Accenture research reveals that a full 64% of M&A executives anticipate generative artificial intelligence (AI) to revolutionize deal processes, reflecting the seismic shift underway in mergers and acquisitions.

AI in M&A represents the strategic application of machine learning and natural language processing to automate and enhance virtual data room (VDR) workflows. By transforming static document repositories into intelligent analysis platforms, AI addresses critical industry challenges:

- Accelerating deal velocity through rapid document processing

- Improving precision to identify potential risks and foster data-driven decision making

- Reducing operational costs by automating labor-intensive tasks.

These systems perform sophisticated functions such as contractual clause extraction, financial anomaly detection, and automated compliance checks. This article explores how AI-powered VDR automations are redefining due diligence, providing M&A professionals with actionable frameworks for implementation.

How AI transforms due diligence

Artificial intelligence is fundamentally reshaping M&A due diligence by automating high-volume document analysis and risk detection, tasks that traditionally consumed weeks of human effort.

Unlike conventional methods, AI algorithms enable firms to process thousands of contracts, financial statements, and operational records in hours, identifying critical patterns and anomalies that escape manual review. This shift accelerates deal timelines while enhancing precision in three key areas:

Data mining at unprecedented scale

AI-driven tools apply natural language processing (NLP) to extract and contextualize information from diverse sources:

- Pattern recognition. Identifying revenue trends, supplier concentration, or inventory discrepancies across years of financial data

- Anomaly detection. Flagging irregular transactions (e.g. unexplained payment spikes, off-balance-sheet liabilities) in ERP systems

- Cross-document verification. Automatically correlating clauses in supplier contracts with disclosures in board minutes

Risk detection with surgical precision

AI-powered analytics tools transform risk assessment by:

- Automatically tagging high-risk clauses (change-of-control provisions, non-competes)

- Comparing indemnification terms against industry benchmarks

- Detecting unreported tax liabilities through invoice/ledger cross-analysis

- Identifying revenue recognition red flags in sales contracts and financial reports

Strategic human-AI collaboration

The true value emerges when AI directs human expertise:

- Early risk triage. Documents are auto-categorized, allowing legal teams to focus on the remaining materials that contain material risks

- Contextual prioritization. Algorithms rank issues by financial impact and probability, accelerating decision-making

- Audit-ready documentation. AI-generated audit trails link findings to source documents, strengthening disclosure defenses

This synergy doesn’t replace human judgment but optimizes it. As EY notes, AI VDR capabilities frame data to “significantly facilitate due diligence teams’ work,” enabling earlier discovery of deal-breakers while ensuring human experts concentrate on nuanced interpretation and stakeholder negotiations. The result? Greater competitive advantage, faster closures with significantly lower diligence costs and mitigated post-transaction surprises.

Data rooms for M&A

Overall rating:

4.9/5

Excellent

Overall rating:

4.8/5

Excellent

Overall rating:

