Mergers and acquisitions (M&A) are strategic moves organizations use to grow, adapt, or gain new capabilities.

Today, the U.S. leads global deal activity. In 2024, the Americas captured the majority of the value in large deals, with U.S. firms accounting for a significant share. EY-Parthenon expects transactions over USD 100 million to remain steady in 2025, around 1,140–1,170 deals.

Every M&A transaction has a purpose. For example, companies pursue deals to grow market share, cut costs, or acquire talent. Whatever the goal, clarity on the deal’s purpose helps align execution with expected outcomes.

In our post, learn the key M&A motives and see how they shape deal strategy and execution. Also, explore practices that help teams turn intentions into results. In addition, check how tools like virtual data rooms streamline workflows and ensure document security.

Popular data rooms for M&A

Overall rating:

4.9/5

Excellent

Overall rating:

4.8/5

Excellent

Overall rating:

4.7/5

Excellent

What are mergers and acquisitions?

The deal is a corporate transaction in which ownership, control, or assets shift between businesses to create a strategic or financial advantage. A merger deal combines two companies. An acquisition involves one business unit being acquired by another. Both let a consolidated entity expand faster than each one could on its own.

Generally, M&As are grouped into the following five categories:

- Horizontal merger. Companies that are direct competitors in the same market combine, offering similar products or services.

- Vertical merger. Companies operating at different stages of the same supply chain join together.

- Market-extension merger. Companies with comparable products or services merge to expand into new geographic markets.

- Product-extension merger. Companies in the same market merge to broaden their product or service lines with complementary offerings.

- Conglomerate merger. Companies from different industries come together, diversifying their operations.

In every case, the acquiring company seeks to capture advantages, which can be achieved through economies of scale, efficiency, or diversification. The target firm, in turn, provides the assets, capabilities, or market access that make those gains possible. Together, the transaction reshapes both sides into a stronger competitive entity.

1. Strategic mergers and acquisitions motives

M&A provides a way to achieve rapid growth that would take years to accomplish independently. Strategic drivers highlight how companies expand reach, increase influence in their markets, and enhance operational capabilities.

| Driver | Key actions | Impact |

| 1. Scale and market share expansion | ✅Acquire competitors to increase market share ✅Enter new regions or markets | Expanding size and reach strengthens market position and creates opportunities for cost advantages. |

| 2. Revenue synergies | ✅Combine products or service offerings ✅Align customer bases to drive additional sales | Integrating offerings generates new revenue streams that are difficult to achieve organically. |

| 3. Cost synergies and efficiency gains | ✅Eliminate redundant roles and functions ✅Consolidate procurement, production, and back-office functions | Streamlined business operations improve profitability and enhance operational performance. |

| 4. Vertical integration | ✅Acquire upstream suppliers ✅Acquire downstream distributors | Control over key inputs and customer access strengthens reliability and the overall value chain. |

2. Financial mergers and acquisitions motives

Many transactions are guided by the goal of strengthening the company’s financial position and capturing hidden value. These motives determine how deals are structured, priced, and executed to maximize returns and manage risk.

| Driver | Key actions | Impact |

| 1. Tax gains and financial engineering | ✅Leverage tax shields ✅Utilize net operating losses (NOLs) ✅Optimize interest deductions | Optimizing taxes improves the company’s financial position and enhances post-transaction returns. |

| 2. Undervalued assets and arbitrage | ✅Acquire undervalued companies or assets ✅Extract hidden value from existing operations | Unlocked mispriced assets create efficiency gains and growth potential. |

| 3. Financial leverage | ✅Structure deals to be accretive to earnings ✅Use debt strategically | Returns to shareholders increase while risk is managed through careful leverage. |

| 4. Risk diversification and portfolio balancing | ✅Accelerate product or market expansion ✅Hedge against cyclical exposure | Reduced exposure to business or market volatility supports long-term performance. |

3. Non-financial mergers and acquisitions motives

Some transactions are undertaken to secure critical resources, talent, or intellectual property. Defensive motives also protect market position and ensure compliance with regulatory or industry pressures, safeguarding long-term competitiveness.

