Financial due diligence (FDD) reports become critical shields when policy shocks hit. After President Trump’s tariffs vaporized 18.7% of >$100-million deals and 51.3% of their transaction value, FDD has become an even more critical step in the M&A cycle.

This definitive assessment uncovers hidden risks, validates earnings sustainability, and transforms data into negotiation leverage. For dealmakers, it’s non-negotiable risk mitigation. Our guide dissects its components, strategic impact, and best practices to empower your transactions with confidence.

What is a financial due diligence report? Demystifying the cornerstone of M&A

A financial due diligence report (FDD report) is the definitive output of a rigorous, transaction-specific investigation into a target company’s historical performance, current financial standing, and future earnings potential.

Conducted primarily by or for the buy side (acquirers, private equity investors, or strategic buyers), its core purpose extends far beyond number verification. It provides a comprehensive view of the company’s financial health, revealing the underlying drivers behind the numbers and evaluating the quality and sustainability of its earnings.

The FDD report identifies hidden risks and liabilities and validates management’s financial representations. Ultimately, it transforms raw financial statements into actionable intelligence critical for informed decisions on valuation, deal structuring, and risk mitigation.

Financial due diligence vs. financial audit

While both examine financial records, financial due diligence and a financial audit serve fundamentally different objectives. An audit, governed by standards such as Generally Accepted Accounting Principles (GAAP), provides reasonable assurance that financial statements (balance sheet, income statement, and cash flow reports) are free from material misstatement. It’s retrospective, compliance-focused, and designed for a broad audience (regulators, shareholders).

Financial due diligence, conversely, is inherently forward-looking and deal-driven. The diligence process adopts a skeptical, investigative lens, digging deeper to assess the quality of earnings, working capital adequacy, cash flow sustainability, potential operational inefficiencies, tax compliance risks, and exposures that impact the deal’s value and feasibility. FDD uncovers nuances an audit may overlook, such as customer concentration risk or off-balance-sheet obligations.

Why the FDD report is indispensable for assessing true financial health

Ignoring a robust financial due diligence report is a high-stakes gamble. It provides the irreplaceable foundation for accurately gauging a target company’s market position and the company’s future potential by:

- Uncovering hidden realities. It reveals sustainable earnings, hidden liabilities (litigation or environmental claims), aggressive accounting, or declining trends that can’t be observed from surface-level financial statements and preliminary due diligence.

- Validating stability. It assesses working capital cycles, debt, and cash flow to determine the company’s ability to meet obligations and fund growth.

- Identifying deal-breakers. Flagging critical red flags like unresolved tax compliance issues or weak controls that drastically impact valuation or post-acquisition potential.

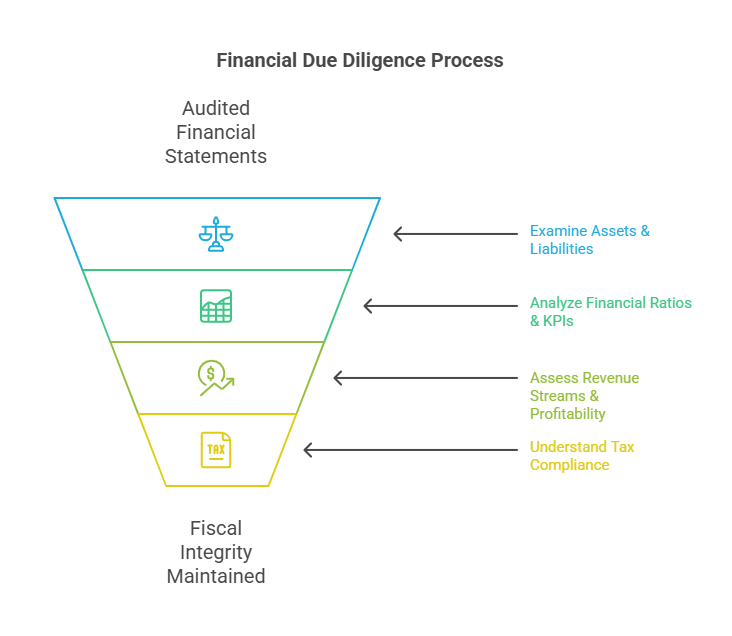

Key components of a financial due diligence report

Having established the purpose of the financial due diligence report, we now dissect its core anatomy. This section details the essential investigative areas of financial due diligence:

1. Interrogating the audited financial statements

Key areas of scrutiny include:

Income statement (P&L)

- Analyze revenue recognition policies for aggressiveness or conservatism.

