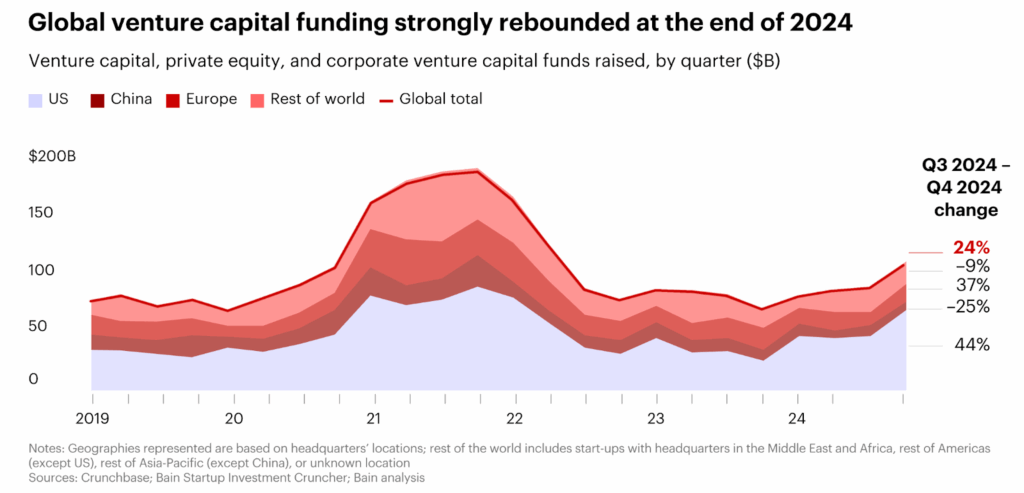

In 2024, after a challenging year, global venture capital funding surged back in the final quarter, jumping 24% quarter-over-quarter and reaching approximately $120 billion across 4,000 deals.

Source: Global Venture Capital Outlook: The Latest Trends

This resurgence highlights the fluidity of the venture capital market, where opportunities continue to arise rapidly. However, an inherent risk comes with the potential for high returns, making due diligence more crucial than ever. So, for venture capital firms and startups, thorough due diligence is key to ensuring that investments are sound, risks are minimized, and long-term growth in the target market is achievable.

To make your investment decisions more informed and strategic, read our guide and learn the following:

What is venture capital due diligence?

Venture capital due diligence is a comprehensive assessment conducted by venture capital investors to evaluate a startup’s investment potential, risks, and growth prospects. In particular, it involves an in-depth analysis of the target’s financials, business model, market potential, competitive landscape, leadership team, legal standing, and intellectual property.

Venture capital due diligence differs from other types of due diligence in its focus on future potential rather than past performance. For early-stage companies, the emphasis is on growth prospects, innovation, and market disruption, while due diligence for mature businesses often focuses on established financial history and stability.

Key differences include the following:

- Potential vs. History. Startups are evaluated based on future growth and market fit, not past performance.

- Market landscape. VC due diligence examines emerging market opportunities, while mature business due diligence examines established market positions.

- Leadership. Strong leadership and vision are critical in startups, whereas mature businesses rely more on management history.

- Risk appetite. VC investors tolerate more uncertainty, focusing on long-term potential, whereas traditional due diligence is more risk-averse.

In short, venture capital due diligence is forward-looking, risk-tolerant, and innovation-focused.

Key components of a venture capital due diligence checklist

The following investigations help investors assess key aspects of a startup, uncover risks, validate assumptions, and gauge its potential for sustainable growth.

