Signing the M&A agreement is just the beginning. The challenge lies in combining two companies into a single entity, a process known as post-merger integration (PMI). What follows is a period where strategy meets reality, where leadership decisions, team morale, and operational alignment determine the deal outcomes.

When PMI fails, it is often the result of misaligned leadership, disengaged employees, or incompatible systems. Research shows that even as frequent acquirers improve at capturing value, integration problems still drive 83% of failed deals.

The solution lies in structure. A post M&A integration checklist keeps teams focused, prioritizes critical tasks, and ensures accountability. It provides a comprehensive plan from Day 1 through the first 180 days and beyond.

This guide details the key phases, workstreams, and practical steps for a successful integration process and outcomes. Equipped with these insights, executives, IMO leads, and private equity teams can keep mergers on track and secure lasting results.

Key phases of post-merger integration

PMI can be complex due to the involvement of multiple teams, systems, and processes. However, knowing the following main stages can help you guide the process:

Phase 1. Preparation (Pre-close)

🔲 Mission: Set the stage for a smooth Day One.

The groundwork is done here. Leadership sets the vision, defines how decisions will be made, and looks ahead to where the friction points may be — whether in culture, systems, or reporting. It’s the moment to make sure you’re not walking into Day One blind.

Phase 2. Day One (0–48 hours)

🔲 Mission: Build trust through stability and clear communication.

On Day One, the priority is to demonstrate that leadership is aligned and the organization is stable. Employees, customers, and partners want to see business continuity: payroll runs on time, system access works, and the leadership team speaks with one voice. If you manage that, you earn the trust to do harder things later.

Phase 3. First 30 Days

🔲 Mission: Keep operations steady while listening to key stakeholders.

The first month is about stabilizing and listening. Leaders start aligning processes, reaching out to key customers, and testing where early synergies can be delivered. At the same time, this is when you discover how people actually feel. Here, HR “listening tours” and team feedback become just as valuable as financial reporting.

Phase 4. 90 Days

🔲 Mission: Move from two companies to one.

By this stage, integration becomes tangible. Systems are being connected, reporting lines are clarified, and cultural differences are addressed openly. It’s when the organization shifts from “two companies working side by side” to “one combined organization learning to operate as one.”

Phase 5. Long-term optimization (120+ days)

🔲 Mission: Lock in value and build for the future.

After the basics are working, the agenda turns forward-looking. Tech migrations are complete, new operating models are settling in, and the newly merged organization begins investing in innovation rather than integration. Post-mortems at this stage are critical. They tell you what worked, what didn’t, and how to do it better next time.

These high-level phases provide a roadmap for post-merger integration. Ahead, we’ll show how they translate into concrete tasks in the sample phase‑by‑phase checklist table.

Functional workstreams and areas to cover

Post-merger integration touches every part of the business. Organizing it into functional workstreams helps teams focus on the areas that have the greatest impact.

Key workstreams include the following:

- Governance and integration management office. The IMO provides structure to integration activities, defining senior leadership roles, decision-making authority, and reporting lines. It maintains accountability throughout the process.

- Communication and stakeholder management. This workstream focuses on keeping employees, customers, and suppliers informed with clear updates. It ensures confidence and continuity.

- Culture and people. Attention is given to talent retention, leadership alignment, and workforce restructuring, including payroll, benefits, and employee engagement. It supports a smooth human transition.

- Technology and systems integration. This integration process involves assessing IT compatibility, migrating data, and standardizing processes across platforms. It maintains operational efficiency.

- Finance, reporting, and synergies. This area covers aligning financial reporting, consolidating accounts, and tracking cost savings and revenue synergies. It helps to measure the deal’s performance against expectations.

- Operations and supply chain. Focus is on integrating logistics, procurement, manufacturing, and facilities. It maintains smooth day-to-day operations and supports scalability.

These workstreams form a coordinated approach that increases the likelihood of a successful post-merger integration.