- Scrutinize the cost of goods sold (COGS) for consistency and accuracy of inventory costing.

- Examine operating expenses for trends, unusual spikes, non-recurring items, and potential understatement or overstatement.

- Assess EBITDA quality by adjusting for owner perks, non-recurring gains/losses, and non-arm’s-length transactions.

- Evaluate the sustainability of net income by identifying one-time events or accounting changes.

Balance sheet

- Verify the existence, ownership, and valuation of major assets (especially on the recent balance sheet).

- Analyze accounts receivable aging for collectability risk and potential bad debt exposure.

- Scrutinize inventory levels, turnover rates, and risks of obsolescence.

- Review accounts payable terms and aging for potential cash flow pressures or disputes.

- Assess debt terms, covenants, and repayment schedules.

- Examine equity components, including retained earnings and capital injections.

Cash flow statement

- Reconcile reported net income to cash flow from operations, identifying significant non-cash adjustments or discrepancies.

- Analyze the quality and sustainability of operating cash flow. Is profit converting to cash?

- Evaluate investing activities (capex) for alignment with business strategy and maintenance vs. growth spend.

- Review financing activities for reliance on debt or equity infusions to fund operations.

2. Assets & liabilities

Key investigative steps include:

Tangible assets

- Physically verify major fixed assets (property, plant, equipment) where feasible.

- Review maintenance records, depreciation policies, and assess overall condition and remaining useful life.

- Evaluate real estate titles, leases, and potential environmental issues.

Intangible assets & intellectual property

- Confirm ownership and registration status of patents, trademarks, copyrights, and domain names.

- Assess the defensibility, remaining life, and ongoing value of key intellectual property.

- Review licensing agreements (inbound and outbound) for terms and restrictions.

- Evaluate the strength and transferability of customer relationships and contracts.

Liabilities (recorded and potential)

- Review debt agreements for covenants, collateral, and potential acceleration triggers.

- Analyze lease obligations (operating and finance) under relevant standards, such as Accounting Standards Codification Topic 842 (ASC 842).

- Scrutinize warranty provisions, litigation reserves, and environmental remediation estimates for adequacy.

- Investigate off-balance-sheet obligations (e.g., guarantees, contingent liabilities).

- Review pension and employee benefit obligations.

3. Financial ratios & KPIs

Financial due diligence examines these essential metrics:

- Liquidity. Current Ratio, Quick Ratio, Cash Ratio (Assessing the company’s ability to meet short-term obligations).

- Profitability. Gross Profit Margin, Operating Profit Margin (EBIT Margin), Net Profit Margin, Return on Assets (ROA), Return on Equity (ROE) (Measuring earnings power relative to sales and capital employed).

- Leverage. Debt-to-Equity Ratio, Debt-to-EBITDA Ratio, Interest Coverage Ratio (Assessing financial risk and debt servicing capacity).

- Efficiency. Inventory Turnover, Days Sales Outstanding (DSO), Days Payable Outstanding (DPO), Cash Conversion Cycle (Measuring effectiveness in managing working capital and operations).

- Industry-Specific KPIs. Customer Acquisition Cost (CAC), Customer Lifetime Value (CLTV), Same-Store Sales Growth, Production Yield, Occupancy Rates. These are crucial for understanding the target company’s market position and operational drivers.

4. Revenue streams & profitability

The financial due diligence focuses on:

Revenue analysis

- Break down revenue by product line, service type, geography, distribution channel, and key customer.

- Quantify customer concentration risk (e.g., revenue from top five customers).

- Analyze pricing strategies, discounting practices, and historical price trends.

