Key features:

- Project setup in less than 15 minutes

- Storage-based pricing for clear project budgeting

- In-app live chat support 24/7, including holidays and weekends

Overall rating:

4.8/5

Excellent

Securedocs

Free trial: 14 days

Key features:

- Built-in electronic signatures and templates

- Granular user permissions and activity logs

- Q&A workflows with Excel export

Overall rating:

4.5/5

Good

Onehub

Free trial: 30 days

Key features:

- FTP getaway for mass uploads

- Document previews supporting popular file formats

- Comments and tasks for collaboration

Overall rating:

4.4/5

Good

HighQ

Free trial: Yes

Key features:

- Q&A workflows for bidder interaction

- Custom data room audits

- Custom user invitation letters

Overall rating:

4.7/5

Excellent

DFIN

Free trial: 14 days

Key features:

- AI contract analysis for due diligence

- Automatic PII redaction in uploaded documents

- Multi-deal management and project reporting

In today’s fast-paced startup ecosystem, efficient data management and secure information sharing are critical for raising capital and building investor confidence. Virtual data rooms — secure online repositories for sensitive documents — have emerged as a must-have tool for startups preparing for due diligence, fundraising rounds, mergers, or strategic partnerships. According to recent industry reports, the global virtual data room market is growing at a compound annual growth rate (CAGR) of approximately 16%, projected to surpass $1.6 billion by 2026. This surge reflects the increasing reliance of startups and investors on digital platforms that streamline deal-making while ensuring top-tier security standards like AES-256 encryption and SOC 2 compliance.

For early-stage startups, having a well-structured VDR can cut fundraising timelines by up to 30 days, as investors can quickly access organized financials, legal documents, and intellectual property records. It’s also a mark of professionalism — companies with a well-prepared data room are perceived as more credible and investment-ready.

What is a virtual data room for startups?

A startup virtual data room is a secure document-sharing platform designed to store and manage sensitive files during crucial business activities.

Essentially, a startup virtual data room is a deal room for fundraising, IPOs, M&A, and strategic partnerships. Unlike traditional cloud solutions, VDRs come with advanced security and data management features, granular access permissions, and compliance-ready audit logs.

For startups, securing a virtual data room solution is more than just about file storage — it’s about optimizing investor interactions, streamlining due diligence, and ensuring business continuity. Unlike basic cloud storage, which lacks structured security protocols and document tracking, VDRs are specifically designed to handle the complex needs of financial transactions, regulatory compliance, and stakeholder transparency.

Given that many early-stage founders operate in highly competitive markets, having an organized data room can also be a strategic advantage. A well-maintained startup data room signals to potential investors, acquirers, and regulatory bodies that a company is serious, transparent, and well-prepared —all critical factors in increasing investor confidence and expediting deals.With data stored in the cloud projected to reach 100 zettabytes in 2025, equivalent to half of the world’s garnered data, the importance of secure, scalable document management solutions like VDRs is becoming more critical than ever

Why Startups Need a Data Room?

Startups face intense scrutiny during fundraising, M&A, and partnerships, where every document counts. A well-prepared VDR doesn’t just save time; it signals professionalism, transparency, and security to investors.

1. Efficient Fundraising & Due Diligence

During fundraising and M&A, investors demand access to a wide array of documents. A well‑organized VDR accelerates due diligence by centralizing content and eliminating redundant back‑and‑forth, cutting deal cycles by weeks or even months.

Some providers report reductions of up to ~30 days compared to physical data rooms.

2. Security and Compliance

Startups often handle highly confidential data: IP, customer contracts, legal disclosures. VDR platforms typically offer advanced security: AES‑256 encryption, multi‑factor authentication, dynamic watermarking, remote‑wipe, redaction, and compliance with SOC 2, ISO 27001, GDPR/HIPAA standards.

3. Investor Confidence & Professionalism

Investors expect professionalism. An organized VDR signals maturity, improves credibility, and helps a startup stand out during competitive fundraising.

4. Real‑Time Analytics & Engagement Tracking

Modern VDRs provide dashboards showing who accessed which file, and how often. This enables founders to understand investor behavior and tailor follow‑ups or negotiation strategy.

5. Scalability & Long‑Term Use

As a startup grows, its documentation grows. VDRs scale with you—whether it’s seed‑round fundraising or eventual IPO, M&A or audit preparation — without changing platforms.

Key features and benefits of virtual data room solutions

1. Advanced data security

Security is a top priority in any due diligence process. Startups need a secure data room to protect their most sensitive information, whether it’s financial statements, intellectual property, or strategic business plans. A robust VDR includes:

- AES-256 encryption for confidential data, ensuring protection against cyber threats and unauthorized access.