Sample phase-by-phase PMI checklist

Here’s where the strategy turns into action. The table below shows how activities typically unfold across each phase of post-merger integration:

| Phase | Key tasks | Responsible teams |

| 1. Preparation for day one | ✅Define integration goals and measurable success metrics. ✅Establish the Integration Management Office (IMO) and assign leadership roles. ✅Conduct a culture assessment and identify potential clashes. ✅Map all technology systems, platforms, and dependencies. ✅Plan internal and external communications strategy. ✅Identify key talent and retention risks. | IMO Leadership HR IT |

| 2. Day one | ✅Send the merger announcement to all employees. ✅Communicate roles, responsibilities, and priorities to teams. ✅Ensure legal and compliance handover is completed. ✅Provide system access and credentials to relevant staff. ✅Announce leadership changes. ✅Notify key customers and suppliers. | IMO HR Legal Communications IT |

| 3. First 30 days | ✅Begin IT systems integration and verify data migration. ✅Align financial reporting processes and accounts. ✅Implement HR integration: payroll, benefits, and onboarding of transferred staff. ✅Track and report early cost/revenue synergies. ✅Collect structured employee and customer feedback and log issues. | IMO IT Finance HR Operations |

| 4. 30–90 days | ✅Complete integration of core operations and workflows. ✅Standardize processes across locations and functions. ✅Continue culture alignment initiatives, including training and workshops. ✅Optimize supply chain, procurement, and facilities. ✅Monitor, measure, and expand cost/revenue synergies. | IMO Operations HR Supply chain Finance |

| 5. Post 90–180+ days | ✅Compare integration outcomes against initial targets. ✅Close out legacy processes and systems. ✅Institutionalize the new operating model and governance. ✅Implement continuous improvement initiatives. ✅Document lessons learned and best practices for future deals. | IMO Leadership Operations Finance HR |

By assigning ownership and sequencing tasks phase by phase, leadership teams can strengthen risk management, accelerate synergy capture, and keep the organization moving in the same direction.

Common pitfalls and how to avoid them

Teams may hit predictable obstacles even with a good integration plan. Recognizing these common pitfalls early will help you act proactively.

1. Leadership misalignment

Teams can stall or pull in different directions when executives aren’t clear on priorities or decision rights. That’s why an Integration Management Office is essential. It keeps roles defined, key decisions coordinated, and accountability visible.

2. IT and systems complexity

Two platforms that “should” work together rarely do. As a result, small differences can lead to downtime, data errors, and frustrated employees. Assessing systems early and rolling out changes in stages helps prevent these issues from derailing operations.

3. Cultural integration blind spots

If employees feel uncertain, ignored, or undervalued, top talent may leave. Retention programs, open communication, and visible leadership engagement go a long way in keeping people committed.

4. Weak communication

Rumors and confusion spread fast if updates are inconsistent or delayed. Missteps in blending different workplace cultures can deepen that divide. Clear and frequent messaging across channels helps employees, customers, and suppliers understand what’s happening and what to expect.

When leadership, technology, culture, and communication work together, the integration stands a much better chance of success.

Virtual data rooms in post-merger integration

These days, most companies rely on online platforms to keep PMI organized. When teams manage dozens of documents, multiple stakeholders, and cross-functional projects, the best solutions make it possible to see everything in one place, stay on schedule, and reduce mistakes.

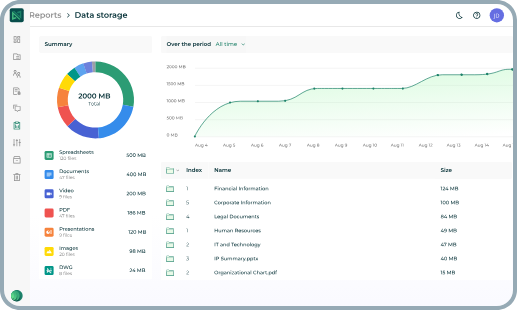

One of the most advanced tools today is a virtual data room (VDR). It is a secure online data repository and communication space. This is where you can store contracts, reports, financial statements, and other critical documents. Everyone from internal teams and external advisors gets secure data access and collaborates across time zones and devices. You can also control who sees what. Moreover, every action is logged, so nothing slips through the cracks.

Virtual data room interface

Using a VDR makes the post-merger integration process faster and safer. Teams can work on the same documents without confusion, compliance is easier to manage, and confidential information stays secure. It also gives leadership a clear view of what’s happening, so nothing is hidden and everyone is accountable.

