When you’re trying to gather funds for your business, having a structured way to show your past financial statements and metrics can help you win investor confidence. In this case, an investor data room can be your secret weapon for smoothing out your fundraising process.

Having an investor data room ready to go can grease the wheels and make a great impression on potential backers. Just ask Andrea Funsten, an investor at Basecamp Fund, who’s undoubtedly encountered a wide array of startups. As she shares on Twitter, a well-prepared data room is key for portfolio companies:

Even as early as the seed stage, an organized data room can make you stand out from the crowd. Sharing a list below of items that I received this week from a founder who is ~2 months away from raising. Left me so impressed and eager to move fast on the deal.

What is a data room for venture capital?

A venture capital data room is a meticulously organized data room that serves as the centralized location for securely storing vital company documents of a tech startup.

Controlled data room access stands out as one of the primary advantages of an investor data room. Thanks to granular access controls and read-only permissions offered by each startup data room, only designated individuals can access information in a controlled way. This capability is crucial, considering the alarming statistics highlighted in an IBM report, which revealed a 15% increase in the global average cost of a data breach in 2023.

Efficiency is another key advantage provided by investor data rooms, crucial in processes like due diligence, fundraising, company sales, strategic partnerships, or IPO preparations. According to a Harvard Business Review survey, each deal pursued by a VC firm entails evaluating 101 opportunities. However, only a fraction of 4.8% proceed to a due diligence process, with a mere 1.7% advancing to term sheet negotiation.

During due diligence, VCs meticulously assess factors including the quality of the founding team, business model viability, market dynamics, industry trends, and company valuation. Good news? An investor data room simplifies each of these processes. Let’s see how.

Why do venture capitalists need virtual data rooms?

A common misconception among those unfamiliar with investor data rooms is that they’re merely glorified storage solutions. However, the reality is far more nuanced.

For startups, online data rooms offer a plethora of advantages, including:

- Security of high-confidentiality documents: Virtual data rooms provide strict security protocols and features such as granular permissions, data controls, and prevention of unauthorized document copying or downloading — a level of protection impossible with physical data rooms.

- Streamlined due diligence process: While a polished pitch deck is crucial, due diligence plays an equally pivotal role in fundraising. At this stage, data rooms make it easy to organize all the details in a centralized storage space, thus simplifying internal decision-making for potential investors.

- Ease of data sharing. Each investor data room offers seamless data-sharing capabilities, allowing startups to efficiently distribute sensitive information to prospective investors. With robust features like granular permissions, digital watermarks, and more, these platforms ensure smooth yet secure interactions between startups and investors.

- Document engagement tracking. Startup data rooms also provide robust document engagement tracking features, allowing startups to monitor investor interactions in real-time, and track document views, downloads, and other user activities. Apart from offering valuable insights, it helps startups optimize their engagement and tailor communication strategies accordingly.

- Transparency. Few things deter potential investors as effectively as a lack of transparency. Virtual data rooms provide a remedy to this concern by establishing a centralized platform where authorized parties can readily access all sensitive information, cultivating an atmosphere of openness, trust, and credibility throughout the investment process.

Popular data rooms for venture capital

Overall rating:

4.9/5

Excellent

Overall rating:

4.8/5

Excellent

Overall rating:

4.7/5

Excellent

What documents should be in a data room for venture capital?

Curating a comprehensive data room is crucial for startup success. Here’s a rundown of the top documents to include:

Overview folder and documents

This section offers a concise overview of your business, including details on the problem you’re addressing, your solution, and competitors. Be sure to include:

- A one-page business overview

- Competitive matrix

- Go-to-market strategy

- Proof of value documents

- Links to your company website and social media platforms

- Product demo video

- Pitch deck

Research by Gartner reveals that a staggering 86% of seed round pitch decks are rejected before presentation. To maximize fundraising potential, it’s essential to identify investors’ pre-screening criteria and tailor your pitch decks accordingly.

Financials and cap table

As per findings from CB Insights Analysis, 38% of startups falter due to cash-related issues, such as depletion or failure to secure funding. To assure investors of your startup’s financial stability, it’s imperative to provide a comprehensive economic overview spanning from your inception to the present day, along with forward-facing projections.