| Component | Investigation | Importance |

| Financial due diligence | Financial statements (balance sheet, income statement, cash flow)Revenue models and projectionsUnit economicsBurn rate and runwayDebt and liabilitiesProfitability and marginsCap table and dilution risks | Ensures a financially viable model, a clear path to profitability, and no hidden financial risks that could impact valuation or future funding rounds |

| Legal due diligence | Corporate structure and governanceContracts and obligationsIntellectual property rightsRegulatory and compliance risksLitigation and legal disputesCap table and equity ownership | Protects against legal exposure, ensures compliance with industry regulations, and confirms clear ownership of IP and assets |

| Market and competitive analysis | Total addressable market (TAM) and serviceable market (SAM)Industry trends and dynamicsCustomer segments and demandCustomer acquisition strategy ((including customer lifetime value and customer acquisition cost ratio))Competitive landscapeMarket barriers and risks | Helps assess whether the startup has a strong market position, sustainable demand, and a clear growth trajectory, which are all crucial for shaping an effective marketing strategy |

| Product and technology assessment | Product-market fit (PMF)Scalability and infrastructureTechnology roadmapCybersecurity and complianceTech stack and development processIntellectual property risks | Verifies the startup’s technology is secure, scalable, and aligned with market needs; identifies technical challenges that may compromise future expansion |

| Team and leadership evaluation | Founder and leadership experienceTeam dynamics and cultureDecision-making and governanceKey-person risk and succession planningHiring and talent acquisitionFounder’s vision and execution ability | Ensures the startup has a strong leadership team with the expertise and resilience necessary to drive the company’s strategy and growth |

| Operational due diligence | Business processes and workflow efficiencyScalability and capacity for expansionVendor and supplier relationshipsCustomer support and service qualityUnit economics in operationsRegulatory compliance in operations | Confirms the startup operates efficiently, can scale effectively, and meets necessary regulatory requirements |

Thorough due diligence helps investors maximize their potential return on investment and minimize the likelihood of unpleasant surprises down the road. However, it comes with several difficulties, which we explore next.

Data rooms for VC due diligence

Overall rating:

4.9/5

Excellent

Overall rating:

4.8/5

Excellent

Overall rating:

4.7/5

Excellent

Common challenges in venture capital due diligence

VCs must carefully handle the following hurdles to ensure they make well-informed decisions:

1. Limited access to accurate financial data

Invalid or incomplete financial records compromise profitability, revenue projections, and cash flow assessment. Additionally, startups may not yet have established robust reporting practices, which can lead to data gaps or inconsistent records. So, due diligence teams must work closely with the target to validate numbers and ensure they align with market standards and expectations.

2. Regulatory and compliance complexities

Startups, especially those in highly regulated sectors like healthcare or fintech, must comply with many local, national, and international laws. As due diligence requires a deep dive into these regulatory frameworks, the procedure becomes complex. A failure to properly assess compliance risks can lead to financial or legal consequences after closing the deal.

3. Assessing the long-term viability of startups

Venture capitalists often face challenges in projecting growth, revenue, and market positioning due to the unpredictable nature of startups. In particular, technological advancements, shifting consumer behavior, and evolving market competition can all impact their trajectories. Thus, assumptions made during the due diligence process may no longer be valid as the market changes.

4. Differences in valuation expectations between investors and founders

Founders are typically more optimistic about their company’s future. Investors, in turn, are often more conservative, focusing on data-driven metrics. It usually leads to negotiations where the two parties are not aligned in assessing the company’s worth. As a result, the deal may be delayed or derailed.