4.7/5

Excellent

Core AI-powered VDR automations

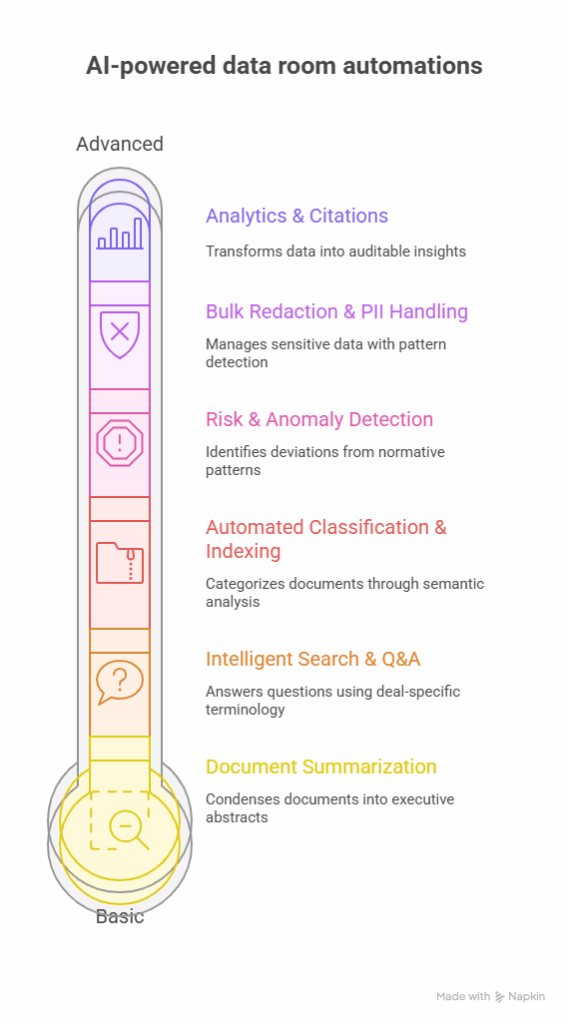

Virtual data rooms have evolved into intelligent processing engines through several foundational AI capabilities that transform unstructured documents into actionable intelligence. These automations create a structured knowledge framework essential for complex M&A workflows:

Document summarization: Precision distillation

AI-powered summarization acts as a digital analyst, condensing complex legal and financial documents into executive-grade abstracts while preserving critical context.

Advanced natural language processing extracts material clauses from contracts, identifies financial trends in statements, and highlights operational risks in reports, all while maintaining direct links to source materials.

This capability enables rapid comprehension of dense documentation without sacrificing auditability. The technology processes hundreds of pages in minutes, distilling key obligations, liabilities, and compliance requirements into accessible overviews with embedded verification paths.

“Generative AI is helpful in parsing the mountain of data that needs to be reviewed.” Bain & Company

Intelligent search & Q&A: Contextual intelligence

Modern VDRs feature conversational interfaces that understand deal-specific terminology and conceptual relationships:

- Natural language queries replace keyword guessing, allowing precise questions like “Show all supplier contracts with automatic renewal clauses post-2025.”

- Responses include page-level citations with highlighted source text for instant validation.

- Cross-document synthesis correlates clauses across agreements, minutes, and disclosures.

These systems operate within the VDR’s encrypted environment, maintaining full audit trails of all interactions. The architecture supports multilingual queries and preserves conversation histories, enabling continuity in extended due diligence engagements while eliminating external research dependencies.

Automated classification & indexing: Intelligent taxonomy

Upon document ingestion, AI algorithms apply multi-layered categorization:

- Content-based tagging identifies document types (contracts, financials, compliance) through semantic analysis.

- Metadata extraction captures critical attributes: effective dates, governing laws, and counterparties.

- Contextual indexing establishes relationships between documents across folders.

Advanced systems combine optical character recognition (OCR) with entity detection to process even handwritten notes and legacy scans, enforcing consistent taxonomies across global teams.

This structured foundation enables downstream AI functions while preventing manual indexing errors that compromise data integrity. The automation extends to version control synchronization, ensuring newly uploaded iterations inherit accurate classifications.

Risk & anomaly detection: Proactive safeguards

AI algorithms scan documents to identify deviations from normative patterns:

- Contractual anomaly detection. Flags non-standard clauses (e.g. uncapped indemnities, atypical termination triggers) against industry-specific legal benchmarks

- Financial irregularity spotting. Analyzes historical data and identifies revenue spikes inconsistent with seasonality, unexplained balance-sheet fluctuations, and non-compliant accounting treatments

- Compliance gap analysis. Detects missing regulatory documentation (e.g. tax filings, permits) through cross-referencing disclosure lists

The systems employ contextual understanding to distinguish material risks from benign variations and prioritize findings by potential financial impact and regulatory severity.

Bulk redaction & PII handling: Automated compliance

Platforms integrate specialized AI engines for sensitive data management:

- Pattern-based personally identifiable information (PII) detection. Automatically locates dozens of identifier types, including SSNs, IBANs, passport numbers, and medical codes across document formats

- Category-driven redaction. Enables batch processing of sensitive data classes (e.g. redact all financial IDs across 500 contracts with one command)

- Context-aware preservation. Maintains document structure while removing sensitive content, ensuring non-PII information remains usable

Language-specific NLP models ensure precision in documentation, with configurable validation workflows and pre-application review.

