Environmental risks can derail multimillion-dollar transactions. Whether you’re acquiring a commercial property, investing in an industrial site, or undergoing a merger, overlooking environmental due diligence can result in costly remediation and long-term liabilities. The stakes are high, and the regulatory landscape is unforgiving.

This guide provides a comprehensive environmental due diligence checklist for experienced professionals involved in real estate transactions, private equity, and corporate acquisitions. Backed by industry data and case studies, it outlines how to identify, document, and mitigate environmental risks before they escalate.

According to the U.S. Environmental Protection Agency (EPA), failure to conduct adequate environmental due diligence can result in legal liability under the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA), even for innocent buyers (source).

What is environmental due diligence?

Environmental due diligence (EDD) is the comprehensive process of identifying, evaluating, and documenting environmental risks that could affect a property, a business, or a transaction. This process should involve an in-depth assessment of environmental conditions to determine whether liabilities, such as contamination, regulatory violations, or past hazardous substances, might impact the asset’s value or create future obligations for the buyer.

EDD plays a key role in a variety of high-stakes transactions and strategic decisions, including:

- Commercial and industrial real estate transactions: Buyers need to ensure the land or facility is free from environmental contamination that could lead to remediation costs or operational delays.

- Mergers and acquisitions (M&A): Acquiring a target company with hidden environmental issues can create unexpected financial and legal exposure. EDD helps evaluate risks linked to facilities owned or operated by the business.

- Corporate refinancing and equity investments: Financial institutions and investors often require an environmental site assessment before extending credit or capital to reduce risk exposure.

- Regulatory compliance: Regulatory agencies may impose significant penalties for non-compliance. EDD ensures that all permits are in place and that operations meet environmental laws and requirements.

How environmental due diligence differs from other forms of due diligence

While legal and financial due diligence focus on corporate structure, contracts, liabilities, and financial performance, EDD centers on the condition of the environment related to the business or property. It requires a different level of technical expertise and often involves site visits, laboratory testing, historical research, and regulatory reviews.

The goal is to determine whether:

- There are existing or potential environmental liabilities

- Environmental compliance review has been conducted and documented

- Environmental permits are current and sufficient for ongoing operations

- The site has any known or suspected hazardous substances or regulated materials

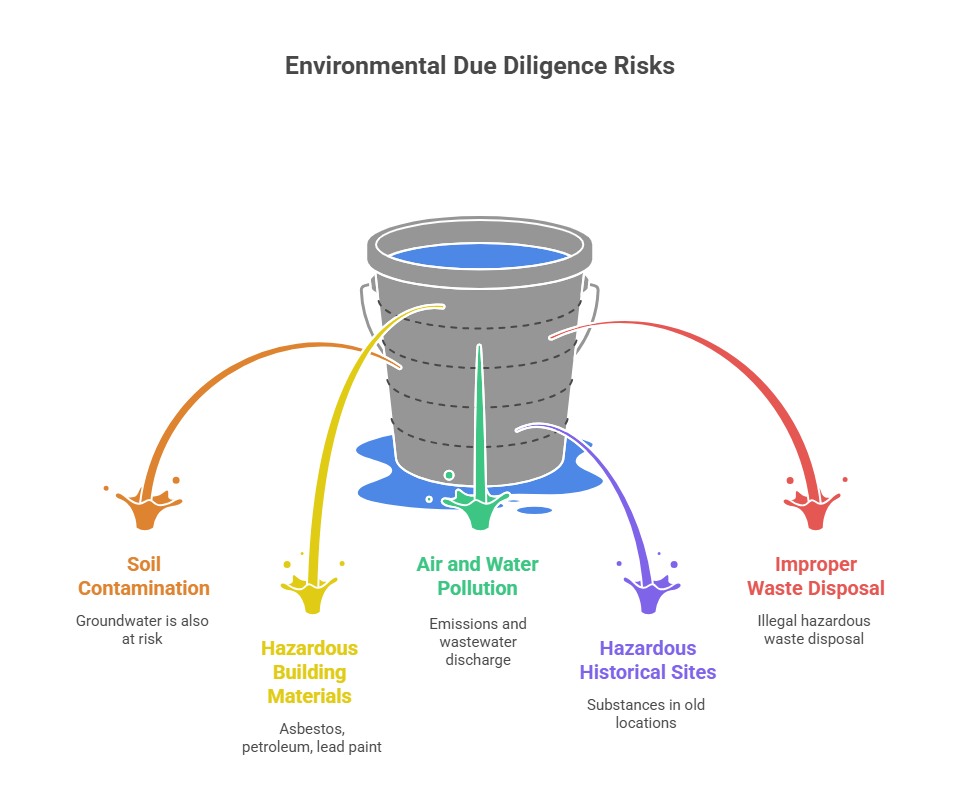

Examples of risks evaluated during environmental due diligence

- Soil or groundwater contamination: Leaking underground storage tanks or industrial runoff may lead to long-term liability under federal cleanup programs.