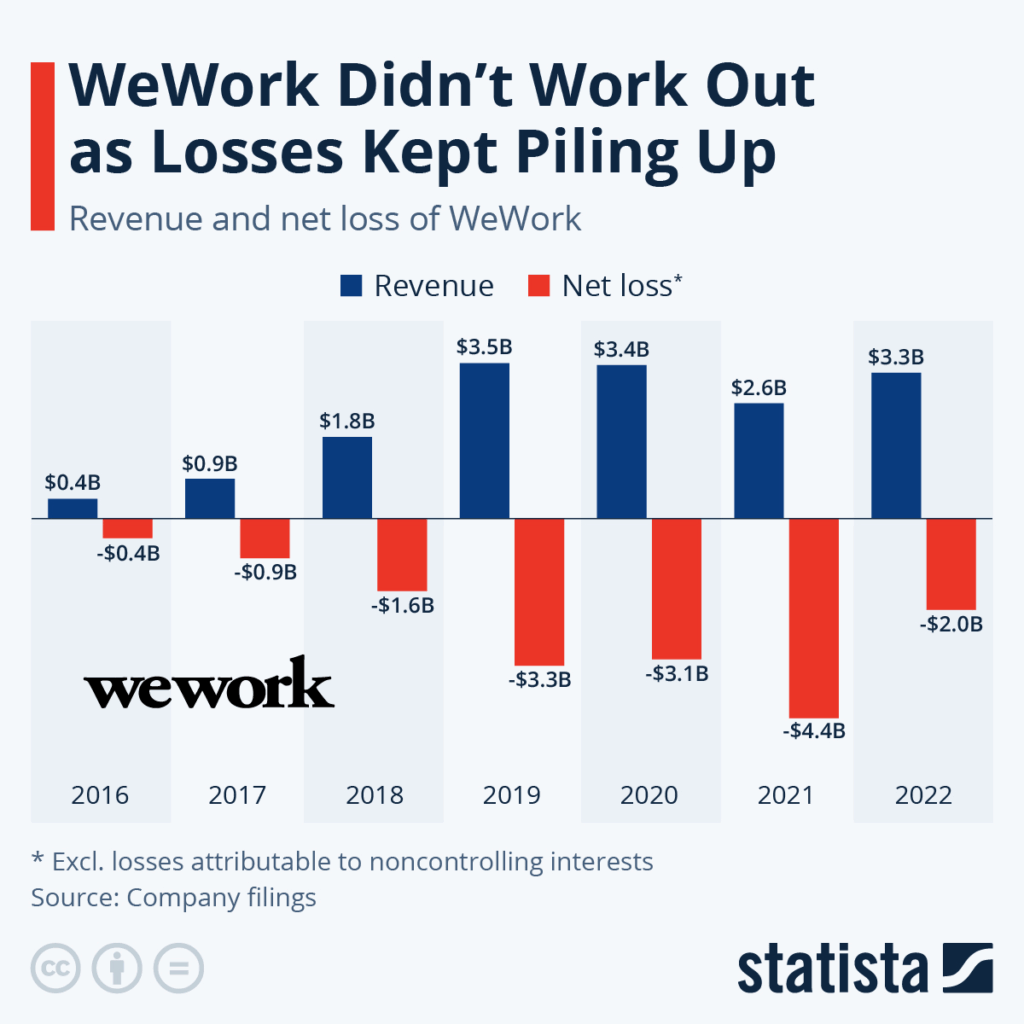

✔️ Real-life case

WeWork: The rise and fall

What happened?

WeWork, once valued at $47 billion, expanded rapidly with SoftBank’s backing. However, its 2019 IPO filing exposed deep losses, an unsustainable business model, and governance issues, particularly around CEO Adam Neumann’s leadership. The company’s reliance on long-term leases without steady revenue made it vulnerable. Investor confidence collapsed, the IPO was canceled, and WeWork’s valuation dropped to $8 billion. Neumann resigned with a $1.7 billion exit package.

Despite restructuring efforts, WeWork filed for bankruptcy in November 2023 due to ongoing financial struggles.

Source: WeWork Didn’t Work Out as Losses Kept Piling Up | Statista

Lessons learned:

- Sustainability over hype. Growth must be backed by profitability.

- Strong governance is crucial. Unchecked leadership poses risks.

- Venture capital has limits. Overreliance without financial stability leads to failure.

With careful planning, expert support, and clear communication, investors can mitigate risks and make informed decisions.

How to conduct an effective venture capital due diligence process?

The following is a structured approach for investors and expert tips for ensuring thorough and efficient due diligence:

1. Establish a structured checklist for investors

A checklist for investors is a detailed list of criteria to evaluate key areas of a startup, such as financial health, legal compliance, and team capabilities. It helps ensure thorough due diligence and reduces the risk of overlooking crucial factors.

Expert tip! Tailor your checklist to the specific industry and stage of the startup. For example, for tech early-stage companies, ensure that product scalability, IP rights, and tech stack are heavily scrutinized. For healthcare startups, focus more on regulatory compliance, patents, and clinical trials.

