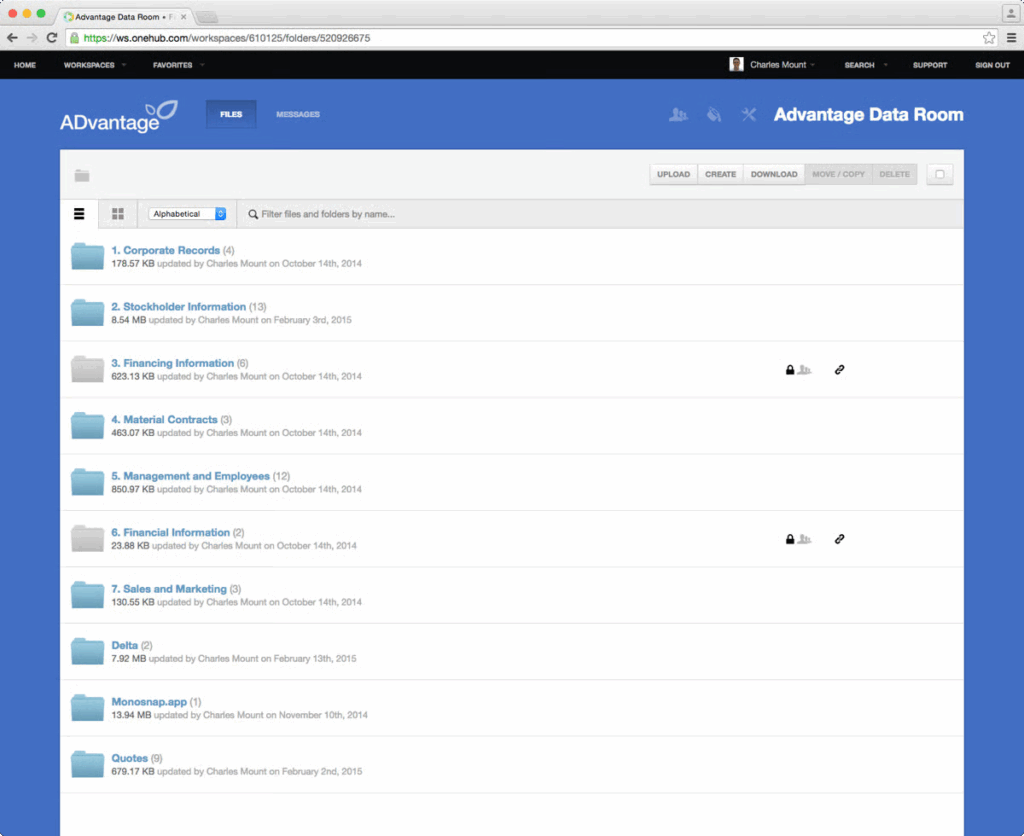

Onehub

Onehub is a secure file-sharing platform that also offers virtual data room functionality. It focuses on simplicity, branded workspaces, and controlled access for external users. It is often selected by organizations that need a straightforward alternative to Firmex without heavy deal-specific workflows.

Source: G2

What users like

- Easy setup and clean interface

- Smooth collaboration with clients and partners

- Simple tools that work well for everyday projects

What users dislike

- Limited depth for advanced transactions

- May feel too basic for teams running multiple complex deals

Note: The list of alternatives to Firmex is not limited to only these five solutions listed in the article and depends on your project or deal needs. Some other competitors you can consider also include Datasite, Ansarada, DealRoom, or Box.

| Provider | Core tools | Pricing model | Free trial |

| Firmex | Q&A sectionRedactionSingle Sign-OnIP restrictionMulti-factor authentication | Quote-based | N/A |

| Ideals | 8 levels of granular access controlsDark modeRedactionE-signatureDue diligence checklist | Subscription, quote-based | ✅Yes |

| Intralinks | Granular access controlsAudit trailsRedactionCustomizable brandingReporting dashboard | Quote-based, not transparent | N/A |

| SecureDocs | Audit railsMulti-factor authenticationSingle Sign-On | Flat-fee, from $250 per month | ✅Yes, 14 days |

| Venue by DFIN | RedactionAuto notifications for activityAdvanced search filtersUser session timeoutMulti-project management | Quote-based, not publicly available | N/A |

| Onehub | Collaboration tools such as comments and notificationsAuto indexingAudit trailsOnline viewerFull-text search | Transparent, subscription-based | ✅Yes, 14 days |

Note: This comparison table is based on the publicly available information of each provider.

How to Choose the Right Alternative

So, what do you pay attention to when looking for the right VDR fit? Here are the main decision factors:

- Deal size and complexity. Start by assessing how large and complex your typical deals are. Enterprise-level transactions usually require platforms built for long deal cycles, many external parties, and strict controls, while mid-market deals often benefit from simpler setups that are faster to launch and easier to manage.

- Budget and pricing model. Pricing can quickly become a deciding factor, especially if projects run longer than expected. Look for providers that clearly explain how costs are calculated, what is included in each plan, and which actions may increase the final bill. A transparent pricing model helps avoid surprises and makes planning easier from the start.

- Required features. Not every team needs the same toolset. Some projects benefit from advanced analytics, automation, or AI-driven insights, while others focus mainly on regulatory alignment and formal compliance requirements. The right choice depends on which features genuinely support your work rather than adding unnecessary complexity.

- Team size and geography. Consider how many people will use the platform and where they are located. Large, distributed teams often need stronger coordination tools and consistent performance across regions, while smaller teams may prioritize speed and simplicity over depth.

- Workflow needs. Think about how your team actually works during a transaction. Some teams rely heavily on structured Q&A, reporting, and tracking, while others mainly need a secure space to store and review documents. The best alternative is the one that fits naturally into your existing workflow instead of forcing you to adapt to the software.

Final thoughts

- Firmex is a well-established VDR trusted for M&A, legal, and compliance work, but some users look elsewhere due to usability, pricing, and feature limitations.

- The best Firmex alternative you might consider depends on deal size, team structure, and how complex the transaction workflow is.

- Security, usability, analytics, and pricing transparency are the most important criteria when comparing VDR providers.

- The top five alternatives to Firmex are Ideals, Intralinks, SecureDocs, Venue by DFIN, and Onehub. Each serves different deal types and organizational needs.

- Choosing the right VDR means matching the platform’s strengths to your actual workflow rather than defaulting to the most popular option.