- Multi-factor authentication (MFA) for secure access, reducing the risk of credential theft.

- Secure document sharing with watermarks, dynamic access controls, and view-only permissions, preventing unauthorized distribution or leaks.

- Audit logs to monitor data room activity, providing a clear record of who accessed what information and when.

- Granular access permissions, ensuring that investors, legal teams, and stakeholders only see the documents they need.

- Time-restricted access links, offering an added layer of security for due diligence processes.

2. Efficient document management

Managing sensitive documents efficiently requires structure, accessibility, and control. A hierarchical folder structure ensures startups can systematically organize:

- Investor decks and cap tables, keeping financial and ownership records clear.

- Financial updates and growth reports, providing valuable insights for investors and stakeholders.

- Intellectual property information and legal files, protecting patents, trademarks, and contracts.

- Version control tools, allowing startups to maintain a history of document changes and updates.

- Bulk upload and drag-and-drop functionality, streamlining data entry and file management.

- Optical Character Recognition (OCR) technology, enabling easy document searchability.

With a structured, organized data room, startups can ensure that potential investors and business partners find key documents quickly, reducing friction in the diligence process.

3. Investor-friendly collaboration tools

Fundraising, M&A, and partnerships require seamless communication between multiple parties. The best virtual data room solutions enhance collaboration by offering:

- Q&A sections that allow investors to submit questions directly within the data room, reducing back-and-forth email communication.

- Role-based access permissions, ensuring that different stakeholders see only the files relevant to their role.

- Automated notifications, alerting parties when new documents are uploaded or updated.

- Real-time commenting and document annotations, enabling efficient communication between legal, finance, and executive teams.

- Task assignment features, allowing startups to delegate review responsibilities to specific users within the VDR.

- E-signature integrations, expediting agreement finalization without the need for external signing platforms.

4. Seamless integration with startup workflows

A startup data room should not function in isolation — it must integrate seamlessly with existing workflows to improve efficiency. VDR providers now offer integrations with key business tools, enabling startups to streamline processes:

- CRM platforms (e.g., Salesforce, HubSpot) to track investor interactions and engagement within the due diligence process.

- Project management tools (e.g., Asana, Trello, Monday.com) for deal tracking and internal workflow alignment.

- Cloud storage solutions (e.g., Google Drive, Dropbox, OneDrive) to centralize document access while maintaining security protocols.

- Business intelligence tools for data visualization and investor reporting.

- Email and communication platforms to facilitate seamless investor discussions directly from the data room.

By integrating VDR solutions with these tools, startups can eliminate inefficiencies, automate document sharing, and enhance investor engagement throughout the fundraising and M&A processes.

With these advanced capabilities, startups can ensure data integrity, secure investor confidence, and accelerate growth, making virtual data room solutions an indispensable tool for modern business transactions.

Key Use Cases for Startups

Virtual data rooms are versatile and support startups through every growth stage. Whether raising a seed round or preparing for an IPO, VDRs streamline complex workflows and ensure stakeholders have access to the right information at the right time. Here, we break down the main use cases that prove VDRs are more than just storage solutions.

1. Seed and Pre‑Seed Rounds

Even at early stages, having a curated set of documents — pitch deck, cap table, financial model, team bios, key contracts — can significantly accelerate interest from angels and pre‑seed investors.

2. Series A / Venture Capital

As due diligence intensifies, a robust VDR should include legal agreements, intellectual property filings, customer contracts, governance documents, HR contracts, historical financials, and projections.

3. M&A, IPO, Strategic Partnerships

Startups that anticipate exit or acquisition (or even early IPO guidance) benefit from having audit-ready document organization and governance workflows in place via a VDR.

4. Ongoing Reporting & Compliance

Post-investment, VDRs serve as a hub for board materials, investor updates, KPI reporting, and third‑party audits or legal review.