Checklist areas to include:

- Financials. Review balance sheets, income statements, cash flow, and tax filings.

- Market and competitive landscape. Assess total addressable market (TAM), customer acquisition strategy, and competitor analysis.

- Team and leadership. Evaluate the experience and track record of the founding and management team.

- Technology and innovation. Examine product-market fit, intellectual property, and scalability.

- Legal and regulatory compliance. Confirm all ongoing or potential legal issues, including IP disputes, patents, and regulatory compliance.

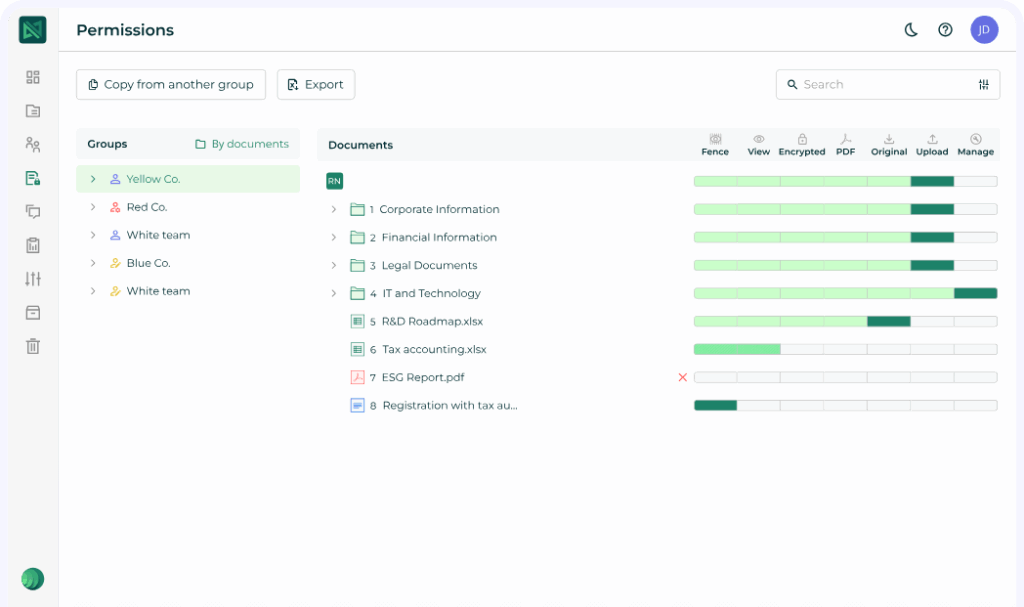

2. Use data rooms for secure document sharing

Data rooms allow users to securely share sensitive information during due diligence. Also, investors can review the company’s documents, financials, and other sensitive data in a controlled VDR environment. Using this secure platform ensures confidentiality, transparency, and streamlined communication between parties.

👁️🗨️ Explore more about data room features and benefits in the next section.

Virtual data room interface

Expert tip! Ensure the data room is organized logically and user-friendly. Avoid flooding it with unnecessary information; only include documents that are directly relevant to the due diligence process. Additionally, ensure that the data room is accessible to key stakeholders and has built-in tracking features to monitor who has accessed which documents.

Key documents to include in a data room:

- Financial statements and projections

- Founders’ agreements and shareholder agreements

- Customer contracts and IP agreements

- Legal filings and tax documentation

- Product roadmaps and technical documentation

3. Engage third-party experts for thorough evaluations

Venture capitalists should involve outside professionals to ensure an unbiased and in-depth assessment. Financial auditors, industry specialists, and legal advisors can identify hidden risks and provide a deeper understanding of the startup’s potential and challenges.

Learn more: How to Use Third-Party Experts for Effective Due Diligence – N3 Business Advisors

Expert tip! When hiring third-party experts, choose individuals or firms with specific experience in the industry. For example, if investing in a biotech startup, consult with professionals who understand FDA regulations, clinical trials, and market trends in the healthcare sector.