Analytics & citations: Verifiable intelligence

AI transforms unstructured data into auditable insights through:

- Tabular data extraction. Converts financial statements and operational reports into structured datasets while preserving original formatting

- Visual intelligence. Interprets charts/graphs to extract underlying data, such as market trends or financial analysis

- Source-anchored outputs. Automatically links all generated insights to exact document locations (page, paragraph, coordinates)

This creates self-validating analysis chains where every AI-generated conclusion remains tethered to verifiable evidence within the source material.

Use cases and world impact

The following scenarios illustrate how forward-looking firms are harnessing AI-powered VDR capabilities to navigate the deal making process, demonstrating measurable improvements in due diligence efficiency, negotiation outcomes, and post-merger value realization.

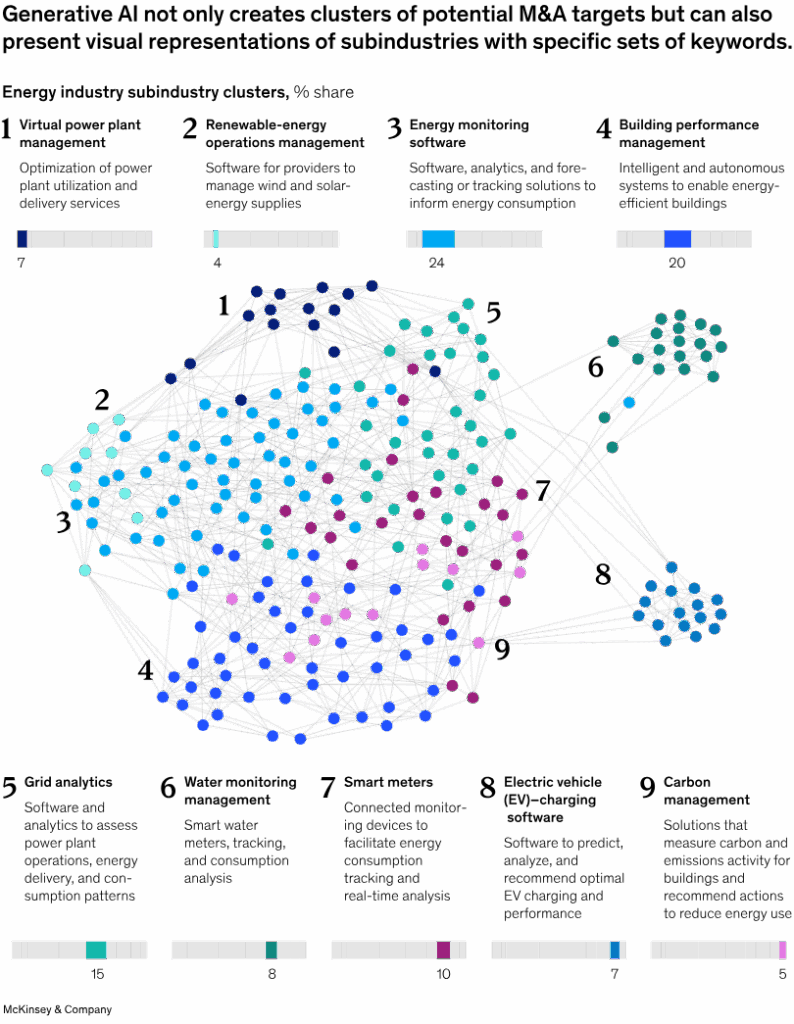

Strategic target identification

AI capabilities can significantly enhance market scanning processes by analyzing real-time market data and trusted sources, such as global patent databases, financial disclosures, and industry news archives.

For instance, these systems identify acquisition targets demonstrating high strategic alignment by correlating niche market signals with a buyer’s operational capabilities.

Natural language processing techniques can detect emerging technology synergies in startup documentation that traditional screening methods might overlook. This application often reduces target identification timelines from several months to weeks while helping ensure potential matches align with core growth objectives and cultural integration parameters.

Accelerated due diligence

During investigative phases, AI tools can automate document examination across multiple dimensions, such as financial modeling or regulatory compliance. These systems review contractual language to flag unusual clauses, analyze financial records for irregular patterns, and trace compliance gaps across regulatory frameworks.

