Overall rating:

4.5/5

Good

Dealroom

Free trial: 14 days

Ease of use

Average 4.1

Customer Support

Average 3.9

Ease of setup

Average 4.2

Global rankings

Dealroom virtual data room software:

the complete guide

Dealroom is a data room provider that started as a small company in downtown Chicago in 2012. The provider caters to a variety of industries and use cases, including private equity, corporate development, investment banking, real estate, startups, IPOs, and venture capitals. Among its clients are global leaders, including AZEK, Emerson, Jamf, and Cadence Education.

Besides, DealRoom offers several products, among which are solutions for due diligence, M&A management, pipeline management, and post-merger integration. There’s also a virtual data room called FirmRoom.

Let’s learn about the provider’s services, prices, pros, and cons in more detail.

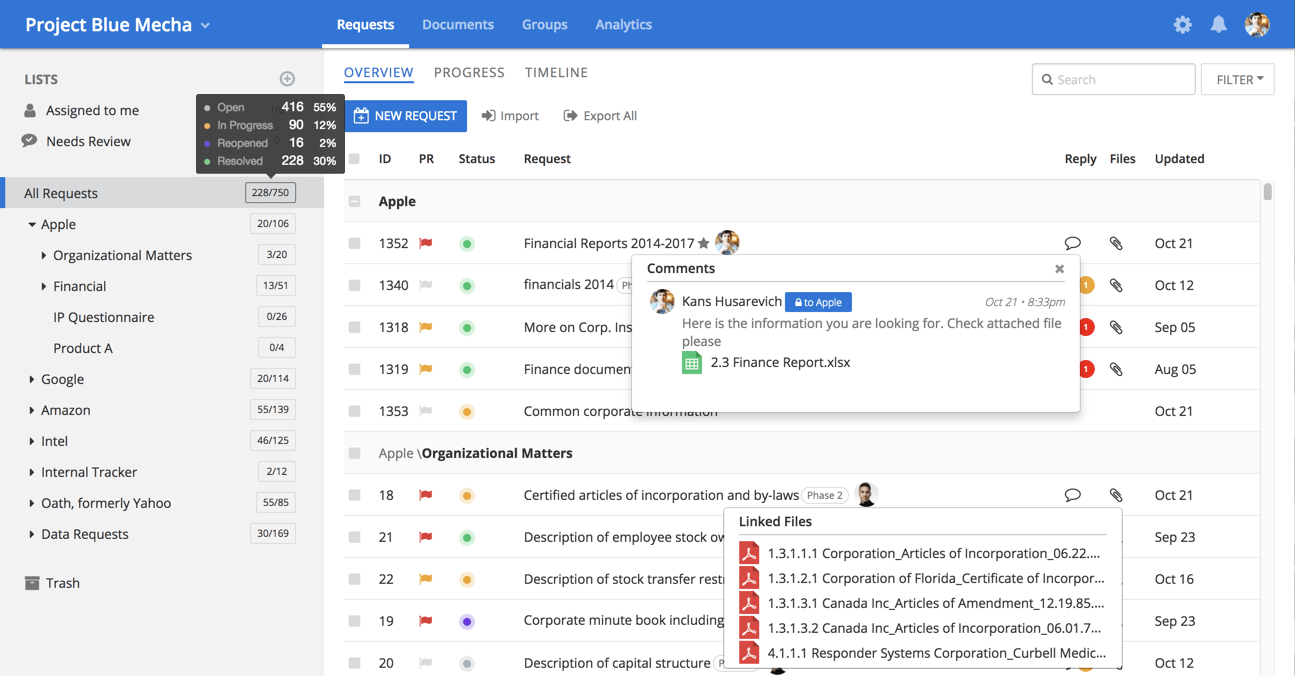

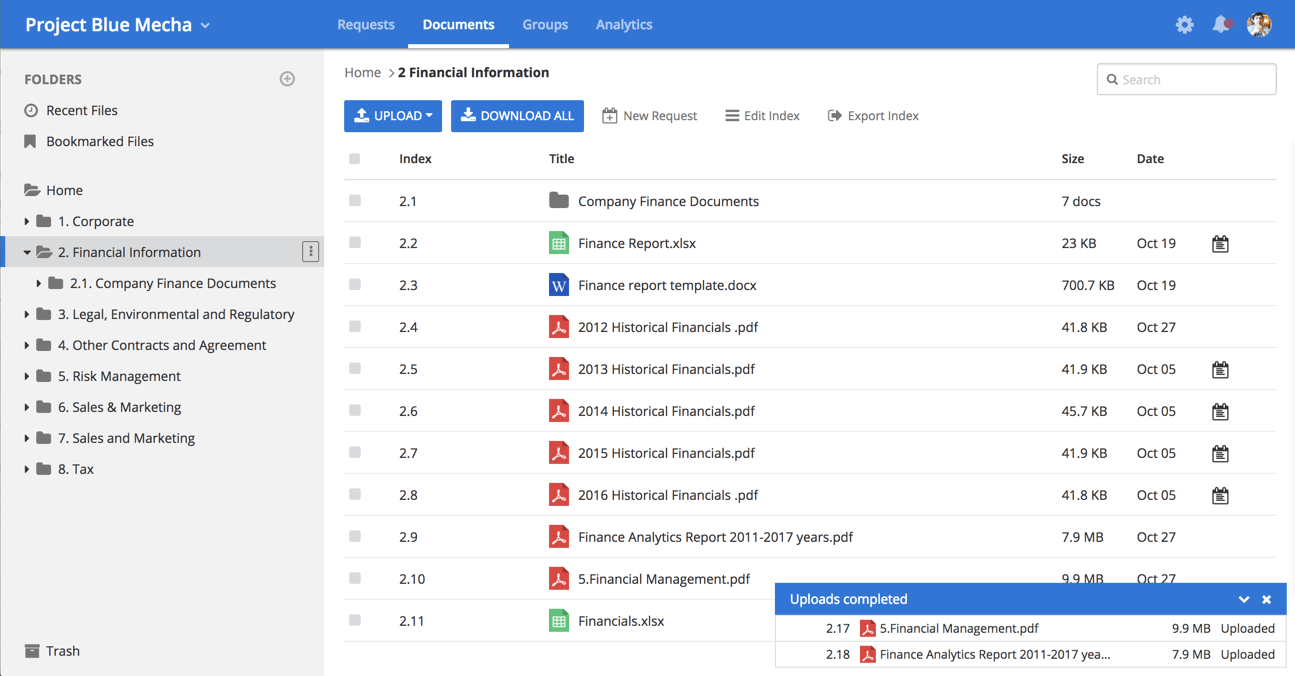

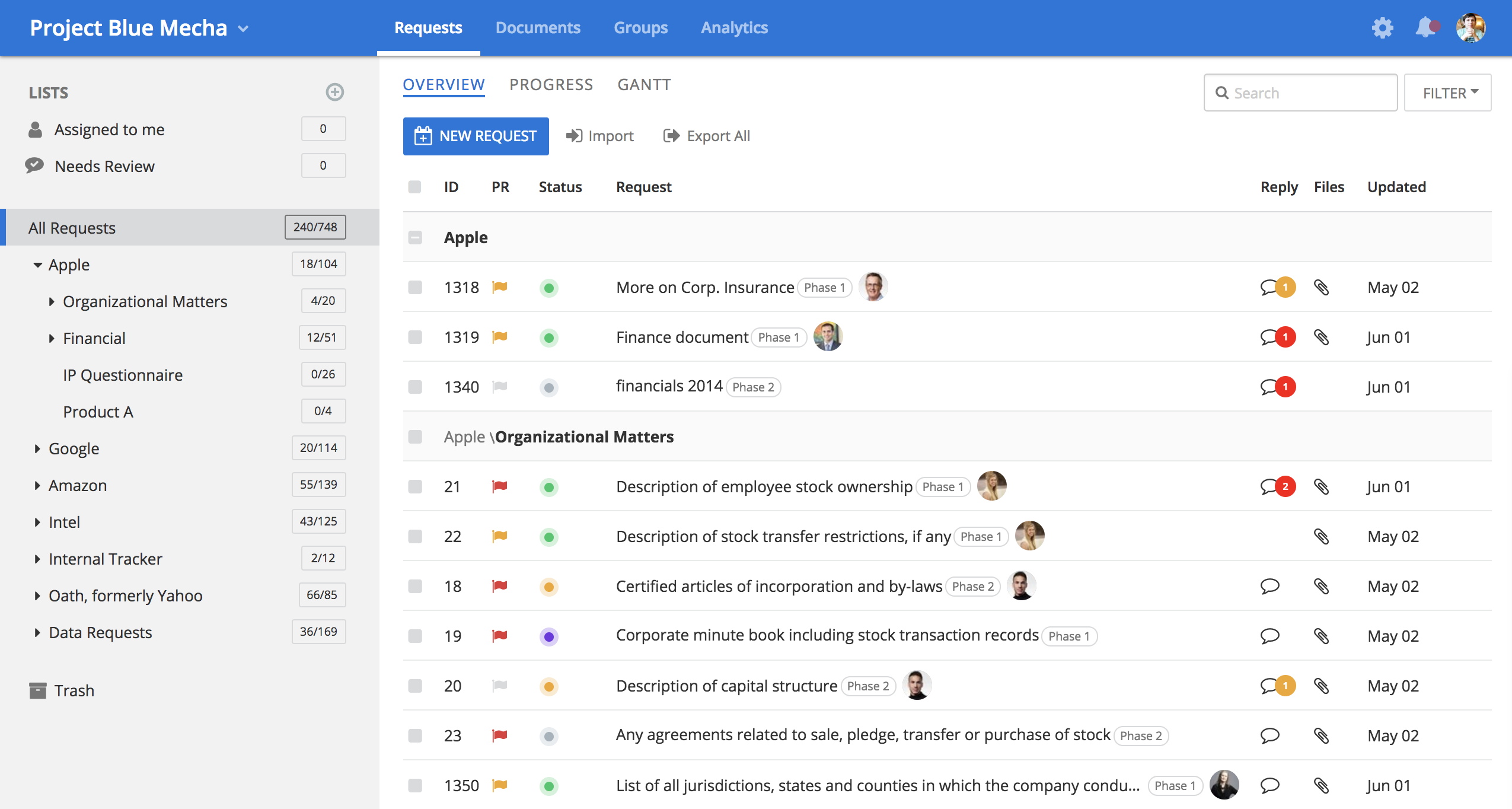

Software screenshots

Dealroom data room features

Security

User and data management

Customization

Security features

At DealRoom, data security is a top priority. This secure data room ensures sensitive information remains protected while being easily accessible to authorized users. Unlike traditional data rooms, DealRoom offers secure file sharing and data room software built with infrastructure security at its core.

DealRoom goes beyond industry standards to provide virtual data room solutions that minimize risk and eliminate security concerns. Their cloud storage and private cloud servers keep confidential data safe, while robust access controls ensure sensitive documents remain protected throughout the entire deal process.

Key security features offered by DealRoom include:

- Multi-factor authentication – Adds an extra layer of security, reducing unauthorized access.

- Granular user controls – Administrators can set user permissions to manage who accesses sensitive documents.

- 256-bit encryption & security protocols – Protects confidential data both in transit and at rest.

- Audit trail – Tracks all the data accessed, downloaded, or modified for in-depth analytics.

- Global compliance – Ensures compliance with privacy laws standards and international regulations.

