How you organize and share your deal documents can keep things rolling or bring everything to a standstill. In the past, traditional data rooms, also known as physical data rooms, involved managing piles of paperwork, restricted access, and lengthy delays. Now, a virtual data room makes managing essential documents way easier and safer for everyone involved in the due diligence process.

But it’s not just about uploading files into folders. The way you set up your data room matters. A messy or confusing layout can slow down the whole process and frustrate buyers and advisors.

In this post, you will learn how to create a well-structured VDR that helps your team stay on track and keeps the deal moving smoothly.

Why Structure Matters in M&A VDRs

A well-built document storage ensures a successful transaction. In particular, it delivers the following benefits:

1. Efficiency

A disorganized data room can confuse deal participants. By contrast, a clean VDR enables buyers and their advisors to quickly find what they need without requiring clarification.

Structured documents and a clear indexing system enable faster reviews, fewer bottlenecks in Q&A workflows, and quicker turnaround times on key decisions.

2. Security

M&A data is highly sensitive and often subject to strict confidentiality, regulatory, and contractual obligations. Without a proper structure and permissions, there is a risk of unauthorized access and leaks.

The global average cost of a data breach reached $4.9 million. This represents a 10% increase over the previous year and the highest on record.

A well-set-up VDR lets you control access with a few clicks, whether it’s assigning user roles, hiding sensitive legal documents, or tracking who’s doing what. It’s a simple way to reduce mistakes and keep your deal data clean and in the right hands.

3. Regulatory readiness

Today, deals must meet increasingly strict compliance requirements. Poorly organized data rooms make it difficult to prove regulatory alignment, respond to audits, or implement retention policies post-closing.

84% of M&A professionals expect to face increasing regulatory expectations and scrutiny in the next two years.

A well-built VDR ensures that sensitive personal or financial data is properly stored, tagged, and protected with the necessary access permissions. All this supports compliance with GDPR, SOC 2, and ISO 27001.

In high-stakes financial transactions, a thoughtfully organized VDR is a strategic advantage that builds confidence with buyers, advisors, and regulators alike.

Data rooms for M&A

Overall rating:

4.9/5

Excellent

Overall rating:

4.8/5

Excellent

Overall rating:

4.7/5

Excellent

Step‑by‑Step Guide to Structuring an M&A Data Room

A data room is only as effective as its organization. Poorly built VDRs slow down diligence, confuse buyers, and introduce avoidable risk. Here’s how to structure a data room that supports speed, clarity, and control throughout the mergers and acquisitions deal:

1. Draft a visual schema

Before uploading a single file, sketch out the data room layout on paper or as a digital map. Think of it as a blueprint for your deal.

Why it matters:

- Reduces folder bloat and duplication later

- Ensures alignment with legal, finance, and IT teams before launch

- Helps define access boundaries and security zones

✅Pro tip: First, group content into high-level workstreams (e.g., legal, financial, operational). Then, map what folders and specific documents sit beneath each.

2. Design an intuitive folder index

An intuitive data room table reduces time spent hunting for files and reflects the logic of due diligence workflows.

Structure guidelines:

- Use clear top-level categories (e.g., Corporate, Financials, Contracts, IP, HR, etc.)

- Keep folder depth shallow, ideally no more than 2–3 levels

- Avoid nesting or acronyms that only your internal team understands

✅Customization tip: Adjust your top-level folders to reflect industry standards (e.g., “Clinical Trials” for biotech companies, “Source Code” for software companies, etc.).

3. Keep file naming and indexing consistent

Inconsistent names lead to confusion, version errors, and lost time. Therefore, use a standard format from the outset.

Recommended naming format:

[DocumentType]_[Date]_[Version].filetype

Example: P&LStatement_2024Q1_v2.pdf

Best practices:

- Use underscores instead of spaces

- Avoid abbreviations or internal nicknames

- Indicate when a document is obsolete or superseded (e.g., Superseded_ShareholdersAgreement_2023.pdf)

✅Why this matters: Buyers expect transparency. So, clean, consistent naming reduces friction and enhances confidence in your organization.