- Asbestos, petroleum products, or lead-based paint: Older buildings may harbor legacy pollutants that trigger environmental regulations or occupational safety violations.

- Air emissions or wastewater discharges: Non-compliance with air or water permits can halt operations and lead to environmental litigation or enforcement actions.

- Historical sites with hazardous substances: Facilities located on or near contaminated sites may still carry legal risk, even if the contamination occurred decades ago.

- Improper disposal of hazardous waste: A lack of documentation or controls over hazardous material disposal can result in fines and operational restrictions.

EDD also examines whether environmental audits have been conducted in the past, if there are any outstanding violations, and whether the company has addressed issues identified in earlier reviews. This can include examining the company’s compliance history, exposure to environmental litigation, and records of past regulatory inspections.

Best data rooms for due diligence

Overall rating:

4.9/5

Excellent

Overall rating:

4.8/5

Excellent

Overall rating:

4.7/5

Excellent

Key components of an environmental due diligence checklist

EDD isn’t a single step — it’s a detailed, multi-stage process that includes document reviews, on-site inspections, expert input, and regulatory checks. A comprehensive diligence checklist helps identify and mitigate potential environmental liabilities before finalizing a transaction. Below is a structured framework tailored for high-value acquisitions, site transfers, or mergers.

Phase I Environmental Site Assessment (ESA)

A Phase I ESA is the foundation of EDD. Conducted according to ASTM E1527-21 standards, the process consists of:

- Site inspection and visual reconnaissance

- Historical land use research (e.g., Sanborn maps, aerial photos)

- Interviews with current and past property owners, tenants, or site workers

- Review of federal, state, and tribal environmental records

The goal is to identify recognized environmental conditions (RECs) and determine whether a Phase II ESA is necessary. It also provides early visibility into the presence of environmental issues that may affect the property’s usability, valuation, or compliance obligations.

Phase II ESA (if needed)

If RECs or potential contamination is identified, a Phase II environmental site assessment is required. It typically includes:

- Soil, water, and air sampling

- Laboratory analysis of pollutants, petroleum products, or hazardous substances

- Subsurface investigation of underground storage tanks (USTs)

These assessments allow buyers to evaluate the extent of contamination and calculate cleanup costs, if applicable. The findings may also trigger mandatory reporting to regulatory authorities or affect the terms of the transaction.

Environmental permits and compliance records

A thorough environmental compliance review includes collecting and validating all relevant permits and operational approvals:

- Stormwater discharge and air emissions permits

- Hazardous waste generator IDs and Spill Prevention, Control, and Countermeasure (SPCC) plans

- Environmental audits conducted by internal teams or certified consultants

- Records of past violations, inspection reports, and enforcement actions

This process helps determine whether the target company has historically met regulatory requirements or if prior violations may carry over as post-acquisition liabilities.

Asbestos, mold, and lead assessments

These legacy environmental conditions are especially prevalent in buildings constructed before the 1980s. Due diligence should include:

- Asbestos-containing materials (ACM) surveys in insulation or flooring

- Lead-based paint inspections in older residential or commercial units

- Mold sampling and remediation history, particularly in facilities with past water damage

Improper environmental management of these hazards can result in costly remediation and exposure to employee health claims or environmental litigation.

PCB and UST inventory

Even after decommissioning, historical records of polychlorinated biphenyls (PCBs) and USTs must be accounted for. Your checklist should capture:

- Inventories of PCB-containing equipment, such as transformers and ballasts

- Locations and specifications of existing or removed underground storage tanks

- Documentation of testing, removal, closure, or post-removal contamination status

Failure to document disposal or testing can lead to unknown exposure risks and future enforcement actions.

Site plans and ownership history

Understanding how a property was used — and by whom — is essential for evaluating the scope of environmental risk. Collect:

- Certified title reports and up-to-date boundary surveys

- Documentation of environmental liens, deed restrictions, or recorded land use covenants

- Full chain of title and prior ownership records dating back at least 50 years

Ownership history often reveals undocumented waste disposal, unpermitted operations, or adjacent properties that may have contributed to cross-site contamination.

Environmental consultants and third-party reports

Third-party insight enhances the credibility and depth of the due diligence process. Seek out:

- Comprehensive environmental audits prepared by licensed professionals

- Hydrology and geology reports to assess the behavior of contaminants on-site

- Endangered species or habitat impact assessments for rural or protected areas

- Proper environmental evaluations and formal risk mitigation recommendations

These reports can directly impact how lenders, investors, and legal teams evaluate the risk profile of the transaction, and they are often critical inputs during the integration process post-acquisition.