Cross-referencing capabilities can automatically validate representations against evidentiary documents, potentially reducing verification cycles substantially. Such technology frequently surfaces material considerations, like undisclosed contingent liabilities or non-standard intellectual property terms that could escape manual review in complex data arrangements.

Strategic decision-making

Generative AI applications can simulate numerous deal structuring scenarios by modeling term variations against historical outcomes. For example, algorithms can process unstructured data from communications and draft agreements to predict target company concession thresholds or optimize earn-out structures based on performance probabilities.

This approach often creates data-driven negotiation frameworks while maintaining audit trails of term evolution. Such systems can assist teams in reaching consensus on key deal terms more efficiently while potentially reducing post-signing disputes.

Integration synergy activation

Post-merger integration can leverage AI as both an advisor and an execution partner. Cultural integration tools can analyze communication patterns and personal relationships to identify team alignment considerations, while operational harmonization systems can map process touchpoints for consolidation opportunities.

Synergy tracking applications typically monitor performance indicators against projections with real-time alerts. These technologies often generate tailored integration playbooks that reduce manual planning efforts, with some implementations showing accelerated synergy realization timelines.

Performance optimization

Ongoing AI monitoring applications can transform merged entities into learning organizations through continuous improvement cycles. Such systems can correlate operational data with market signals to adjust growth strategies or identify underperforming assets for potential divestiture using predictive valuation models. Perpetual synergy audits across business units could be automated, turning M&A activities into continuous value drivers rather than isolated events.

Challenges & human oversight

While AI-powered VDRs deliver transformative efficiency, their implementation requires careful navigation of technical and ethical boundaries. Here are several key considerations implementing AI in M&A:

Data privacy issues

AI systems operate within strict data governance frameworks where training data accessibility remains a fundamental constraint. Sensitive M&A documentation cannot be used for model training without compromising confidentiality, limiting algorithm exposure to diverse transactional patterns.

“Terabytes or petabytes of text, images or video are routinely included as training data, and inevitably some of that data is sensitive: healthcare information, personal data from social media sites, personal finance data, biometric data used for facial recognition and more.” IBM

Model limitations & hallucinations

Generative AI models occasionally produce plausible but factually incorrect outputs, a phenomenon known as “hallucinations.” For instance, algorithms might invent non-existent contractual clauses or misattribute financial terms during analysis.

AI companies openly admit that AI hallucinations can be frequent, particularly when the system lacks training data on a particular topic. For example, OpenAI’s model o3 hallucinated 33% of the time when performing the PersonQA benchmark test, which involves answering questions about public figures.

This requires careful consideration. Inaccuracies necessitate human verification, particularly for legal disclosures, comprehensive reports, and financial representations where errors could materially impact deal terms.

The imperative of human validation

Human validation remains critically important at every stage of AI implementation because research consistently indicates that completely eliminating hallucinations from generative AI systems is currently technologically unattainable. This fundamental limitation necessitates expert verification across multiple dimensions:

- Legal interpretation. AI-powered tools flag unusual clauses but cannot assess strategic implications in evolving deal contexts.

- Financial nuance. Revenue anomaly detection must be contextualized against business cycles and market events.

- Ethical redaction. Automated PII removal still requires review for false positives/negatives before application.

Regulatory and disclosure complexities

AI technologies often create legal ambiguities around disclosure obligations:

- “Fair disclosure” standards. When AI identifies material risks undisclosed by sellers, does this constitute constructive knowledge under transaction agreements?

- Audit trail requirements. Regulators increasingly demand documentation of human oversight steps in AI-assisted due diligence.

- Cross-border compliance. Varying jurisdictional stances on AI-generated reports (e.g. EU AI Act vs. SEC guidelines) create compliance mosaics.

These concerns necessitate clear protocols defining how AI findings integrate with traditional disclosure frameworks and legal representations.

Best practices for implementing AI VDRs

Successful AI integration in M&A workflows demands strategic alignment between technology capabilities and human expertise. Here are the three practices for embracing AI responsibly:

Vendor evaluation: Beyond feature checklists

Selecting AI-powered VDRs requires a multidimensional assessment transcending basic functionality comparisons. Security architecture must be scrutinized through independent SOC 2 Type II or ISO 27001 certifications, with particular attention to data residency options meeting jurisdictional requirements.