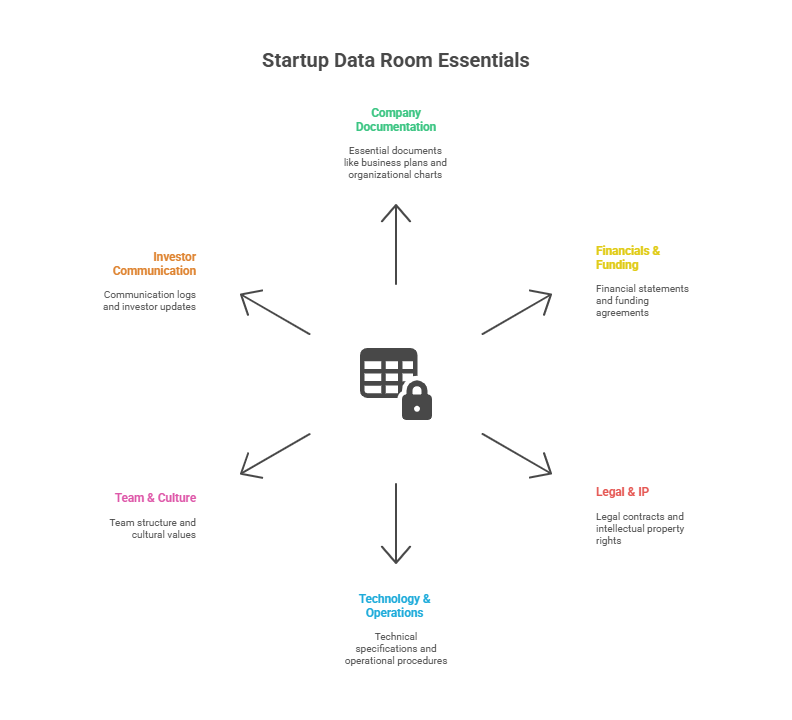

Putting the VDR Together: What to Include

Building an effective virtual data room starts with knowing what documents investors expect to see. A well-structured VDR not only accelerates due diligence but also builds trust. From company formation papers to financial statements and IP documents, here’s what every startup should include for a seamless investor experience.

Company Documentation

- Pitch deck, executive summary, term sheets

- Articles of incorporation, shareholder agreements, cap table

- Board materials: minutes, consents, governance documents

- Market analyses, competitive landscape, marketing collateral

Financials & Funding

- Historical financial statements, projections, revenue models

- Cap table, previous fundraising agreements, investor rights documents

Legal & IP

- Contracts (customers, suppliers, leases), employment agreements

- IP filings, patent details, licenses, open‑source usage

Technology & Operations

- API documentation, architecture diagrams, product roadmaps

- Regulatory compliance documents if relevant (HIPAA, GDPR, etc.)

Team & Culture

- Employee and contractor agreements, org chart, onboarding materials

- Policies, board bios, recruitment plans.

Investor Communication

- Quarterly or monthly investor updates (charts KPIs, challenges)

- Meeting decks, historical Q&A summaries and correspondence

Best Practices for Startups

Even the most secure VDR can fall short if it’s poorly organized or outdated. Adopting proven best practices will ensure your data room is always ready for investor scrutiny and can help avoid costly delays.

1. Build Early

Start the data room prep well before fundraising begins (ideally 3 months ahead), so documents are complete, well‑organized, and error‑checked. Trying to retroactively scramble a VDR is time-consuming and less credible.

2. Organize with Clarity

Use a clear folder structure by domain (Legal, Financial, IP, etc.). Name files descriptively and version clearly. This helps investors and internal users navigate quickly without confusion.

3. Define Granular Access Controls

Permissions should be role-based. For example, only legal counsel sees full legal agreements; investors see redacted or summary versions. Limit downloads, printing, or forwarding based on role and document sensitivity.

4. Leverage Analytics & Q&A Features

Track investor behavior—who’s viewed what, time spent on pages—and proactively engage. Use VDR‑embedded Q&A tools to manage questions linked to documents and maintain a centralized, searchable thread.

5. Keep It Updated

Upload new documents quarterly or after major milestones. Remove outdated or irrelevant files to keep clarity high. Investors expect the most current information in one place.

6. Educate Your Team & Investors

Provide clear instructions on navigation, permissions, and expectations. Minimize time wasted clarifying permission errors. Some platforms offer onboarding guides or tutorials tailored to VDR users.

Feature Checklist: What to Look For in VDR Platforms

Not all virtual data rooms are created equal, and startups must carefully evaluate platform features. From AI-powered automation to compliance certifications, selecting the right provider can drastically affect speed and security. Here, we outline the core features to consider when choosing your VDR solution.

| Feature Area | Why It Matters for Startups |

|---|---|

| Security & Compliance | Look for SOC 2, ISO 27001, GDPR/HIPAA certifications; AES‑256 encryption; watermarking; redaction; remote wipe options |

| AI & Automation | Advanced providers like Ansarada and V7 Go offer AI to score document readiness, auto‑index, redaction, and summarization—reducing manual effort and closing deal prep faster |

| Analytics & Reporting | Real‑time dashboards showing engagement by investor or document help inform follow‑ups and strategy |

| Q&A Module | Built‑in Q&A workflows centralize investor questions and answers, avoiding email threads and version confusion |

| Scalability | Flat‑fee or tiered pricing models that support unlimited users and document volume help startups avoid surprises as they grow |

| Ease of Use | Intuitive UI, drag‑and‑drop uploads, auto‑index, search, SSO support reduce learning curve and adoption friction |

ROI and Quantitative Impact

How much value can a virtual data room deliver for a startup? Beyond security, VDRs shorten deal timelines, build investor confidence, and reduce administrative costs. Here, we break down the tangible ROI metrics that prove the business case for implementing a VDR.