- Evaluate backlog quality, duration, and cancellation rates (if applicable).

- Assess sales pipeline and conversion rates.

Profitability analysis

- Analyze gross profit margins by product/service line to identify winners and losers.

- Understand key cost drivers for COGS (e.g., raw materials, labor, logistics).

- Scrutinize the operating expense structure for fixed versus variable components and scalability.

- Identify key drivers of EBITDA margins and their sustainability.

- Assess the impact of volume, price, and mix changes on overall profitability.

5. Tax compliance & obligations

Key areas examined include:

- Review federal, state, and local tax returns for the past 3–5 years, including all schedules and attachments.

- Analyze income tax provisions and reconciliations between book and taxable income.

- Assess the status of open tax years and any ongoing audits or disputes with tax authorities.

- Identify potential exposure areas. Unremitted sales/use tax, payroll tax issues, nexus concerns, transfer pricing risks, R&D credit claims, and uncertain tax positions (ASC 740).

- Review tax attributes (Net operating losses, tax credits) and potential limitations on their usability post-acquisition.

- Examine the tax implications of different deal structures (asset vs. stock purchase).

Identifying potential financial risks & red flags

Common red flags and potential risks include:

| Red Flag | Example | Potential Interpretation |

| Inconsistent Trends in the Company’s Financial Performance | Q3 revenue jumps 40% while industry averages 5% growth, with no clear explanation | Potential earnings manipulation, unstable operations, or undisclosed one-time events affecting comparability |

| Aggressive Accounting | Recognizing $1.2 million revenue upon contract signing before product delivery | Inflated financial performance, future restatement risk, or violation of revenue recognition standards |

| Customer/Supplier Concentration | 70% of sales are dependent on a single retail chain facing bankruptcy rumors | Critical vulnerability to customer loss, limited bargaining power, or imminent revenue cliff |

| Deteriorating Margins | Gross margin declined from 42% to 28% over 18 months despite flat sales | Rising input costs, pricing pressure, or operational inefficiencies eroding profitability |

| Weak Cash Flow Conversion | $5 million net income but only $800,000 operating cash flow due to inventory buildup | Poor working capital management, low-quality earnings, or potential obsolescence issues |

| Unusual Transactions | $750,000 “consulting fee” paid to a board member’s private company | Undisclosed conflicts of interest, fund diversion, or governance breaches |

| Legal & Regulatory Exposures | Ongoing Department of Justice (DOJ) antitrust investigation with potential 8-figure penalties | Material liability exposure, business model threats, or reputational damage |

| Internal Control Weaknesses | A financial controller reconciles bank statements and approves vendor payments | High fraud risk, reporting inaccuracies, or inability to prevent financial misstatements |

| Off-Balance Sheet Items | $15 million in operating lease obligations missing from the balance sheet | Hidden leverage, understated liabilities, or unexpected cash flow drains |

| Management Over-Optimism | Projecting a 30% CAGR despite 3 years of declining sales in a stagnant market | Unrealistic growth assumptions, credibility gap, or attempt to inflate the valuation |

How financial due diligence shapes M&A outcomes

A comprehensive financial due diligence (FDD) report transforms M&A execution by clarifying a fair market value, exposing risk, and reshaping deal architecture.

Normalizing earnings

FDD strips out non-recurring items, such as owner perks, one-time gains, and inflated revenues, to reveal true operational performance. This adjusted EBITDA becomes the basis for valuation. In many cases, uncovering aggressive accounting practices results in purchase price reductions. The buyer gains negotiation leverage by demanding dollar-for-dollar adjustments and embedding risk premiums into the final agreement.

Establishing a working capital peg

Setting a normalized working capital target ensures the buyer doesn’t inherit liquidity gaps or obsolete inventory. For sectors like construction, where receivables often outpace payables and cash conversion cycles stretch 30–45 days, deviations uncovered in diligence may trigger price reductions at closing. Net working capital issues can result in 20% reductions in final deal prices and are very common.