Third-party experts to consider:

- Financial auditors (verify the accuracy and consistency of financial statements)

- Legal advisors (identify legal risks, review contracts, and ensure regulatory compliance)

- Industry experts (assess market trends, competitive positioning, and scalability)

- Technology consultants (validate technical infrastructure, scalability, and cybersecurity measures)

Following these tips and implementing a systematic approach to due diligence can improve venture capitalists’ chances of making successful investments.

The role of virtual data rooms in venture capital due diligence

The following table showcases the functionality of data rooms in venture capital due diligence and their benefits for all parties involved. It also compares VDRs with traditional document-sharing methods to help you identify the best way to manage sensitive investment data.

| Data room feature | Benefits | Traditional document sharing |

| Bank-grade security and compliance | Ensures that sensitive data is encrypted and complies with global regulations (SOC 1, 2, 3, GDPR, ISO 27001, HIPAA). It reduces the risk of data breaches and legal consequences for all parties. | Typically lacks stringent encryption and security measures, posing higher data breach risks. |

| Role-based access control and document-level permissions | Grants specific access to documents based on the user’s role. Investors, legal teams, and startup executives can safely access the relevant data without compromising confidentiality. | Often relies on basic folder sharing without granular control, increasing the risk of unauthorized access. |

| Q&A section and document annotations | Allows due diligence teams to ask questions and leave comments within the document, streamlining communication and clarifying critical points. It reduces delays caused by lengthy email exchanges. | Communication typically happens via emails or external chat platforms, leading to disjointed discussions and slower resolution. |

| Bulk upload and drag-and-drop functionality | Facilitates the fast upload of large volumes of documents and enables teams to get all relevant data into the system quickly and efficiently. | Often requires manual file uploads with more time-consuming processes, especially with large document sets. |

| Full-text search and OCR technology | Enables users to search documents using keywords, including scanned files, making finding specific information across vast datasets easier. | Searching and locating information in traditional documents is time-consuming and manual, especially with scanned files. |

| Customizable due diligence checklists | Offers structured, ready-made checklists that investors can tailor to the specific needs of the venture capital process, ensuring they don’t overlook essential documents. | Typically lacks structured checklists, resulting in potential oversights and missed critical documents. |

| Audit trails and reporting | Tracks and logs all user activity, including document views, downloads, and edits. It guarantees transparency and accountability throughout the process. | Tracking activity manually can be difficult, often requiring external systems to monitor user actions, resulting in less transparency. |

| Document version control | Ensures that teams always work with the most up-to-date documents, minimizing confusion over outdated information and streamlining decision-making. | Version control is often manual, leading to potential confusion over which document is the most recent and risking errors. |

Before, we highlight the top data room providers for venture capital due diligence and explore some expert tips to make the deal transparent and risk-free.

Best practices for investors conducting due diligence

The following effective practices help investors protect their capital, strengthen partnerships with founders, and increase the likelihood of long-term success.

1. Ensure accurate and complete financial and legal reviews

One of the biggest risks in venture capital investment is discovering financial inconsistencies or legal complications after this investment is made. For example, early-stage companies may present optimistic revenue projections, understate liabilities, or lack proper legal protections for their intellectual property.

To avoid this, investors must insist on audited financial statements, validate revenue streams, and carefully examine contracts, debt obligations, and regulatory compliance. As mentioned, engaging legal and financial experts early in the process helps identify hidden risks and ensures the target complies with regulations, maintains financial transparency, and meets industry standards.

Another way to mitigate these risks is to conduct thorough scenario analysis and stress testing the startup’s financial and legal assumptions. That involves evaluating the business’s performance under different market conditions, assessing potential regulatory changes, and identifying contractual obligations that could impact future growth.

2. Maintain transparency with startup founders

A common challenge in VC deals is misalignment between investors and founders, leading to conflicts over growth strategies, valuations, and operational control. When expectations are unclear, disagreements can slow down execution and even result in a failed investment.