Common challenges in environmental due diligence

Even experienced professionals face complications during the environmental due diligence process. While a well-designed diligence checklist helps identify and manage risks, certain challenges remain inherent, especially in complex, multi-site, or international transactions.

Delays from extensive site investigations

Phase I and Phase II environmental site assessments (ESAs) can extend deal timelines, particularly when environmental advisors encounter site-specific variables that require additional sampling or review. Unexpected findings — such as buried debris, undocumented underground storage tanks, or signs of illegal disposal — often trigger supplemental testing. Additionally, lab processing for soil or water analysis may take several weeks, further delaying transaction milestones.

These delays can affect deal momentum, financing approvals, or regulatory submissions. The longer the process involves unresolved environmental issues, the greater the risk of buyer fatigue or loss of stakeholder confidence.

Regulatory requirements vary by region

Environmental laws are complex and often inconsistent across jurisdictions. U.S. state-level regulations may impose stricter standards than federal guidelines, while international projects must navigate an entirely different set of compliance requirements. This inconsistency complicates compliance strategies, especially when the target company owns or operates facilities in multiple locations.

Local permitting authorities may also interpret the same federal rule differently, which can result in additional compliance obligations, delayed permit approvals, or conflicting legal interpretations. A property deemed compliant in one jurisdiction may require remediation or new environmental audits in another. This poses a major challenge for global M&A transactions or large portfolio acquisitions.

Potential contamination and cleanup costs

Sites with a history of industrial use, improper hazardous substance disposal, or proximity to contaminated zones are often associated with high-cost remediation requirements. These liabilities may not be fully visible until detailed testing reveals concentrations of pollutants that exceed regulatory thresholds.

The costs of addressing potential contamination can vary widely depending on the nature of the environmental conditions, ranging from several thousand dollars for minor cleanup to millions for full-scale remediation. Without accurate data from environmental audits conducted early in the process, buyers may underestimate the financial impact of these liabilities. Moreover, lenders may reduce financing amounts or impose conditions based on the presence of unresolved risks.

Balancing financial goals with environmental responsibility

In highly competitive deals, buyers may feel pressure to move quickly or overlook minor environmental concerns. However, doing so can result in major post-acquisition costs and exposure to environmental litigation. Striking the right balance between commercial objectives and long-term environmental responsibility requires disciplined decision-making.

Risk management teams often play a key role in these decisions, using environmental due diligence findings to develop indemnification clauses, escrow agreements, or insurance solutions to offset future exposure. Still, when environmental liability significantly outweighs strategic gain, walking away remains the most prudent option.

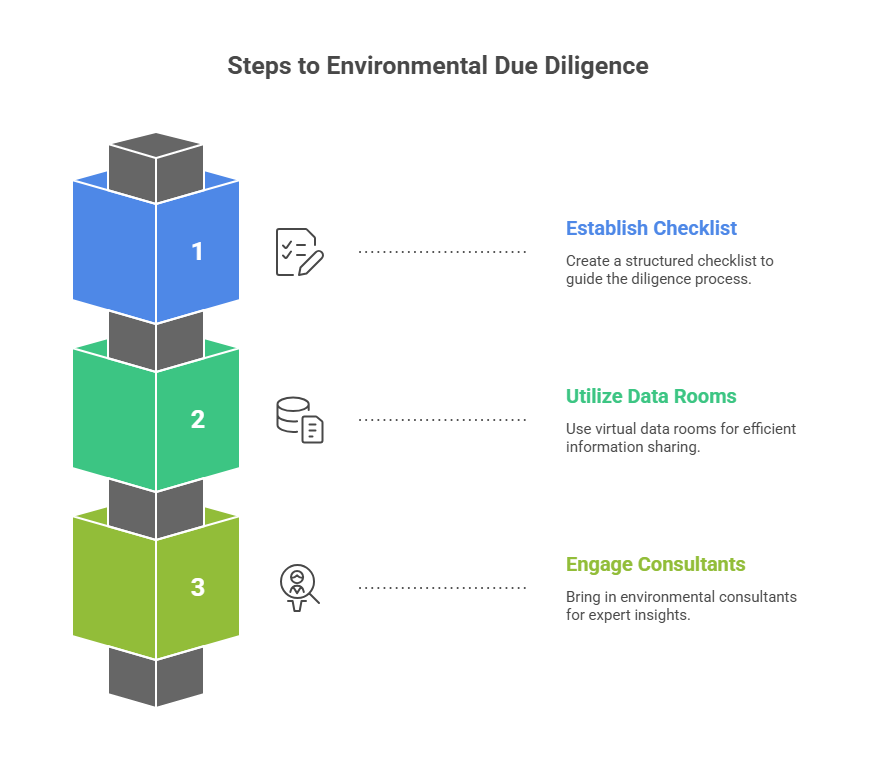

How to conduct an effective environmental due diligence process

Success requires a clear process, experienced professionals, and proper tools.