“Working capital is the most common purchase price adjustment metric, included in 89% of deals from the 2023 ABA [ American Bar Association’s Private Target Mergers and Acquisitions Deal Point] study,” said Daniel Avery, Director at Goulston & Storrs.

Restructuring the deal

Material financial risks often lead to revised deal structures. Earnouts mitigate uncertainty. Asset deals may be favored over stock purchases to isolate legacy liabilities. Legal terms, representations, warranties, and escrow provisions, are tailored to the specific risks surfaced during diligence.

The walkaway threshold

FDD also defines when a deal must be abandoned. Unsustainable margins (e.g., <8% in construction), cash flow volatility exceeding 20%, or unfiled liabilities surpassing equity often meet the threshold for termination, shielding the buyer from post-close value destruction.

Case in point: Kyanite–Keppel termination

A walkaway threshold was precisely the case in August 2020, when Kyanite Investment Holdings, a unit of Temasek Holdings, withdrew its S$4 billion ($2.9 billion) bid for an additional 30.6% stake in Keppel Corp. After Keppel posted a Q2 net loss of S$697.6 million (its first in over two years), Kyanite invoked a clause tied to unmet income thresholds and exited the deal. The financial underperformance breached pre-agreed conditions and nullified the transaction. This illustrates how diligence can stop a deal entirely when value or viability evaporates.

Case in point: Kraken–NinjaTrader acquisition

Conversely, in March 2025, Kraken’s $1.5 billion acquisition of NinjaTrader showcased how robust financial due diligence can validate value and unlock opportunity. Using AI-driven analysis to assess sustainability, growth, and risk within hours, Kraken confirmed strategic alignment and closed the deal with confidence.

Best data rooms for due diligence

Overall rating:

4.9/5

Excellent

Overall rating:

4.8/5

Excellent

Overall rating:

4.7/5

Excellent

Best practices for conducting financial due diligence

Executing a truly effective financial due diligence process requires strategic discipline and collaboration to transform data into decisive insights for a successful deal:

Assemble a multidisciplinary due diligence team

Moving beyond core accountants is critical. Tailor your due diligence team to the target’s industry, complexity, and perceived risks. Include specialized expertise:

- Tax professionals for intricate diligence on tax exposures

- Legal professionals to dissect contracts and litigation

- Human resources experts for compensation, pension, and retention risks

- Information technology (IT) specialists to assess system integrity and data reliability

- Operational consultants familiar with the sector’s key areas and competitive landscape

Define a dynamic scope and precise objectives upfront

Avoid a generic, boilerplate approach. Clearly articulate the diligence process scope based on the specific deal rationale (strategic fit, potential synergies), preliminary findings (red flags), and the target company’s market position.

Prioritize key areas. Is it validating sustainable earnings, assessing working capital adequacy, or scrutinizing a specific intellectual property claim? Establish clear questions that the FDD report must answer to inform the buy-side financial decision. Crucially, remain agile. Allow the scope to evolve as the diligence team uncovers new leads requiring deeper investigation.

Utilize standardized checklists wisely, not rigidly

Treat a financial due diligence checklist as a foundational starting point. Encourage the team to dig deeper when anomalies arise, follow investigative threads, and adapt their approach based on emerging findings. The real value lies in critical thinking applied beyond the checklist items to uncover the true narrative behind the numbers.

Enforce stringent confidentiality and data security protocols

Execute a robust confidentiality agreement (NDA) before any data exchange. Implement rigorous protocols for handling physical and digital documents, particularly when utilizing virtual data rooms (VDRs). Control access strictly, employ watermarking, use secure communication channels, and ensure all team members understand their obligations.

Foster proactive and transparent communication

Maintain open, consistent dialogue between the due diligence team, the buyer’s leadership, the sell-side management, and their advisors. Schedule regular update calls to discuss findings, request clarifications promptly, and address potential roadblocks as soon as possible.