To foster a strong partnership, investors should establish open communication from the start, setting clear terms for funding, decision-making authority, and business objectives. Regular check-ins, structured reporting, and mutual goal-setting reduce friction and improve long-term success.

In addition, drafting detailed term sheets and investment agreements can prevent misunderstandings by clearly outlining rights, responsibilities, and expectations.

3. Identify and mitigate risks before investment

Many investors focus on a startup’s potential without thoroughly assessing the challenges that could derail its growth. In particular, they fail to recognize scalability issues, customer churn, or shifting regulatory environments.

So, investors should remember that thorough due diligence involves conducting scenario analyses, stress-testing financial models, and evaluating industry-specific risks. They should also assess the startup’s adaptability to market changes and have contingency plans to address potential obstacles before they become deal-breakers.

Besides, engaging with industry experts and conducting reference checks on key team members can provide deeper insights into the startup’s credibility, leadership capabilities, and ability to execute its business strategy. It ensures more informed and strategic decisions for portfolio companies.

The more careful and thorough investors are, the earlier they spot risks and increase their chances of strong returns. Next, we invite you to explore the best data room platforms to streamline and secure the due diligence process.

Best VDR providers for venture capital operations

We selected the most advanced providers for VC due diligence based on functionality, security, and user reviews. Check them out below and compare.

1. Ideals

Ideals is a user-friendly platform that protects data, streamlines collaboration, and ensures transparency throughout the venture capital due diligence process. With its mobile and desktop apps and multilingual interface, the software enables smooth document sharing and access management. Thus, it is ideal for global teams working across different time zones.

Additionally, Ideals meets the highest security standards and offers comprehensive protections for processes, applications, infrastructure, and personnel. So, investors can trust the platform with sensitive data, providing peace of mind throughout the due diligence journey.

2. Securedocs

Securedocs offers unlimited users and storage, making it a strong option for due diligence processes. However, a notable drawback is its limited administrative roles. Each plan only includes five admin roles, with an additional cost for every extra five. This structure may not be ideal for larger or more complex transactions.

3. DFIN

Donnelley virtual data room, a subsidiary of Donnelley Financial Solutions, offers advanced security and document management features for complex corporate transactions. However, its higher cost compared to other VDR providers may deter smaller firms or those managing less complex deals.

Now, you can compare these top providers and choose the best option:

| Features important for VC due diligence | Ideals | Securedocs | DFIN |

| Granular data access control | 8 levels | 5 levels | 4 levels |

| Detailed audit trail | ✅ | ✅ | ✅ |

| IP address-based access restriction | ✅ | ✖️ | ✖️ |

| Compliance | GDPR HIPAA FedRAMP EU/US Privacy Shield EU-US DPF | GDPR HIPAA EU-US DPF | GDPR HIPAA FedRAMP EU/US Privacy Shield EU-US DPF |

| Automatic data indexing | ✅ | ✅ | ✅ |

| Screenshot prevention | ✅ | ✖️ | ✖️ |

| Multi-format support | ✅ | ✅ | ✖️ |

| Full-text search with OCR | ✅ | ✖️ | ✅ |

| Advanced Q&A | ✅ | ✅ | ✖️ |

| 24/7 in-app support | ✅ | ✖️ | ✖️ |

| Free trial | Yes | Yes | ✖️ |

| Rating (according to Capterra) | 4.8(308 reviews) | 4.9(161 reviews) | 5.0(2 reviews) |

Learn more about these providers to choose the best tool.

Conclusion

- Venture capital due diligence is a forward-looking, risk-tolerant process focused on assessing a startup’s growth potential, market fit, leadership, financial stability, and legal standing.

- Venture due diligence includes investigating financials, legal matters, market and competitive landscape, product and technology, team and leadership, and operational efficiency.

- Limited access to accurate data, complex compliance needs, assessing startup viability amidst market changes, and differing valuation expectations between investors and founders can complicate the process.

- Virtual data rooms strengthen security, transparency, and organization during due diligence. Role-based access, audit trails, and real-time collaboration tools improve the efficiency and accountability of the process.