1. Establish a structured diligence checklist

Coordinate with legal, environmental, and compliance teams to cover all areas. Here’s an example framework:

| Stage | Task | Responsible |

| Pre-LOI | Conduct Phase I ESA | Environmental consultant |

| Pre-Closing | Review permits, past violations | Legal & compliance |

| Post-Closing | Track mitigation actions, reports | Risk & operations manager |

2. Use virtual data rooms (VDRs)

VDRs simplify the environmental DD process. Thanks to these essential instruments, due diligence teams can:

- Upload site reports, environmental audits, and compliance records

- Track document access and requests

- Coordinate input from multiple stakeholders

3. Bring in environmental consultants

For complex projects, you should also engage specialists to evaluate environmental conditions, identify issues, and support environmental compliance reviews.

Best VDR providers for environmental due diligence

Below are some of the best VDR providers commonly used to support EDD in high-stakes transactions — these include iDeals, SecureDocs, and DFIN.

Ideals

Known for its intuitive interface and strict security protocols, Ideals remains a preferred choice for enterprise-level due diligence. It provides:

- Advanced features like audit logs and access tracking, which are critical for regulatory compliance and internal accountability

- Strong integration with EDD checklists, allowing teams to manage and update files in real-time

- Secure upload and categorization of documentation like environmental permits, Phase I and II ESA reports, and hazardous substances records

Ideals is ideal for organizations handling multiple high-stakes transactions or managing exposure across several historical sites.

SecureDocs

SecureDocs offers a cost-effective, reliable platform with essential VDR features designed for mid-market diligence. Key benefits include:

- Easy setup with role-based access for external environmental consultants or regional compliance teams

- Support for document watermarking and automatic indexing, reducing manual errors and preserving the integrity of reports

- Simplified permissions management — valuable when managing a diligence process involving multiple counterparties or third-party advisors

SecureDocs is especially helpful when environmental audits must be distributed to several users during a compressed deal timeline.

DFIN

DFIN combines robust VDR capabilities with powerful AI tools that streamline environmental document review. Notable features include:

- AI-driven contract review tools like eBrevia that can extract and analyze environmental conditions clauses, regulatory compliance obligations, and environmental liability triggers

- Customizable dashboards for tracking document uploads, requests, and approvals across diligence phases

- Regulatory-grade security for industries like energy, chemical manufacturing, or infrastructure, where the environment is core to the business model

DFIN is particularly well-suited for regulated sectors conducting acquisitions where integration process planning requires real-time insights from environmental data.

Best practices for businesses conducting environmental due diligence

Even with a well-organized diligence checklist, the process may involve nuance, regulatory interpretation, and risk allocation. These best practices can help businesses in the environmental sector mitigate exposure and protect long-term value.

- Validate the accuracy and completeness of all reports. Environmental site assessment, audit, and compliance documentation must be recent, certified, and fully disclosed as part of any EDD process. Gaps in documentation — especially for hazardous substances disposal, air emissions, or past environmental permits — can result in hidden liabilities. Third-party validation adds a critical layer of assurance.

- Maintain transparency with regulatory authorities. Transparent communication fosters trust and expedites environmental permitting or remediation agreements. When problems identified in due diligence are disclosed proactively, companies are more likely to negotiate favorable terms with agencies rather than face reactive enforcement actions.

- Identify and mitigate risks before closing. Conducting environmental due diligence isn’t just about identifying environmental issues — it’s about determining how they affect the deal. Buyers should assess whether to remediate the property pre-closing, request price adjustments, or require the seller to indemnify against specific risks such as environmental liens, past violations, or undisclosed underground storage tanks.

- Track post-closing compliance obligations. Environmental due diligence must continue post-transaction. Incorporate environmental reps, warranties, and covenants in the purchase agreement and create a roadmap for monitoring ongoing environmental compliance. This is especially important when acquiring facilities with long permitting cycles, historical contamination, or active remediation projects.

Conclusion

A well-structured environmental due diligence checklist is critical to protecting your company, ensuring compliance, and reducing long-term liabilities. The process always involves more than just checking boxes — it requires evaluating complex environmental issues, identifying past violations, and managing stakeholder expectations through evidence-based analysis.

By working with qualified environmental consultants, leveraging secure virtual data rooms, and following industry best practices, businesses can conduct due diligence that is not only thorough but strategically aligned with operational and legal risk management goals.