Document security

DealRoom’s digital data room is trusted by M&A professionals, offering bank-grade security that keeps business operations running smoothly:

- View-only access – Restrict users to viewing without allowing downloads.

- Document view restriction – Control which parts of a document can be seen by different users.

- Customizable document permissions – Maintain complete control over deal documents in data room due diligence.

- Dynamic & static watermarking – Easily apply watermarks to prevent unauthorized distribution.

- Intuitive user management – Add users and define access controls quickly and efficiently.

- Monitoring & reporting – Gain insights on login times, document views, and time spent on files.

Secure storage of confidential information

Dealroom’s platform is built to defend against vulnerabilities, ensuring secure storage for confidential documents and business software via:

- Strict ID protocol – Each user has a unique single-user ID and password.

- Two-factor authentication – Reduces password theft risks with additional login verification.

- Encrypted and protected data – All data is encrypted using 256-bit AES encryption.

- Customizable allowances – Admin teams can set user-specific data management permissions.

- Data siloing in private cloud storage servers – Ensures data is accessed only by authorized parties.

- Eliminated insecure emails – Keeps all communication within the secure virtual data room.

Secure file sharing and exchange

DealRoom’s security infrastructure supports regulatory compliance, ensuring businesses meet industry security standards with:

- Data encryption – 256-bit AES encryption protects data at rest, in transit, and in use.

- Inclusive reporting – Comprehensive audit log and reporting for regulatory industries.

- Accident redemption – Disaster recovery with failover capabilities and data center recovery testing.

- Adjunct to existing securities – Extends security to maximize ROI.

- Worldwide network – Complies with regional data sovereignty requirements.

Pricing

DealRoom offers flexible pricing plans tailored to different deal management needs, with options for monthly or annual billing.

- DealRoom Pipeline

Ideal for tracking deal targets, easy data management, communication, and tasks. Includes unlimited users, Outlook integration, deal stage tracking, and BI reporting. - DealRoom Diligence & Integration

Designed for buy-side and sell-side projects, featuring automated workflows, a diligence requests tracker, a virtual data room, project management features, AI-powered contract analysis, and integration worklists. - DealRoom M&A Platform

A comprehensive solution combining DealRoom Pipeline and Diligence & Integration, plus bundle discounts, multiple project rooms, advanced BI reporting, premium onboarding, and API access.

Request a demo to explore how DealRoom virtual data room can support your deal process.

Top 3 data rooms software

Overall rating:

4.9/5

Excellent

Overall rating:

4.8/5

Excellent

Overall rating:

4.7/5

Excellent

Unique features

DealRoom offers innovative virtual data rooms with advanced data management features.

Key differentiators:

- Automated index numbering – Simplifies organization and retrieval of legal documents.

- Insightful analytics – Aggregates user management data for better decision-making.

- Secure file sharing & data room services – Facilitates fast and efficient collaboration among multiple parties.

- AI-powered search & document inventory – Makes information management easy.

- Post-merger integration tools – Supports businesses no matter the stage of the deal.

Such features make DealRoom one of the best data rooms available today.

Customer support

Dealroom provides 24/7 customer service to ensure clients receive the assistance they need anywhere, anytime:

- 24/7 customer support – Always available for urgent inquiries.

- Dedicated account managers – Personalized guidance for high-volume transactions.

- Online knowledge base – Provides resources for day-to-day operations.

- Live chat & phone support – Ensures quick responses to any issues.

With a free trial and advisory services, businesses can experience Dealroom’s business software before committing.

Document management

Managing confidential documents is effortless with Dealroom’s seamless document organization tools.

Key features:

- Drag-and-drop file uploads – Allows quick file sharing with security protocols.

- Automated document notifications – Alerts users about changes in documents.

- Role-based access controls – Ensures access controls based on user permissions.

- Digital watermarking – Protects sensitive data from unauthorized distribution.

These document management features make Dealroom ideal for virtual deal room users.

Pros and cons

Now let’s look at the advantages and disadvantages of the virtual data room.