4. Set up permissions and access controls

Data security measures ensure that sensitive information is accessible only to authorized parties at the appropriate time and under specified conditions. Virtual data rooms support this by enabling administrators to assign granular, role-based permissions controlling who can view, download, edit, or print confidential documents.

The following matrix outlines access levels by role, ensuring each user group is granted only the visibility and control necessary for their function in the deal:

| Role | Access level | Example folders |

| Internal legal team | View / Edit / Download | All folders |

| Finance team | View / Edit | Financials, tax, forecasts |

| Executive team | View only | Key corporate and strategic documents |

| External buyer | View only | Financials, contracts, HR |

| Legal advisors | View / Download | Legal, regulatory, compliance |

| Other advisors (e.g., Tax, ESG) | View / Download | Assigned workstreams only |

| IT / Security admins | Admin / Manage permissions | N/A (Access to settings, not content) |

Best practices:

- Set access by role or group, not by individual

- Apply “view-only” access for sensitive content during early diligence

- Restrict download or printing on highly confidential documents (e.g., IP, litigation)

❗Security warning: Never assign top-level access to external users. Use nested permissions to maintain control.

5. Upload documents

A clean data upload process reflects deal readiness. Furthermore, it builds trust with potential buyers and advisors by demonstrating that your team is organized, detail-oriented, and committed to transparency from the start.

Checklist before uploading:

- Files named using the standard convention

- Document versions are final or marked as draft/superseded

- Redundant or placeholder files removed

- Each document is in its appropriate folder

✅Versioning tip: For updates, either replace the existing document or upload a new version with a “v2” tag. Don’t leave both unless specifically required.

❗Quality check: Have someone not involved in prep navigate the room. If they struggle, so will your buyer.

6. Maintain and engage with your VDR

A virtual data room isn’t a “set it and forget it” tool. Maintenance ensures relevance, accuracy, and professionalism.

Ongoing tasks:

- Replace outdated drafts with finalized versions

- Monitor access logs for unusual activity

- Regularly review Q&A interactions (if enabled)

- Close out folders as items are resolved or disclosed

✅Engagement tip: Assign a dedicated “VDR owner” on your team to coordinate updates and field document-related requests.

❗Red flags: If multiple users download the same outdated file or if reviewers frequently request missing docs, it’s time to audit your structure.

A clear data room layout keeps things moving. It helps reviewers stay focused, reduces the chances of missing something important, and cuts down on the endless back-and-forth that slows deals down. Moreover, a well-built platform provides better control, enabling you to manage access, respond quickly to requests, and stay organized even under pressure. When every detail counts, a well-structured VDR helps you stay one step ahead.

Security and Compliance Best Practices

In mergers and acquisitions, information security is a key requirement. Thus, a single misstep can jeopardize the deal, damage reputations, and lead to regulatory penalties. That’s why most virtual data rooms feature multilayered security and built-in compliance safeguards.

Core Security Features and Recommended Practices

A trusted VDR should include the following enterprise-grade protections to control access, monitor usage, and deter confidential data breaches:

- Encryption. Ensure the VDR provides end-to-end encryption using enterprise-grade standards (e.g., AES 256-bit), safeguarding files in transit and at rest.

- Two-factor authentication. Use a platform that requires two-factor authentication by default to protect access with a second layer of identity verification.

- Granular permissions. Configure user roles within the VDR to apply precise access rights, limiting each user’s ability to view, download, edit, or print based on their specific needs.

- Watermarking. Enable automatic watermarking that displays user-identifying information (e.g., email, IP address, timestamp) on all confidential documents to discourage misuse.

- Session timeouts and IP restrictions. Activate automatic session timeouts and restrict access to approved IP ranges to reduce unauthorized access risks.

- Activity logs and audit trails. Utilize detailed activity tracking to monitor every document interaction, providing transparency and supporting audit readiness.

These features provide deal teams with complete visibility and control, enabling them to detect suspicious behaviour early and respond proactively.

Key Compliance Frameworks

Leading virtual data rooms aligns with the following regulatory standards, enabling organizations to meet their legal obligations and pass due diligence without incurring compliance risks:

- The GDPR ensures the proper handling of personal data in the VDR storage, particularly in cross-border EU transactions.