| Driver | Key actions | Impact |

| 1. Technology and intellectual property acquisition | ✅Acquire innovation, patents, or Research and Development capabilities ✅Integrate new technologies into existing operations | Access to advanced technologies and intellectual property strengthens competitiveness and reduces the risk of market disruption. |

| 2. Talent acquisition | ✅Acquire strong management teams ✅Hire specialized employees | Bringing in skilled personnel enhances organizational capability and supports growth initiatives. |

| 3. Eliminating competition | ✅Acquire competitors to neutralize threats ✅Prevent erosion of market share | Reducing competitive threats safeguards market position and protects business performance. |

| 4. Regulatory necessity | ✅Respond to regulatory pressures ✅Consolidate in regulated industries | Compliance and strategic consolidation ensure long-term stability and alignment with industry requirements. |

By breaking down the key motives behind M&A, we can see how strategy, finances, and defensive goals shape every deal. Next, we’ll look at real-world examples to show these drivers in action.

👁️🗨️Example motives from real deals

The following examples highlight high-profile acquisitions and show how different drivers translate into concrete deal logic and execution.

1. Merck & Co. acquires Verona Pharma – $10 billion

- Industry: Pharmaceuticals

- Motive: Pipeline expansion

Merck’s acquisition of Verona Pharma adds the promising respiratory drug Ohtuvayre to its portfolio, aiming to bolster its pipeline and offset revenue losses from patent expirations. This move reflects a strategic focus on expanding therapeutic offerings in the respiratory domain, aligning with growth and revenue synergy motives.

2. Electronic Arts (EA) acquired by Silver Lake Partners, Saudi Arabia’s Public Investment Fund (PIF), and Affinity Partners – $55 billion

- Industry: Gaming

- Motive: Strategic growth

In the largest-ever private equity deal, EA was acquired to revitalize operations amid declining revenues. The acquisition group plans to leverage EA’s intellectual property and gaming franchises to drive organic growth and increased profitability, illustrating revenue synergy and asset acquisition motives.

Whatever the deal driver, teams need a tool to manage information, coordinate stakeholders, and ensure the processes stay on track.

New technologies for a competitive advantage: VDRs in M&A motivations

Some teams still rely on generic file-sharing tools to manage sensitive transaction documents. However, these methods can be slow and difficult to secure.

A virtual data room provides a centralized, protected, and easy-to-use platform for managing transaction materials. By centralizing sensitive information in a controlled environment, the solution helps deal teams streamline due diligence and maintain confidentiality. Moreover, it helps coordinate stakeholders effectively.

Explore the key benefits of using a virtual data room and the features that make these benefits possible:

1. Organizing documents aligned with transaction motives

VDRs facilitate the structured organization of documents such as synergy plans, IP portfolios, and cost breakdowns. Key features include:

- Structured folder hierarchy for easy navigation

- Advanced search and tagging for quick retrieval

- Bulk upload with automatic indexing

- Customizable categories and labels for document types

2. Ensuring safe, controlled access by stakeholders and advisors

Advanced permission management ensures sensitive information is shared only with authorized parties. Key features include:

- Granular user permissions (view, download, print)

- Multi-factor authentication

- Time-limited access and auto-revocation

- Permission templates for user roles

3. Enabling transparency among deal teams

Transparency is critical when multiple teams collaborate on a deal. Key features include:

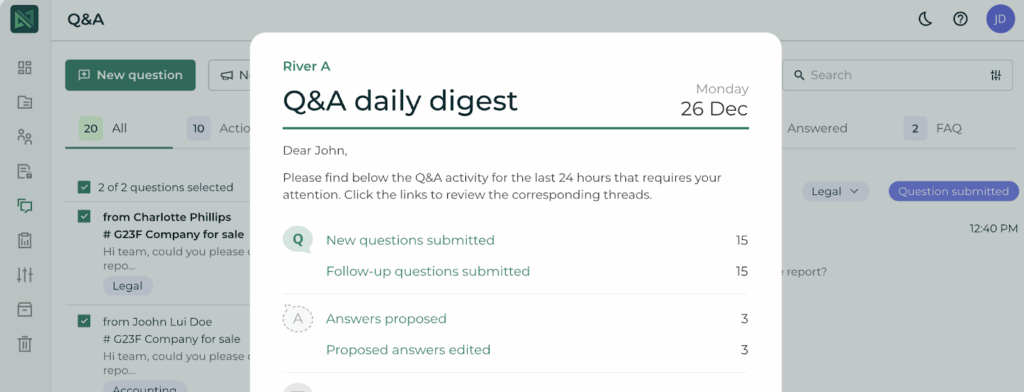

- Integrated Q&A modules for structured communication

- Real-time activity tracking of document access

- Audit logs for monitoring user interactions

- Notifications and alerts for document updates or questions

4. Supporting motive-focused diligence with advanced features

Advanced tools help align diligence with deal motives. Key features include:

