Key features:

- Project setup in less than 15 minutes

- Storage-based pricing for clear project budgeting

- In-app live chat support 24/7, including holidays and weekends

Overall rating:

4.8/5

Excellent

Securedocs

Free trial: 14 days

Key features:

- Built-in electronic signatures and templates

- Granular user permissions and activity logs

- Q&A workflows with Excel export

Overall rating:

4.5/5

Good

Onehub

Free trial: 30 days

Key features:

- FTP getaway for mass uploads

- Document previews supporting popular file formats

- Comments and tasks for collaboration

Overall rating:

4.4/5

Good

HighQ

Free trial: Yes

Key features:

- Q&A workflows for bidder interaction

- Custom data room audits

- Custom user invitation letters

Overall rating:

4.7/5

Excellent

DFIN

Free trial: 14 days

Key features:

- AI contract analysis for due diligence

- Automatic PII redaction in uploaded documents

- Multi-deal management and project reporting

Taking a company public is one of the most transformative milestones in its lifecycle. An Initial Public Offering (IPO) is not only a financial event but also a complex regulatory process that requires transparency, precision, and credibility at every stage. Companies preparing for an IPO must present a vast amount of sensitive documentation to underwriters, regulators, legal counsel, auditors, and potential investors. Every document—from audited financial statements to board meeting minutes—must be accurate, accessible, and securely managed.

Traditional methods of document management—whether physical data rooms or generic cloud storage—cannot meet the demands of today’s IPO environment. The stakes are simply too high. Leaks, disorganization, or delays can jeopardize not only the IPO timeline but also investor confidence. This is why Virtual Data Rooms (VDRs) for IPOs have become an indispensable tool. They provide a secure, centralized, and fully auditable environment that allows stakeholders to access and evaluate critical information with confidence.

What Is a Virtual Data Room for IPOs?

A Virtual Data Room (VDR) is a secure online platform designed for the storage, management, and controlled sharing of sensitive corporate information. In the context of IPOs, a VDR serves as the central hub where all documentation related to the listing process is collected, organized, and reviewed.

Unlike general file-sharing platforms, IPO-focused VDRs provide:

- Granular access permissions for different stakeholder groups

- Advanced search and indexing for thousands of documents

- Audit trails to monitor who viewed what and when

- Compliance features that align with securities regulations

- Bank-grade security with encryption and multi-factor authentication

Essentially, the VDR functions as the backbone of IPO preparation, ensuring that information is not only accessible but also protected at the highest standards.

The IPO Process and Where VDRs Fit In

Preparing for an IPO is a multi-stage process that can span months or even years. Each stage involves multiple stakeholders and heavy documentation requirements. A Virtual Data Room supports the IPO journey at every step:

- Pre-IPO Preparation – Gathering corporate records, financial statements, governance documents, and risk disclosures.

- Underwriter Due Diligence – Investment banks and underwriters review all documentation to ensure the company meets regulatory and investor requirements.

- Legal and Regulatory Review – Law firms and regulators examine compliance-related documents, including contracts, employment agreements, and environmental disclosures.

- Prospectus Preparation – Critical data from the VDR is used to prepare the S-1 filing and other prospectus documents.

- Investor Roadshow – Potential institutional investors may need controlled access to financial and operational data before committing to the IPO.

- Post-IPO Transparency – After going public, ongoing disclosure obligations can also be managed within the VDR.

By providing a structured and secure platform, the VDR ensures that each stage flows smoothly, minimizing delays and errors.

Key Use Cases in IPO Preparation

The sheer variety of documentation required for IPOs makes a Virtual Data Room indispensable. Some examples of how VDRs are used include:

- Collecting audited financials and ensuring proper version control.

- Housing corporate governance records, including board minutes and shareholder agreements.

- Storing intellectual property documentation such as patents, trademarks, and licenses.

- Managing contracts and obligations with suppliers, customers, and employees.

- Organizing regulatory disclosures related to environmental, tax, and compliance matters.

- Sharing risk management and insurance documentation with underwriters.

Each of these categories requires meticulous organization and controlled distribution, which a VDR facilitates seamlessly.