- User-friendliness: intuitive and easy-to-use interface

- Industry-leading support: 24/7 support via chat, phone, and email

- Requests management: priority flags, statuses, assignee, reviewer replies, and labels eliminate the need for Excel trackers

- Reporting and analytics: audit reports for regulated and non-regulated industries

- Integrations: the software can be integrated with other tools like Slack, Okta, Salesforce, and Office 365

- 40% faster due diligence: no need for Excel spreadsheets, emails and frequent meetings, which streamlines communications and workflows

- Flat-fee pricing with a free trial – no hidden fees

- Download issues: occasional slow download speed

- No multiple admins: limited flexibility in managing user roles and access levels within the platform

- Few customization features: limited abilities to tailor the platform to specific business needs

- No monthly payment option – plans require annual commitments

Clientele and case studies

Companies rely on DealRoom for its security features, intuitive interface, and in-depth analytics, making it one of the best virtual data rooms available today.

DealRoom data room has helped businesses across multiple industries optimize data room operations with digital data room solutions, improving file sharing, due diligence, and data management.

- UAP Inc. – enhancing file sharing & data management processes

UAP Inc., a leader in the automotive aftermarket industry, implemented DealRoom’s Virtual Data Room software to streamline data management, reduce manual reporting efforts, and manage over 20 M&A deals annually. By leveraging audit trail and automatic index numbering, UAP ensured document security while eliminating 10+ hours of manual work per week. - Wipfli LLP – simplifying the diligence process

Wipfli, a financial advisory and consulting firm, used DealRoom’s virtual data room software to optimize due diligence workflows. By utilizing granular user permissions and infrastructure security, Wipfli improved secure data room operations, saving 20 hours per deal and enhancing virtual data room comparison capabilities for its clients. - Cadence education – managing investment rounds & virtual deal room collaboration

Cadence Education, a leading early childhood education provider, leveraged DealRoom’s best data room providers to manage 15+ roll-up acquisitions totaling over $200 million. Thanks to role-based user management, the company successfully optimized its deal process, reducing manual workload by over 40 hours per transaction.

By offering business software that enhances document management, secure file sharing, and virtual deal room collaboration, DealRoom remains a top choice among electronic data room providers.

Comparison of the top 3 data rooms

|  | ||

| Details | Check price | Learn more | Learn more |

| General business | |||

| Top use cases | M&A, Finance, Life sciences and healthcare, Energy, Real estate, Tech | M&A, Finance, Legal | M&A, IPO, Capital raising, Healthcare, Real estate |

| What users appreciate | Excellent support, easy-to-use, encryption and security features | Encryption, data analysis tool, support | Reliable support, comfortable platform |

| Features | |||

| Fence view | |||

| Granular access permissions | 8 levels | 4 levels | 5 levels |

| Dynamic watermarking | |||

| Built-in redaction | |||

| Two-factor authentication | |||

| Advanced Q&A | |||

| Automatic reports subscription | |||

| Detailed audit trail | |||

| Auto-notifications about new activity | |||

| Custom branding | |||

| Support | |||

| Live chat | |||

| Email support | |||

| Phone support | |||

FAQs

Where is Dealroom located?

Dealroom is located in Chicago, Illinois.

Is Dealroom free?

No, Dealroom charges $1,295+ per month for its services, depending on the pricing package. However, it offers a free 14-day trial, so users can test the platform and see if it meets their requirements.

How much does Dealroom cost?

There are three pricing packages:

- Single Project. $1,295 — $4,995 per month, best for one deal per year.

- Pipeline. Starts at $11,995 per year, best for multiple deals managed simultaneously.

- Execution Suite. Custom pricing, best for serial dealmakers.

Is Dealroom good for M&A?

Yes, DealRoom is a trusted and reliable platform for M&A. It offers secure M&A management tools that allow users to track deal flow, communicate with team members and third parties, assign responsibilities, and complete due diligence fast.