Key features:

- Project setup in less than 15 minutes

- Storage-based pricing for clear project budgeting

- In-app live chat support 24/7, including holidays and weekends

Overall rating:

4.8/5

Excellent

Securedocs

Free trial: 14 days

Key features:

- Built-in electronic signatures and templates

- Granular user permissions and activity logs

- Q&A workflows with Excel export

Overall rating:

4.5/5

Good

Onehub

Free trial: 30 days

Key features:

- FTP getaway for mass uploads

- Document previews supporting popular file formats

- Comments and tasks for collaboration

Overall rating:

4.4/5

Good

HighQ

Free trial: Yes

Key features:

- Q&A workflows for bidder interaction

- Custom data room audits

- Custom user invitation letters

Overall rating:

4.7/5

Excellent

DFIN

Free trial: 14 days

Key features:

- AI contract analysis for due diligence

- Automatic PII redaction in uploaded documents

- Multi-deal management and project reporting

The real estate industry is a major global market valued at over $380 trillion, involving complex transactions and large volumes of sensitive documents. Efficient management and secure sharing of these documents are critical to closing deals quickly and safely.

For this reason, virtual data rooms (VDRs) were created to provide a secure, centralized platform that streamlines document management and enhances collaboration, and protects sensitive information throughout the transaction process.

While traditional data rooms relied on physical paperwork and in-person visits, virtual data rooms offer faster, more secure, and more flexible access, making them the preferred choice.

This article will explore why real estate requires VDRs, their core features, security essentials, how they streamline transactions, leading providers, and best practices for setup and use.

What Is a Virtual Data Room in Real Estate?

A Virtual Data Room (VDR) is a digital platform that provides a centralized, secure environment for storing, organizing, and sharing documents. In real estate, VDRs are primarily used to support:

- Property sales and acquisitions

- Commercial real estate transactions

- Lease negotiations

- Financing and investment rounds

- Due diligence processes

- Portfolio management

Unlike general-purpose cloud storage platforms (like Dropbox or Google Drive), a real estate-focused VDR offers advanced compliance features, granular permission settings, audit trails, and document indexing. These capabilities make it not just a storage solution, but a deal-making engine.

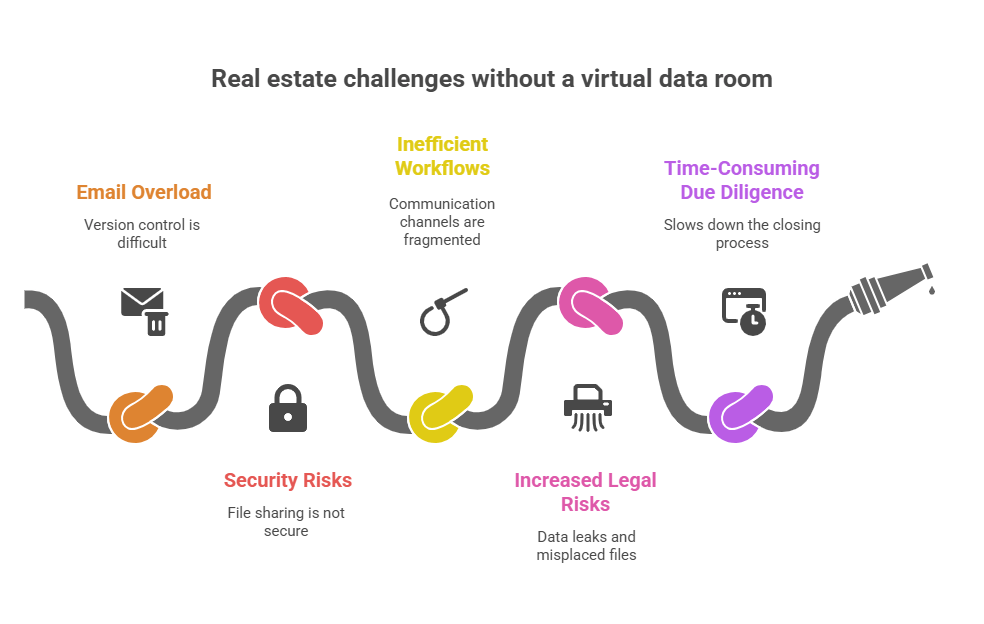

Why real estate needs a dedicated VDR

A virtual data room (VDR) is a secure online platform designed to store and share confidential documents safely. It allows multiple users to access important files anytime, from anywhere, while keeping the information protected.

For real estate professionals, a dedicated VDR is especially valuable because real estate projects involve multiple parties and sensitive data. Using a VDR helps simplify these processes, making it easier to manage real estate portfolios, speed up transactions, and maintain security throughout the deal lifecycle.

Here are the main reasons why real estate needs a dedicated VDR:

- Centralized document storage. Having all critical files, like archives and leases, in one place simplifies management and allows for fast retrieval when needed.

- Secure document sharing. Sensitive information like contracts and financial records is shared only with authorized users, using encryption and strict customizable permissions to prevent data breaches.