Benefits of VDRs for IPOs

The advantages of using a Virtual Data Room in IPO preparation are clear:

Speed and Efficiency

By centralizing documents, VDRs allow underwriters, lawyers, and auditors to access information instantly, reducing the time needed for due diligence and regulatory review.

Enhanced Security

IPO documentation contains highly sensitive financial and operational information. VDRs protect this data with encryption, two-factor authentication, and dynamic watermarks, significantly reducing the risk of leaks.

Transparency and Trust

Audit logs ensure every interaction is recorded, providing regulators and investors with confidence in the process.

Cost Savings

Compared to physical data rooms or fragmented tools, VDRs reduce administrative overhead, courier costs, and time spent resolving version conflicts.

Professionalism

Presenting documents through a branded, well-organized VDR enhances a company’s credibility with investors and regulators.

Challenges Without a Virtual Data Room

Attempting an IPO without a dedicated VDR can be risky. Companies often face:

- Document chaos with multiple versions floating across emails.

- Security breaches when using unsecured platforms.

- Regulatory red flags due to poor auditability.

- Delays in due diligence, leading to missed market opportunities.

- Erosion of investor confidence when information isn’t well organized.

Given the high stakes of an IPO, these challenges can result in costly setbacks or even derail the offering.

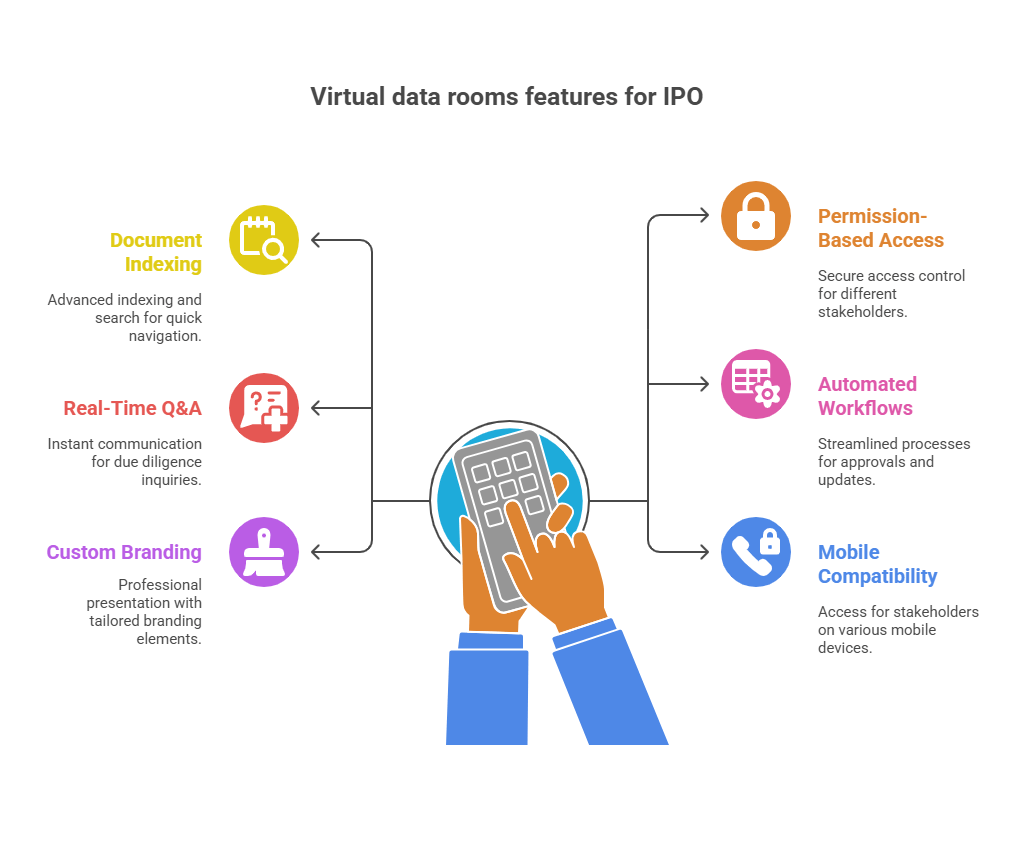

Essential VDR Features for IPO Success

Not all data rooms are created equal. An IPO-ready VDR should include:

- Advanced document indexing and full-text search for rapid navigation.