Popular data rooms

Overall rating:

4.9/5

Excellent

Overall rating:

4.8/5

Excellent

Overall rating:

4.7/5

Excellent

Key features for PMI-focused VDRs

| Feature | How it works in PMI |

| 1. Q&A functionality | Team members can post questions about a document in the VDR, and answers are linked to the specific file. This keeps clarifications in one place and prevents important details from being lost in emails. |

| 2. Milestone tracking | Integration milestones, like system go-lives or HR updates, can be marked and monitored within the virtual data room. Leaders instantly see which steps are complete and which need attention. |

| 3. Analytics on document usage and task status | The VDR shows which documents are being accessed and how often, who has completed assigned tasks, and where bottlenecks appear. This data helps prioritize follow-ups. |

| 4. Integration with project management tools | Tasks, timelines, and document links from the VDR connect to project management software. Thus, teams don’t have to jump between systems. Progress updates are automatic and visible. |

Note: The features in the table cover the essentials for PMI, but modern VDRs offer more. Secure data centers, customizable permissions, automated alerts, e-signatures, mobile access, offline work, redaction, and advanced search capabilities, among others, help teams work faster, safer, and more efficiently.

Benefits of using a VDR for PMI

Here is how virtual data rooms make your integration efforts stronger and enhance efficiency.

1. Faster transparency

These days, teams aren’t scrambling through emails or old spreadsheets. With a VDR, everyone sees the same documents and plans at the same time. Finance in New York, HR in Berlin, operations in Singapore – they all work from the same page and make decisions faster.

2. Stronger security

Sensitive contracts and employee records are always a concern. A virtual data room lets you control document access and keep information safe with robust data protection measures.

3. Simpler compliance and audits

Auditors and regulators need clear records. With a VDR, everything is logged and organized. Thus, you can produce the right reports in minutes.

4. Built-in accountability

Nothing falls through the cracks. Every document viewed, every task completed, and every milestone reached is tracked. Leaders can see where attention is needed and act quickly.

5. Better coordination across teams

Teams are rarely all in one office, and time zones can slow things down. A virtual data room keeps everyone on the same page, avoids duplication, and keeps projects moving without endless back-and-forth emails.

Case study (example): Turning integration chaos into clear action

A manufacturing company merging with a software firm faced very different systems and processes. Finance needed to consolidate accounts, HR had to align benefits, and IT had to migrate data across incompatible platforms.

Using a VDR, finance teams could access the latest balance sheets and forecasts in real time, HR teams tracked approvals for employee benefits in one centralized dashboard, and IT flagged system issues through the platform’s Q&A feature.

By having a single source of truth, tasks that might have taken weeks of emails and meetings were completed in days. As a result, the integration stayed on schedule without errors or miscommunication.

Best practices for a successful PMI checklist implementation

Even the most detailed integration checklist won’t deliver value if it isn’t applied thoughtfully. So, follow the practical approaches below to ensure the desired outcomes.

1. Start planning early

- Build the checklist during due diligence to spot risks before Day One

- Align leadership on priorities and expected outcomes to avoid last-minute confusion

- Map key milestones so your functional integration team knows what to tackle first and what can wait

- Identify dependencies across functions to prevent bottlenecks later

2. Assign strong integration leadership

- Appoint an Integration Manager or IMO to define decision rights and reporting lines

- Make accountability clear for each functional area and task

- Hold regular leadership check-ins to maintain alignment

- Empower leaders to act decisively without constant escalation

3. Prioritize high-impact synergies first

- Focus on initiatives that deliver the largest cost savings, revenue gains, or operational improvements early

- Track progress with measurable KPIs to make wins visible

- Sequence tasks logically to maintain momentum

- Reassess priorities as new information emerges to keep focus on what matters most

4. Maintain open communication

- Provide frequent updates to employees, executives, and external stakeholders

- Use consistent messaging to reduce uncertainty and confusion

- Encourage questions and feedback to surface issues early

- Keep critical updates documented and accessible for all relevant teams

5. Stay flexible

- Treat the checklist as a living document that can evolve with the integration

- Adjust tasks and timelines according to deal size, type, and potential challenges

- Review and update the checklist regularly to keep it relevant

- Be ready to reallocate resources quickly if priorities change

Conclusion

These days, an integration checklist is less about bureaucracy and more about keeping everyone aligned. Leadership needs clarity on who makes which decisions, and teams need to see progress in a structured way. Without that, value capture slips, and momentum is lost.

Advanced modern tools now make even the most complex processes easier. A virtual data room, for instance, ensures information flows securely and consistently. Everyone works from the same version of the truth, and regulators or auditors get the transparency they expect.

In practice, integration succeeds when structure and discipline are matched with flexibility. The comprehensive post-merger integration checklist provides the roadmap, the tools provide the infrastructure, and together they give companies the best chance to retain key employees, accelerate synergy realization, and deliver on the deal rationale.