AI capabilities should undergo technical validation through proof-of-concept testing with sample deal documentation, evaluating performance on domain-specific tasks like cross-contract clause correlation.

Compliance verification extends to emerging AI governance frameworks, including algorithmic transparency and bias mitigation. Crucially, vendor viability must be assessed through development roadmaps, client references in comparable transactions, and contractual commitments to feature parity during subscription periods.

Workflow integration: Structured AI adoption pathways

Deploying AI VDRs necessitates phased integration with existing due diligence processes. Initial training should differentiate between administrator and end-user competencies, with legal teams focusing on AI-assisted redaction workflows while financial analysts master data extraction tools.

Process reengineering must establish clear handoff points between AI-generated insights and human validation, such as mandatory attorney review of flagged contractual anomalies before inclusion in disclosure schedules.

Feedback mechanisms should be embedded directly within the VDR interface, enabling single-click reporting of AI inaccuracies during document review. Parallel run periods, where AI outputs are compared against manual benchmarks, help quantify efficiency gains while building organizational confidence.

Continuous learning: The human-AI feedback loop

Maintaining AI relevance requires institutionalizing knowledge transfer from deal teams to algorithms. Structured feedback protocols should capture three critical dimensions:

- Contextual false positives/negatives in risk detection, with timestamped examples of misinterpreted clauses

- Evolving deal terminology requiring model retraining (e.g. sector-specific EBITDA adjustments)

- Validation gap patterns where human reviewers consistently override AI recommendations

This intelligence should flow into quarterly model refinement cycles, where vendor data scientists retrain algorithms using anonymized deal artifacts. Performance metrics must track precision/recall rates by document type and jurisdiction, ensuring improvements align with actual transaction pain points.

Cross-client benchmarking (anonymized and aggregated) further enhances model sophistication by exposing algorithms to diverse contractual structures and industry conventions.

The most advanced implementations establish dedicated AI stewardship roles, typically senior deal specialists, who coordinate feedback collection, validate model updates, and document system limitations for new team members.

Future outlook: AI’s expanding role in M&A

The next wave of AI in M&A might transcend task automation, evolving into a strategic partner that augments human decision-making across the deal lifecycle. Several interconnected trajectories define this evolution:

Strategic deal intelligence

Agentive AI systems are advancing beyond analysis to predictive advisory roles. By synthesizing market data, historical deal patterns, and real-time regulatory feeds, these systems generate actionable insights for:

- Deal sourcing. Identifying acquisition targets with strategic fit using predictive modeling of growth vectors and cultural compatibility

- Bid optimization. Analyzing vast amounts of data and simulating 10,000+ negotiation scenarios to pinpoint optimal terms while forecasting regulatory hurdles with high accuracy

- Synergy mapping. Projecting post-merger value creation pathways by correlating operational datasets from both entities

This shift transforms AI into a boardroom advisor, particularly in private equity (PE), where 55% of PE firms now deploy machine learning and predictive analytics to forecast the performance of portfolio companies (portcos).

Source: McKinsey

Smoother post-merger integration

AI’s most significant impact emerges during integration through:

- Cultural alignment engines. Analyzing communication patterns across merged entities to identify friction points and recommend team-building interventions

- Synergy identification. Recent studies (March 2025) indicate AI-powered integration planning tools can identify up to 43% more viable synergy pathways than traditional manual methods, enabling teams to model complex operational dependencies with unprecedented granularity

- AI coaching systems. Providing integration managers with real-time playbook recommendations based on historical success patterns

With 80% of dealmakers projected to deploy generative AI tools within three years, the competitive divide will increasingly separate firms that leverage AI as a strategic capability from those treating it as a productivity tool.

Key takeaways

- AI automates high-volume document analysis, enabling faster due diligence through intelligent summarization, risk detection, and cross-document verification.

- Human oversight remains critical to validate AI outputs, counter hallucinations, and contextualize findings within evolving deal dynamics.

- AI VDR implementation depends on rigorous vendor evaluation, phased workflow integration, and continuous feedback loops that refine AI performance.

- Emerging AI applications include predictive target sourcing and AI-guided post-merger integration, with 80% of dealmakers planning to adopt generative AI by 2027.