Key documents to include are:

- Profit and loss (P&L) statement

- Balance sheet

- Cash flow statement

- Net profit margin analysis

- Financial projections

Market and research data

To substantiate that your solution addresses a genuine problem encountered by a substantial audience willing to invest, it’s crucial to furnish supporting data. Essential documents to include are:

- Market size analysis and competitive analysis

- Competitive positioning

- Customer data showcasing demographics and preferences

- Current customer count

- Customer acquisition cost breakdown

- Engagement rate metrics

- Retention rate statistics

- Ideal customer profile (ICP) description

- Buyer personas outlining target audience segments

- Unique selling proposition (USP) documentation highlighting your competitive edge

Cap table/incorporation documents

Providing investors with clarity on your company’s ownership structure is vital. Documents to include here are:

- Summary of the capitalization table outlining ownership percentages and share distribution

- Information on past fundraising rounds or liquidity events for historical context

- Shareholder certificates validating ownership stakes

- Vesting schedules detailing the gradual ownership acquisition by stakeholders over time

- Details of Employee Stock Ownership Plan (ESOP) arrangements

- Voting agreements outlining the voting rights and responsibilities of shareholders

- Investor rights agreements specifying the rights and obligations of investors

- First refusal and co-sale agreements governing the sale of shares and rights of first refusal

Team and stakeholders

When presenting your team, offer a comprehensive overview of their experience and the pivotal roles they play in your business. Ensure to include:

- Concise profiles detailing each team member’s role and tenure with the company

- Copies of employee contracts

- Onboarding documents illustrating your company culture and recruitment process

- Identification of future critical roles within the organization

- A list detailing any contract workers and external firms engaged with your business

Past investor updates

When assembling past investor updates for your data room, consider including the following key documents:

- Information on previous fundraising rounds

- Quarterly performance reports

- Product development updates

- Market analysis and trends

- Strategic partnership announcements:

- Roadmap and future plans

Customer references

When compiling customer reference documents for your investor data room, consider including:

- Case studies, testimonials, and customer success stories

- Usage metrics and customer lists

- Referral program details (if any)

- Contract renewal rates

Product-related documents

Technology documents offer transparency regarding your company’s software products, their functionalities, and the third-party software utilized. Essential documents comprise:

- System architecture diagram illustrating the structure and components of your software system.

- API documentation detailing the interfaces and endpoints for integrating with your software.

- Product backlog export provides insights into the prioritized list of features and tasks.

- Presentation of existing products, possibly through screenshots, to showcase their current state and functionality.

- Comprehensive details on any significant integrations with external systems or platforms.

- Inventory of third-party and open-source software utilized in your product ecosystem for transparency and compliance purposes.

What documents are not to be included in a data room for venture capital?

Write an introduction, and briefly cover the following points:

When crafting a data room to equip investors with pertinent information, it’s crucial to streamline the process and avoid inundating them with unnecessary data.

- Org chart and/or team bios. Including org charts and team bios in an investor data room might not be necessary as investors typically prioritize financial and strategic information over organizational structure details.

- Tax returns, audits, and legal docs. Tax returns, audits, and legal documents are often excluded from data rooms due to their sensitive nature and potential legal implications, which may not align with the purpose of an investor due diligence process.

- Board meeting minutes. Board meeting minutes may be omitted as they can contain sensitive or confidential information not directly relevant to investors’ decision-making processes, focusing instead on strategic discussions and operational matters.

Some other components that may not warrant inclusion in an investor data room are:

- Documents lacking relevance to investors’ decision-making processes.

- Sensitive data protected by privacy laws such as HIPAA or CCPA.

- Materials that may be inconsequential to the current stage of engagement with an investor. For instance, if the interaction is merely a casual coffee chat, it’s advisable to limit the scope of shared documents.

What are the top VDRs for venture capital?

Write a short intro, and recommend the next providers:

Ideals

Ideals is a reputable investor data room solution. With a swift setup in just 15 minutes, it is especially useful for early-stage companies as it doesn’t require a long learning curve.

Robust data security measures like encryption, watermarks, and multi-factor authentication ensure document protection, while features like a secure spreadsheet viewer and activity reports enhance user experience.

For customer support, Ideals offers 24/7 multilingual assistance via live chat, email, and dedicated project managers.

Features that are essential for startups and VCs include a secure spreadsheet viewer, detailed activity reports on document views, and comprehensive security measures including strong encryption and watermarks.

Intralinks

Intralinks VDRPro is a virtual data room software tailored for secure document sharing. Boasting advanced features such as AI redaction, insights dashboards, and video integration with Zoom, it aims to expedite deals with automated setup and preconfigured workflows.

Despite its robust capabilities, pricing details are not transparent, and new users may encounter a learning curve.