- Permission-based access for regulators, underwriters, and investors.

- Real-time Q&A functionality for clarifying due diligence questions.

- Automated workflows for approvals and document updates.

- Custom branding for a professional presentation to investors.

- Mobile compatibility for on-the-go stakeholders.

These features ensure that the VDR isn’t just a repository, but an active enabler of IPO success.

How VDRs Improve Collaboration Between Stakeholders

The IPO process involves a large and diverse group of participants: company executives, legal teams, auditors, regulators, underwriters, and potential investors. Each group requires access to specific sets of information, and each group has different priorities.

A Virtual Data Room provides a common platform where collaboration is controlled but efficient. Executives can upload and categorize documents, lawyers can verify compliance, underwriters can analyze financials, and regulators can review disclosures—all without overlap or confusion. This structured approach reduces friction, accelerates decision-making, and ensures that everyone is aligned.

VDRs for Different IPO Stakeholders

- Company Executives – Prepare documentation and monitor stakeholder engagement.

- Underwriters – Conduct rigorous due diligence with efficient access to financials and contracts.

- Regulators – Review compliance and disclosures with confidence in audit trails.

- Legal Teams – Ensure filings meet securities law requirements.

- Investors – Access select financial data with assurance of accuracy and security.

By serving all these groups, the VDR becomes the single trusted environment for IPO preparation.

Compliance, Security, and Regulatory Readiness

IPOs are heavily scrutinized by regulators such as the SEC, FINRA, and international equivalents. Compliance failures can delay or cancel offerings. A robust VDR supports:

- GDPR and CCPA compliance for data privacy.

- SEC standards for record-keeping and disclosures.

- Audit-ready reporting with complete activity logs.

- ISO-certified security standards to ensure best practices.

The ability to demonstrate compliance directly within the VDR enhances trust and reduces regulatory friction.

Cost vs ROI of Using a VDR in IPO Preparation

While VDRs require an investment, the return is significant. The cost of delays, regulatory missteps, or security breaches during an IPO far outweighs the subscription fee of a high-quality VDR. Moreover, the time saved by underwriters and legal teams translates directly into reduced advisory fees and faster time-to-market.

Comparing VDRs with Other Tools

- Email or Cloud Storage – Convenient but insecure, lacking compliance features.

- Physical Data Rooms – Secure but slow, costly, and inaccessible to remote participants.

- Virtual Data Rooms – Secure, efficient, accessible globally, and compliant by design.

For IPOs, only a VDR provides the necessary combination of speed, control, and security.

Best Practices for Implementing a VDR in IPO

Success with a VDR requires more than just deployment. Companies should:

- Begin uploading documents early to avoid last-minute chaos.

- Define user roles and access levels clearly.

- Leverage audit trails to monitor stakeholder engagement.

- Keep the VDR updated post-IPO to meet ongoing disclosure obligations.

Following these practices ensures the VDR delivers maximum value.

Real-World IPO Scenarios

Consider a technology company preparing to go public. With hundreds of contracts, dozens of patents, and complex financials, the due diligence process could have taken months. By implementing a VDR, the company organized all files in advance, provided underwriters with immediate access, and reduced preparation time by nearly 30%.

Similarly, a multinational manufacturer used a VDR to provide regulators in multiple countries with tailored access to compliance documents, avoiding costly delays and ensuring a synchronized global IPO.

Wrapping up

Now let’s summarize key findings from the article:

- Some of the best data rooms worth considering for IPO are Ideals, Intralinks, and Datasite.

- IPO is the process of offering shares of a private organization to the public via stock issuance.

- Virtual data rooms for IPO are considered the most advanced and helpful ways to facilitate the IPO process.

- Virtual data rooms facilitate IPOs in many ways, including offering easier deal preparation, better compliance with regulators, advanced document management, and all-around support.