- SOC 2 Type II demonstrates that the data room software provider maintains rigorous internal controls, secure system operations, and ongoing monitoring of data security and availability.

- HIPAA ensures the secure handling of protected health information (PHI) within the VDR, particularly in transactions involving healthcare data or clinical records.

- GLBA applies to deals involving U.S. financial institutions, mandating the protection of consumer financial data.

Certified and compliant data room solutions eliminate regulatory risk during the due diligence process and signal to buyers and investors that your organization operates with a high level of governance and preparedness.

Next, we check how to organize your own data room in a logical way that supports an efficient due diligence process.

Sample M&A data room structure

An effective M&A virtual data room organizes documentation into clearly defined top-level folders with relevant subfolders. This approach helps deal teams navigate relevant documents quickly and maintain control.

| Top-level folder | Example subfolders |

| 1. Corporate | Formation documents, Board minutes, Organizational chart |

| 2. Financials | Audits, Financial statements, Financial projections, Tax returns |

| 3. Contracts | Customer agreements, Supplier contracts, Licensing agreements |

| 4. Intellectual property (IP) | Patents, trademarks, Research & Development documentation |

| 5. Human resources (HR) | Employment contracts, Benefits information, Company policies |

| 6. Litigation | Disputes, Regulatory filings |

| 7. Commercial | Sales data, Market analysis, Pricing documents |

| 8. Compliance | Policies, IT architecture, Cybersecurity logs |

| 9. Insurance | Policies, Risk assessments, Claims documentation |

Industry-Specific Folder Additions

The core VDR layout applies broadly. However, each industry has unique documentation requirements that should be reflected in your data room.

| Industry | Recommended folder additions |

| Technology & Software | Source Code, Software Licenses, API Documentation, Product Roadmaps (under IP or Commercial) |

| Biotech & Pharma | Clinical Trials, Regulatory Approvals, Safety Reports, R&D Data (under IP or Compliance) |

| Manufacturing | Supply Chain Agreements, Quality Control Records, Maintenance Logs, Environmental Compliance |

| Financial services | Customer Data Policies, Risk Management Docs, Audit Reports, Regulatory Filings |

| Retail & Consumer Goods | Vendor Agreements, Marketing Materials, Sales Channel Data, Product Safety Certificates |

| Energy & Utilities | Environmental Impact Assessments, Licenses & Permits, Safety Reports, Asset Registries |

Our final step is to utilize the VDR’s tools to the fullest, which enables faster, more accurate, and easier setup and document management.

Tools and VDR Features to Streamline Setup

The following functionality adds value during deal preparation and execution:

1. Smart indexing algorithms

Rather than simply assigning file names and numbers, advanced indexing engines analyze document metadata and folder context to maintain logical placement, even when documents are uploaded in bulk or out of order. This ensures consistency across large datasets and keeps your room audit-ready from the start.

2. Intelligent bulk upload management

Modern VDRs often support document type detection, duplicate flagging, and file format normalization. This speeds up onboarding and helps avoid clutter or inconsistencies that could confuse reviewers.

3. Behavioral engagement insights

Data room document analytics surfaces behavioral patterns. Specifically, the software can highlight unusually frequent views of sensitive documents, time spent per page, or comparative interest across bidders. Thus, deal teams can identify hot spots or potential concerns early in the process.

4. Structured Q&A workflow

Instead of email threads or spreadsheets, built-in Q&A workflows assign responsibility, deadlines, and access rules for each inquiry. Questions can be routed by category (e.g., Legal, Tax, IP) and tracked through resolution, ensuring no information gaps and improving transparency between buyer and seller.

5. Secure workflow integrations

Integration capabilities let virtual data rooms communicate with CRM systems, e-signature platforms, and deal management software. These connections reduce manual data entry, support real-time collaboration, and ensure sensitive documents stay in sync across platforms, especially valuable during multi-phase transactions.

Now that we’ve covered how to structure your data room, what documentation to include, and the key VDR tools that make setup easy and secure, it’s time to explore the best virtual data room services for M&A.