Features that are key for early-stage founders include automated setup, granular user permissions, and 24/7 customer support.

DFin

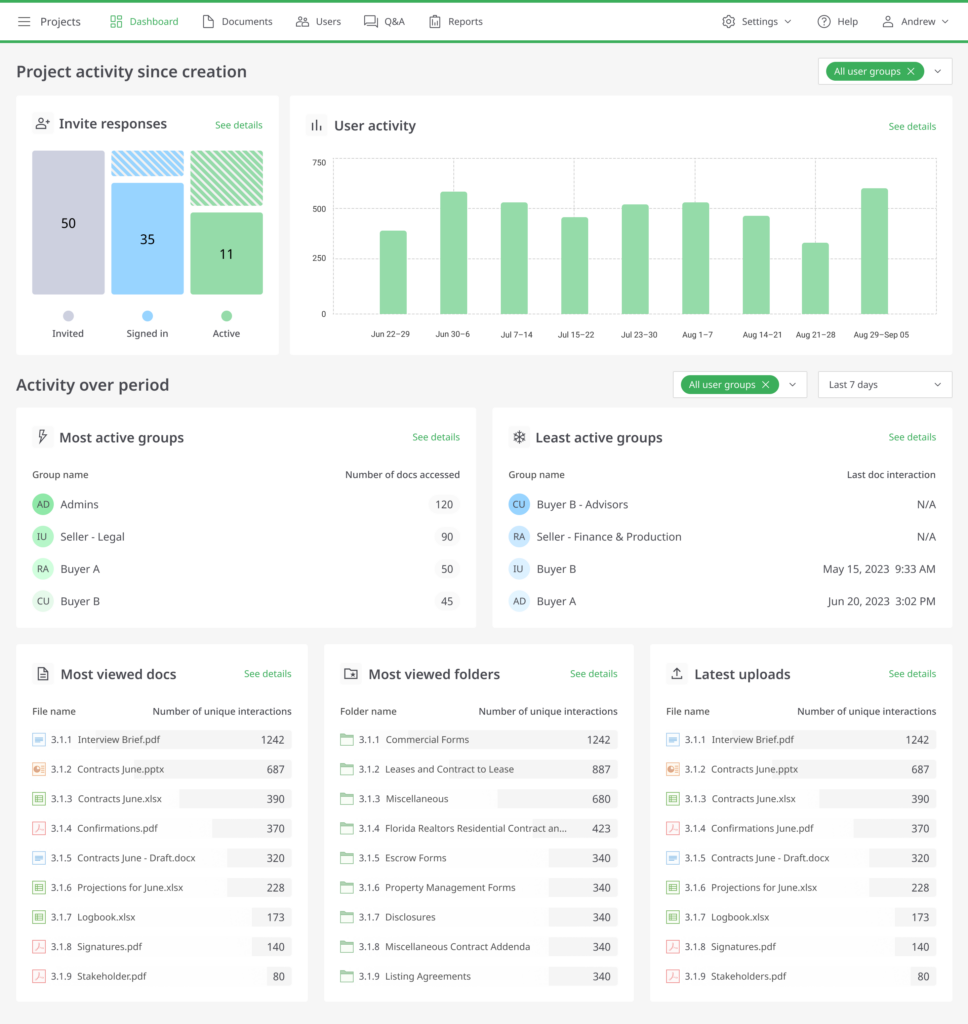

DFIN (formerly known as Donnelley Financial Solutions) offers a comprehensive investor data room solution. Known for its advanced features like AI-powered document indexing, dynamic watermarking, and real-time user activity tracking, DFIN aims to streamline deal workflows and enhance collaboration.

The platform ensures a highly secure environment for confidential document sharing with granular user permissions and controls. While pricing details are available upon request, users may encounter a learning curve due to the platform’s advanced functionality.

Key features for early-stage venture deals include AI-powered document indexing, dynamic watermarking, and real-time user activity tracking, among others.

Summary

Let’s summarize key findings from the article now:

- The investor data room serves as a crucial tool for startups seeking funding by providing a structured platform to showcase past financial statements and metrics, thereby instilling investor confidence and streamlining the fundraising process.

- Essential documents to include in the investor data room are the business overview, financial statements (such as profit and loss, balance sheet, and cash flow statement), market analysis, cap table, team profiles, past investor updates, and customer references.

- Leading virtual data room providers for VC include Ideals, Intralinks, and DFin’s Venue. These platforms offer advanced features for startups and investors involved in fundraising and due diligence activities.