- Analytics dashboards showing document engagement

- Dynamic watermarking to prevent leaks

- Version control to ensure the latest documents are used

- Custom reporting for tracking diligence progress and bottlenecks

With data rooms, deal teams can ensure that diligence, communication, and document management are aligned with strategic motives. This organized approach supports the smooth integration of the consolidated entity, strengthens the company’s operations, enhances competitive advantage, and helps maximize shareholder value.

Best practices

Even the smartest merger and acquisition strategies can stumble if there isn’t focus, clarity, and alignment. Success comes from approaching each step with purpose. Therefore, teams always have to ensure that every move serves the bigger goal.

Here is what top teams do to keep deals on track:

1. Define and document strategic intent

Start with why. Be clear about what the deal is meant to achieve before diving in. This gives everyone a shared understanding and a way to measure progress.

Tips

- List the main goals driving the deal.

- Rank motives by priority.

- Set measurable outcomes.

- Share intent with all stakeholders.

✔️How to rank motives by priority?

First, list all potential deal drivers, which can be market expansion, cost savings, or revenue growth. Second, assess the expected impact of each motive on the company’s long-term strategy and shareholder value. At the same time, consider the feasibility and risks associated with achieving each motive.

Finally, rank motives by combining their strategic importance, potential value, and execution complexity. Review the ranking with key stakeholders before allocating resources and making decisions.

2. Prioritize motives in due diligence and integration

Not every goal carries the same weight. So, focus your efforts where they will have the biggest impact.

Tips

- Map motives to relevant diligence areas.

- Focus resources on high-impact drivers first.

- Adjust priorities as new information emerges.

- Track progress against primary motives.

3. Focus on a few objectives

Trying to do everything at once usually backfires. So, stick to one or two main objectives and treat the rest as longer-term opportunities.

Tips

- Limit deals to 1–2 main objectives.

- Treat secondary goals as future initiatives.

- Define clear success metrics.

- Review focus regularly.

✔️What are success metrics in M&A?

These are measurable indicators of whether a deal achieves its objectives. They include the following: revenue growth

✔️cost savings

✔️synergies realized

✔️retention of key talent

✔️integration milestones

✔️return on investment

4. Use scenario planning to anticipate challenges

Things rarely go exactly as planned. Therefore, modeling different scenarios helps teams spot risks and stay prepared.

Tips

- Model financial variations.

- Test operational and integration challenges.

- Consider regulatory and market shifts.

- Prepare contingency actions.

5. Align executive incentives with the deal’s priorities

Leadership needs skin in the game. When executives are rewarded for hitting key objectives, the team stays focused and accountable.

Tips

- Link compensation to key outcomes.

- Clarify leadership responsibilities.

- Track performance post-close.

- Communicate incentives clearly.

✔️What is linking compensation to key outcomes?

This means aligning executive pay or bonuses with the primary objectives of the M&A transaction. For example, if the deal’s main goal is revenue growth through market expansion, executives could receive a bonus when revenue milestones are achieved post-close.

6. Leverage virtual data rooms

A secure, centralized platform keeps everyone on the same page and supports motive-driven execution.

Tips

- Organize documents by categories.

- Control access with permissions and MFA.

- Track document views and activity.

- Use Q&A tools for structured communication.

- Apply version control and watermarking.

- Review analytics to spot bottlenecks.

These tips improve your chances of a smooth and secure M&A deal.

Conclusion

Whether it’s two businesses joining forces in a horizontal deal or a target company being absorbed by a larger acquirer, the outcome is the creation of a new entity that can compete more effectively.

To succeed, organizations need to define clear strategic intent, prioritize their primary motives, and align integration planning with those goals. Success also depends on using tools like virtual data rooms. They protect data and keep due diligence and communication focused. When these elements come together, a merged company is better positioned to unlock long-term value.