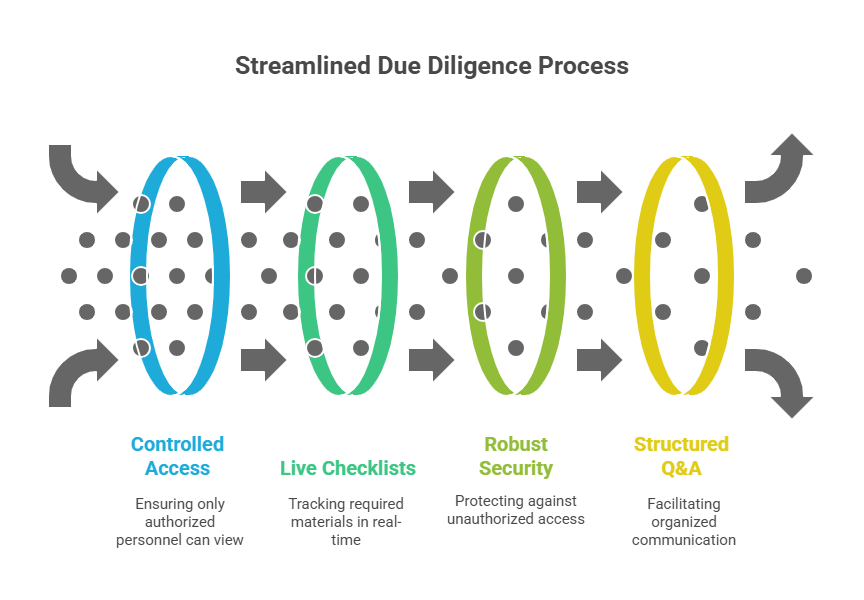

Using virtual data rooms effectively in financial due diligence

Virtual data rooms (VDRs) are secure online platforms for managing sensitive documents during transactions. They directly support the disciplined approach required for high-quality financial due diligence. Here’s how VDR features align with best FDD practices:

Supporting teamwork with controlled access

VDRs allow precise control over who sees what through a multi-level, role-based access system. Tax advisors, legal counsel, operational specialists, and IT auditors can each access only the files relevant to their role, such as tax returns, contracts, or system diagrams, within a single secure space.

Features like partial document visibility and watermarked “View Only” access prevent unauthorized sharing or copying. This environment lets diverse experts collaborate efficiently while maintaining confidentiality.

Adapting the investigation scope with live checklists

Static Excel checklists emailed back and forth create version chaos. VDRs allow admins to upload and manage interactive checklists directly within the platform. Team members with “Edit” permissions can update these lists in real-time as the investigation progresses.

If initial findings point to inventory risks, the checklist can be adjusted immediately to prioritize deeper analysis of stock records and COGS data. This live flexibility ensures the diligence stays focused on the most critical areas.

Protecting sensitive data with robust security measures

VDRs offer stronger protection than email or basic cloud storage for confidential financial data. For example, “Encrypted Download” permissions require user authentication and disable copying/screenshots for sensitive files like audited financials or tax audits.

Additionally, detailed audit logs record every document view, download, and checklist change. Integrated AI redaction tools can automatically find and hide personal information (PII) in documents, reducing compliance risks during sharing.

Clarifying communication through structured Q&A

VDRs include built-in Q&A modules with defined roles (such as Question Submitter, Answer Coordinator, Expert). Questions link directly to specific documents or checklist items, providing essential context.

Answer Coordinators route queries to the right internal expert (e.g., a tax question to the tax specialist), track responses, and manage approvals. This keeps all communication traceable and within the secure VDR, speeding up responses.

Platforms like Ideals, SecureDocs, and DFIN provide these functionalities. By centralizing documents, enabling adaptable planning, enforcing strict security, and organizing communication, VDRs help due diligence teams conduct thorough, efficient investigations essential for sound M&A decisions.

Key takeaways

- A financial due diligence report is the cornerstone of M&A success, transforming raw data into a thorough understanding of the target’s true financial health, risks, and value drivers.

- Its findings directly shape valuation adjustments, deal structure (earnouts/escrows), and critical go/no-go decisions, preventing costly post-acquisition surprises.

- Effective execution requires multidisciplinary expertise, dynamic scoping, and secure VDRs for collaboration.