- Efficiency in multi-party processes. With many stakeholders involved, the platform streamlines communication and accelerates approvals by keeping everyone on the same page.

- Support for the due diligence process. During real estate mergers and acquisitions, a VDR organizes essential paperwork clearly and securely, making reviews quicker and more thorough.

- Secure access and audit trails. It records who views or downloads files, providing transparency and control over document usage.

- Enhance and secure collaboration. Teams and external partners can work together securely, improving productivity and decision-making throughout real estate projects.

- Improved compliance. The platform helps meet legal and regulatory standards by ensuring proper protection of confidential materials and portfolio data.

Core features of a real estate data room

Below are the key features of a real estate data room that support the needs of real estate professionals:

- Portfolio lifecycle support. Provides tools to manage assets through buy, hold, and sell phases for better investment tracking.

- Pre-setup services. Offers document sourcing and structuring before data room launch to ensure a smooth and organized setup.

- Bulk uploading and organization. Enables quick uploading of multiple files at once and lets users organize documents in folders or categories for easy navigation.

- Version control. Maintains different versions of documents so users can track changes and access previous iterations if needed.

- Search functionality. Allows users to quickly find specific documents or keywords within documents using advanced search tools.

- Collaboration tools. Includes features like commenting, Q&A sections, and notifications to facilitate communication among buyers, sellers, agents, and lawyers.

- Mobile access. Supports viewing and interacting with the data room on mobile devices, providing flexibility for users on the go.

- Custom branding. Allows the data room interface to be customized with company logos, colors, and branding for a professional appearance.

- Integration capabilities. Supports integration with other real estate or document management platforms to streamline workflows.

- Reporting and analytics. Provides detailed reports on user activity and document engagement to help stakeholders understand interest levels and due diligence progress.

Security and compliance essentials

Virtual data rooms built for the real estate sector provide robust security measures to protect sensitive information. Let’s explore the key tools:

- End-to-end encryption. Protects sensitive documents during upload, storage, and access using 256-bit AES encryption, making data unreadable to unauthorized users.

- Two-factor authentication. Requires users to verify their identity through two methods, such as a password and a code, to prevent unauthorized user access.

- Granular access controls. Let administrators define exactly who can view, edit, download, or share necessary documents, minimizing risk across user groups.

- Real-time activity tracking. Records all user activity, such as logins, views, and downloads, offering transparency and helping detect suspicious behavior.

- Dynamic watermarking. Adds user-specific watermarks with names, emails, or timestamps to discourage leaks and trace unauthorized sharing if it occurs.

- Redaction. Enables secure removal or masking of confidential data within documents before sharing, helping protect personally identifiable or sensitive details.

- Comprehensive audit trails. Maintains a full log of actions taken in the data room, supporting due diligence, dispute resolution, and internal oversight.

- Data backup and disaster recovery. Includes regular backups, off-site storage, and redundant systems to ensure business continuity in case of failure.

- Compliance with industry standards. Aligns with major regulations like GDPR, SOC 2, HIPAA, and ISO 27001 to support legal and industry-specific compliance.

How VDRs streamline real estate transactions

Virtual data rooms are making real estate transactions faster, more efficient, and more transparent. Here’s how they streamline the process:

- Centralized document access and management. All due diligence materials and essential documents are stored in one secure location, eliminating the confusion of scattered files and endless email threads. This improves organization, reduces delays, and ensures that all stakeholders work from the same source of truth.

- Simplified and transparent due diligence. Built-in Q&A modules allow real-time communication between buyers, sellers, and advisors, while audit logs provide a clear record of every action taken in the data room. This transparency helps prevent misunderstandings and supports compliance throughout the deal.

- Faster, more secure deal cycles. Instant document sharing, customizable user access, and real-time notifications allow deals to move forward quickly without compromising data security. With granular controls, sensitive information is only available to the right people at the right time.

- Reduced manual workload. Features like automatic indexing, version tracking, and built-in notifications cut down on administrative tasks, giving deal teams more time to focus on negotiation, analysis, and closing.

What are the best VDR providers for real estate?

We selected the five VDR market leaders with powerful capabilities for real estate management:

Ideals

Ideals VDR allows businesses to run multiple real estate deals using smart workflows, industry-leading security features, and dedicated mobile applications.

Ideals real estate data room offers advanced customizable Q&A with approver workflows, built-in document redaction, FTP file sharing, CMS integrations, OCR search, and drill-down project reports.

You can secure real estate deals using eight levels of access permissions, dynamic watermarks, encrypted downloads, session timeouts, IP address whitelists, and instant file access revocation on any device.

Best features:

- Unlimited projects, admins, and users

- Unlimited live VDR training

- 99.95% SLA-guaranteed uptime

- 24/7/365 customer support in 14 languages

- SOC 1/2/3, ISO 27001, GDPR, HIPAA, CCPA, LGPD, PCI DSS compliance

Intralinks

Intralinks VDRPro offers robust VDR capabilities combined with AI support and video collaboration. You can enhance onsite inspections with Zoom integration, Q&A workflows with question priorities, AI redaction, automated indexing, and DealCentre integration. You can secure real estate deals using eight levels of permissions, customizable watermarks, and instant file access revocation.