Top 3 Virtual Data Rooms for M&A

1. Ideals virtual data room

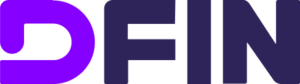

Widely trusted by investment banks, legal firms, and global corporations, Ideals offers a balance of advanced security features and user-friendly design. These virtual data rooms offer secure file sharing, granular permission settings, automatic data room index, real-time audit trails, and multi-level Q&A workflows. Everything is optimized for mergers and acquisitions. With 24/7 multilingual support and compliance with GDPR, SOC 2, and ISO 27001, Ideals is a reliable choice for high-stakes transactions where security, speed, and precision matter.

Ideals interface

2. SecureDocs

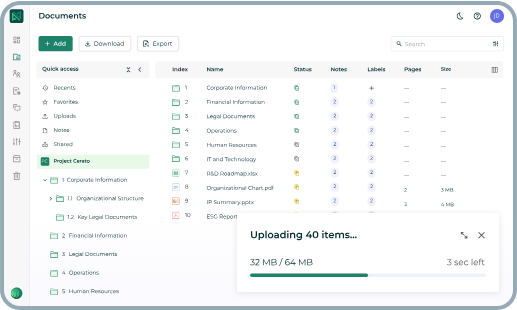

SecureDocs is a straightforward, cost-effective online data room ideal for smaller M&A teams or fast-moving deals. Its clean interface, flat pricing, and instant setup make it a favorite for companies that need to open a secure online repository quickly without compromising on the key security features. With drag-and-drop uploads, permission-based roles, and audit logs, it covers all essentials while remaining easy to use.

SecureDocs interface

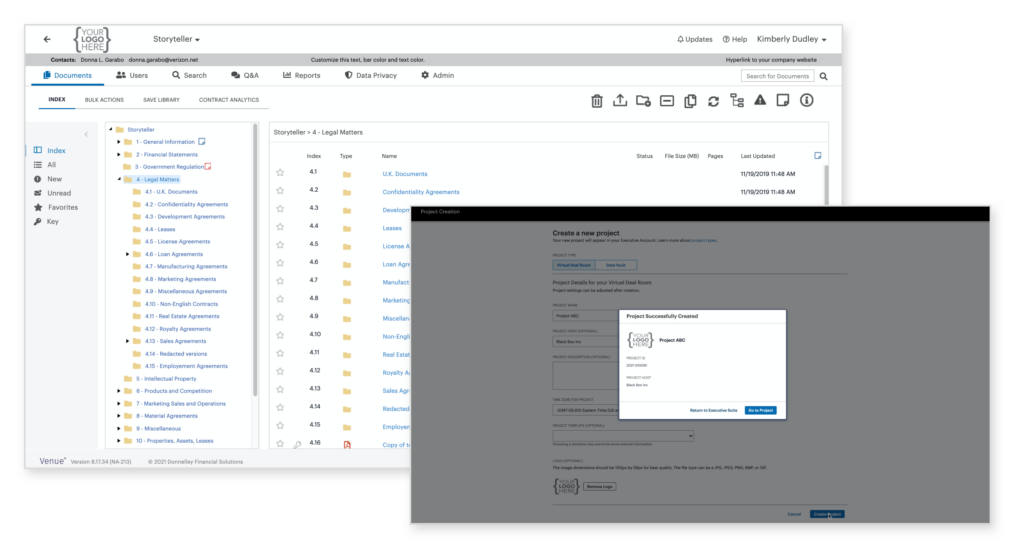

3. DFIN Venue

Developed by financial disclosure experts, DFIN Venue is purpose-built for capital markets and regulated environments. It integrates well with deal prep workflows and offers built-in AI contract analysis, automated document tagging, and a strong focus on compliance. The platform supports advanced collaboration features for legal and finance teams, featuring reliable encryption for sensitive data and high-speed performance.

DFIN Venue interface

Explore the best virtual data room solutions and select the VDR that best suits your needs in complex financial transactions.

Conclusion

A well-organized M&A data room shortens due diligence timelines, prevents costly errors, protects confidential information, and shows potential buyers you’re prepared. In short, proper structure means fewer distractions, smoother collaboration, and faster decisions when timing matters most.

Visit our main page to compare the top virtual data room providers and choose a solution to work smarter, ensure secure document sharing, stay compliant, and close deals confidently.