- Faster fundraise timelines: Companies report cutting due diligence timeline by 3–4 weeks by replacing physical rooms with VDRs.

- Higher investor confidence: Structured VDRs reduce friction and miscommunication, leading investors to move faster and with less skepticism.

- Reduced costs: Compared to consultants, or ad‑hoc email/document exchange, VDRs bundle auditability, compliance, reporting, and analytics—often costing only a few hundred dollars/month early stage.

- Market growth: At ~16% CAGR, the VDR sector is rapidly expanding—reflecting universal adoption across corporate finance, legal, venture capital, and startup ecosystems.

Integrating virtual data rooms with startup operations

A virtual data room is more than just a storage solution — it should be fully integrated into a startup’s operational workflows to enhance efficiency, collaboration, and security. Proper integration ensures that startups can seamlessly manage investor relations, internal documentation, and compliance processes without disruption.

To maximize the value of a VDR provider, startups should:

- Set up a structured folder system for important documents, ensuring that investors and stakeholders can easily navigate due diligence materials.

- Assign role-based access permissions for prospective investors, legal teams, and internal stakeholders, granting controlled access to specific data.

- Monitor data room activity with audit logs, tracking who accessed which documents and when, ensuring transparency and security.

- Use VDRs as a collaboration tool for deal-making, investor relations, and internal team coordination, enabling real-time communication and document updates.

- Automate document approval workflows to reduce manual processes, ensuring that all files are up to date and accessible when needed.

- Integrate with CRM and project management tools to align the data room with existing workflows and maintain efficiency across teams.

- Leverage built-in analytics and reporting features to track investor engagement and optimize data-sharing strategies.

By embedding VDR solutions into daily operations, startups can improve transaction efficiency, enhance security protocols, and ensure seamless collaboration with investors, partners, and internal teams.

Common Challenges & How to Solve Them

Challenge: Cost vs Value

Startups may hesitate due to subscription fees.

Solution: Many platforms offer free trials or low‑tier introductory pricing. Weigh cost against time savings, investor trust, and reduced legal friction.

Challenge: Adoption & Training

If team members or advisors resist using the VDR.

Solution: Choose platforms with intuitive UI and offer brief walkthroughs or guide documents. Many vendors provide onboarding support.

Challenge: Platform Integration

Mismatch with existing cloud storage or tools.

Solution: Select VDRs that support integrations, bulk upload/export, drag‑and‑drop, and auto‑sync features.

Final Recommendations for Founders

- Start building your VDR early—ideally at least several months before funding events.

- Prioritize organization and naming convention in folders.

- Use analytics & Q&A features proactively—don’t just store documents, monitor traction.

- Select a provider balancing cost, usability, and security as per your stage.

- Iterate the VDR over time—continuous updates signal professionalism and transparency.

- Use the VDR as an alignment tool across teams, investors, and advisors—not just a storage box

Virtual data rooms have become essential for startups aiming to raise funds, secure partnerships, and streamline due diligence with confidence and professionalism. By organizing key documents and offering advanced security, VDRs save time, reduce risks, and build investor trust.

With so many providers offering startup-friendly features—like analytics, AI automation, and flat pricing—it’s crucial to choose a platform that matches your growth stage and budget. Whether you’re preparing for your first seed round or planning an exit strategy, selecting from top providers can give your startup a competitive edge and ensure smoother, faster deal-making.

FAQ

How secure are startup virtual data rooms?

Virtual data rooms use AES-256 encryption, multi-factor authentication, and access controls to ensure sensitive documents remain protected against cyber threats and unauthorized access.

What features should startups look for in a virtual data room?

Startups should prioritize granular access permissions, audit logs, secure document sharing, real-time collaboration tools, and compliance certifications to meet their security and operational needs.

How does a virtual data room improve the fundraising process?

A well-organized data room streamlines due diligence, providing investors with quick access to financial records, cap tables, and business plans, accelerating funding decisions and improving investor confidence.

Can virtual data rooms integrate with other startup tools?

Yes, leading VDR providers offer integrations with CRM platforms, project management tools, cloud storage solutions, and analytics software, allowing startups to seamlessly align document workflows with existing business operations.