Best features:

- Dedicated customer service managers

- Preconfigured deal templates

- Multilingual customer support

- ISO 27701 and GDPR compliance

Datasite

Datasite enables strong VDR capabilities and several AI tools for enhanced data automation. You can manage your real estate deal lifecycle with an AI-based search engine, automatic data categorization, DD trackers, customizable Q&A, and AI-powered redaction. You can protect deal workflows using four document permissions, watermarks, and non-plugin IRM.

Features:

- Proprietary VDR training and certification

- 24/7/365 customer support in 20+ languages

- SOC 2; ISO 27001, 27017, 27018, 27701; GDPR, CCPA, AAP compliance

Onehub

Onehub emphasizes simplicity and collaboration while ensuring industry-leading document security. You can enhance real estate deals using an FTP gateway, secure file links, online file viewer, task workflows, Google Drive integration, and in-app messaging. You can secure sensitive data using session timeouts, complex passwords, access revocation, user and document permissions, and role previews.

Best features:

- 14-day free trial

- Unlimited workspaces, users, and storage

- DocuSign e-signature integration

- 24/7 phone support and customized VDR training

- Dedicated customer success managers

- SOC 2, ISO 27001, GDPR, FISMA, PCI DSS Level 1, HIPAA compliance

DFin Venue

DFin Venue enables strong capabilities for accelerating real estate transactions while ensuring robust data protection. You can simplify lease management and due diligence using AI contract analysis, multi-file redaction, real-time data room insights, and scheduled reports. You can secure deal workflows using delayed invitations, automatic watermarks, access permissions, and IRM.

Best features:

- 24/7/365 country-specific customer support

- Localization in 10 languages

- Instant page count within VDR billing

- SOC 2, ISO 27001, HITRUST, GDPR, HIPAA compliance

Best practices for setting up a real estate VDR

A well-structured data room is essential for running smooth and efficient real estate transactions. Proper setup not only saves time but also reduces confusion and risk during due diligence. Here are some best practices for setting up a real estate virtual data room:

- Plan the folder structure. Organize documents into clear categories such as legal, financial, technical, and property-specific files to help users find what they need quickly.

- Use consistent naming conventions. File names should be clear, descriptive, and uniform to avoid confusion and ensure easy navigation.

- Set user permissions carefully. Use role-based access and customizable permissions to ensure each stakeholder only sees the documents relevant to them.

- Upload only final or approved documents. Avoid clutter and confusion by only including verified versions of contracts, appraisals, and reports.

- Enable Q&A and activity tracking. Use the built-in Q&A module for structured communication and audit logs to monitor user activity and maintain transparency.

- Test the user experience. Preview the data room from different user roles to ensure ease of use and confirm that permissions are working as intended.

To help you get started, use the real estate checklist below for organizing the key documents needed for a successful transaction.

| Due diligence area | Real estate checklist sample |

| Real estate ownership | Title deeds and chains of titleWarranty deedsExecutor’s deedsCertificates of titleLand patentsZoning matters |

| Finances | Income and expense statementsRent rollsUtility billsProperty tax recordsInsurance policiesCapital expendituresTenant financial statementsEnvironmental assessment expenses |

| Property | Property inspection reportsProperty appraisal reportsBlueprints and plansAs-built drawingMaintenance and repair recordsProperty surveysLandscaping plansStructural engineering reportsHealth and safety reports |

| Tenant | Application formsEstoppel certificatesContact informationScreening reportsSecurity deposit recordsRenewal agreementsComplaints and maintenance requests |

| Legal | Purchase and sale agreementsLease agreementsListing agreementsLetters of intent (LOI)Assignment and assumption agreementsEscrow agreementsJoint venture agreementsNon-disclosure agreements (NDAs)Mortgage notesDue diligence reportsLegal and regulatory compliance noticesLitigation documentsSettlement agreements |

Key takeaways

- A real estate virtual data room offers secure document sharing and acts as a centralized platform for managing complex transactions with multiple stakeholders.

- VDRs streamline real estate transactions by centralizing document access, simplifying due diligence with Q&A and audit logs, accelerating deal cycles, and reducing manual workloads.

- Core features include bulk uploading, version control, search functionality, collaboration tools, mobile access, custom branding, and integration capabilities.

- Strong security and compliance measures such as end-to-end encryption, two-factor authentication, granular permissions, dynamic watermarking, redaction, and audit trails safeguard sensitive data.

- Best practices for setting up a real estate VDR include planning folder structures, consistent naming, careful permission settings, uploading final documents only, enabling Q&A and tracking, and testing user experience.

- Using a real estate checklist ensures all key documents are organized and ready for smooth transactions.

Proactive adoption of VDR technology supports efficient portfolio management, enabling real estate professionals to stay competitive and close deals faster.